A New York man was called “pathetic” by a Boston restaurant owner who attacked him after he questioned the hefty cancellation fee he incurred when he canceled a reservation because he was hospitalized.

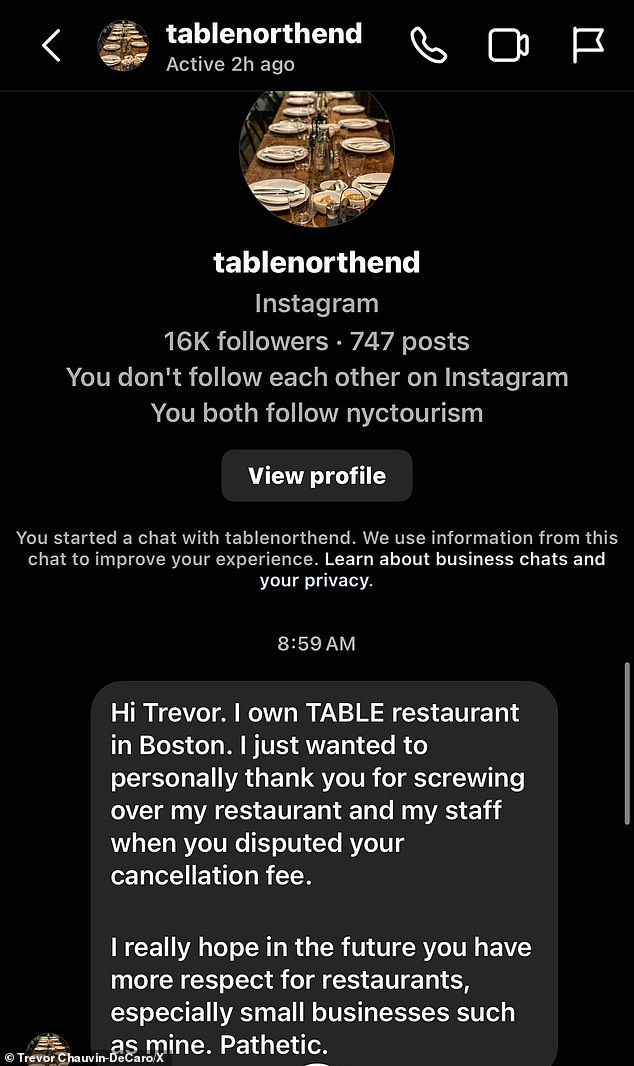

In a lengthy and now public exchange on social media, Trevor Chauvin-DeCaro was pursued and contacted by Boston restaurateur Jen Royle, owner of the North End restaurant. TABLE.

She found his account weeks after he canceled a reservation and sent him a message.

“Hi Trevor,” he wrote in an Instagram DM. ‘I own the TABLE restaurant in Boston.

‘I just wanted to personally thank you for ruining my restaurant and my staff when you questioned your cancellation fee.

‘I really hope that in the future there will be more respect for restaurants, especially small businesses like mine. Pathetic.’

Jen Royle of Boston restaurant TABLE lashed out at a customer whose credit card company questioned her cancellation fee after she canceled due to a hospitalization.

In December of last year, Chauvin-DeCaro made a reservation at TABLE for Jan. 6, when he planned to travel to Boston to see Madonna at TD Garden, according to the Herald.

Chauvin-DeCaro told the outlet that after his AmTrak train was significantly delayed, he found himself in the hospital.

‘The delay was a blessing in disguise. Thank God we were still home,’ she said. He proceeded to go to the emergency room, after which the entire trip was cancelled.

The cancellation meant Chauvin-DeCaro and her husband were forced to make several calls to hotels and businesses, including TABLE, to inform them they would not be attending.

Because the cancellation occurred within the 48-hour period before the MESA reservation, staff told the couple they would have to pay the $250 cancellation fee, $125 per person.

Chauvin-DeCaro contacted Chase, her credit card company, to activate the card’s travel protection insurance, which includes coverage for cancellation due to hospitalization, and “I never thought about it again,” she said, until Royle sent him a DM.

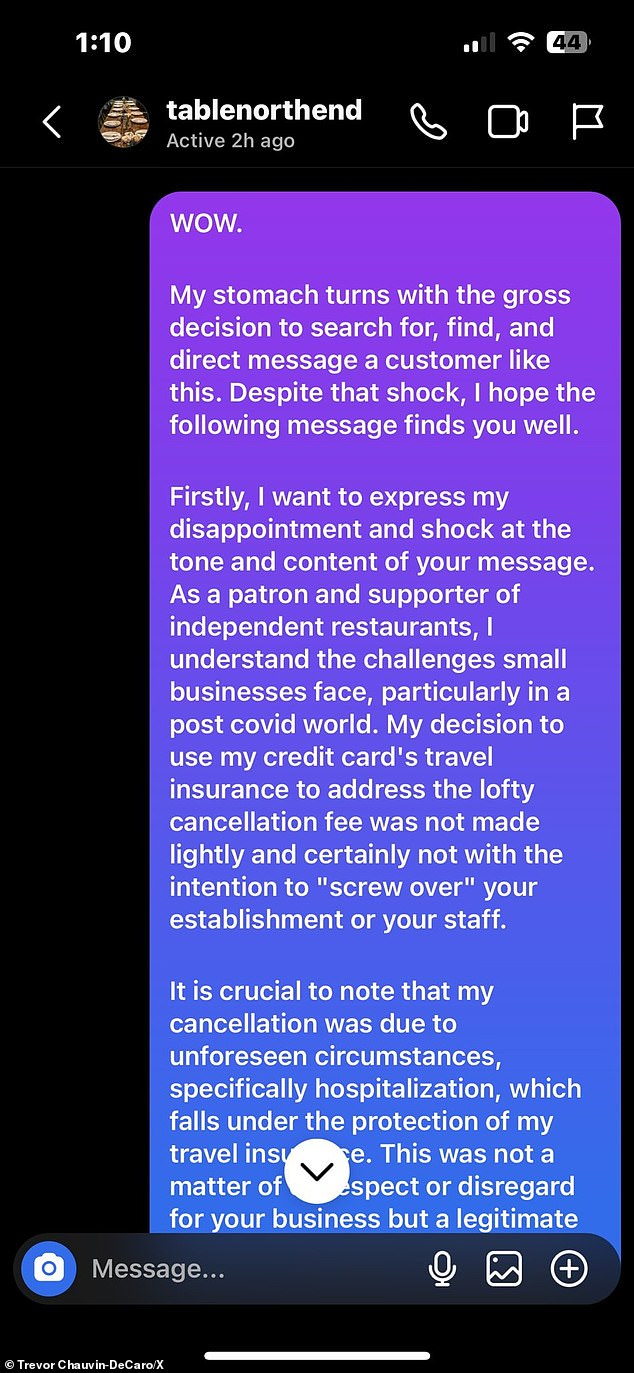

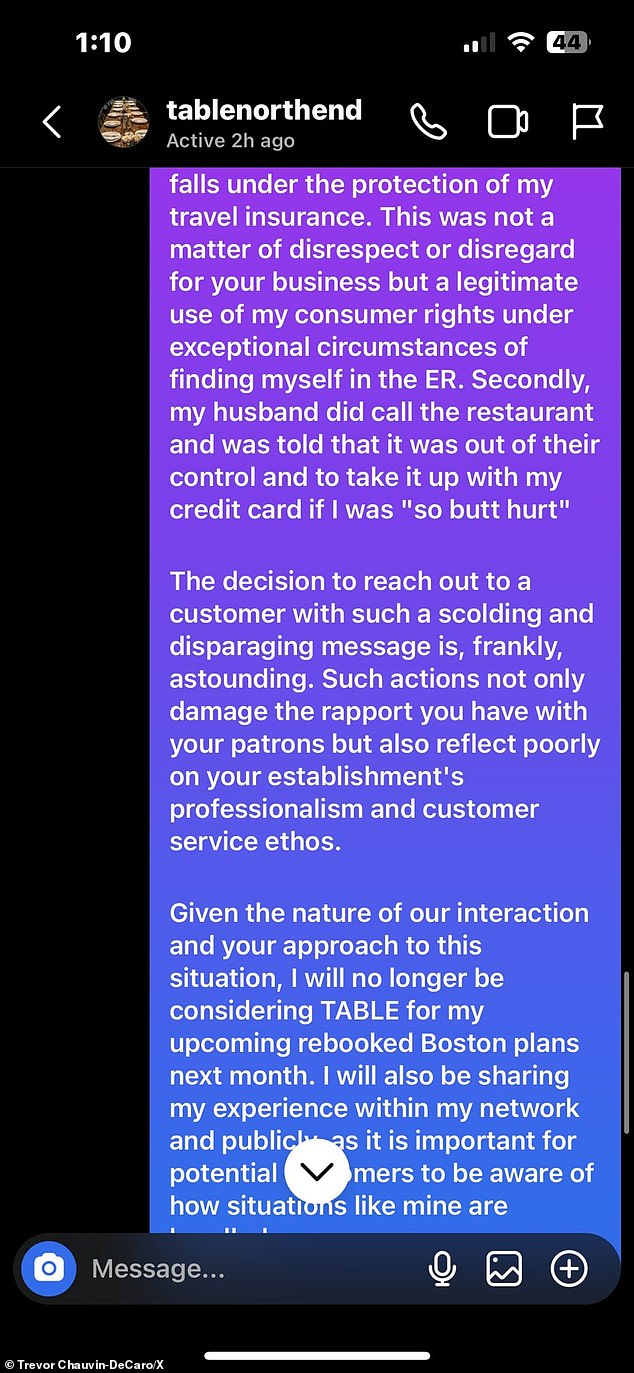

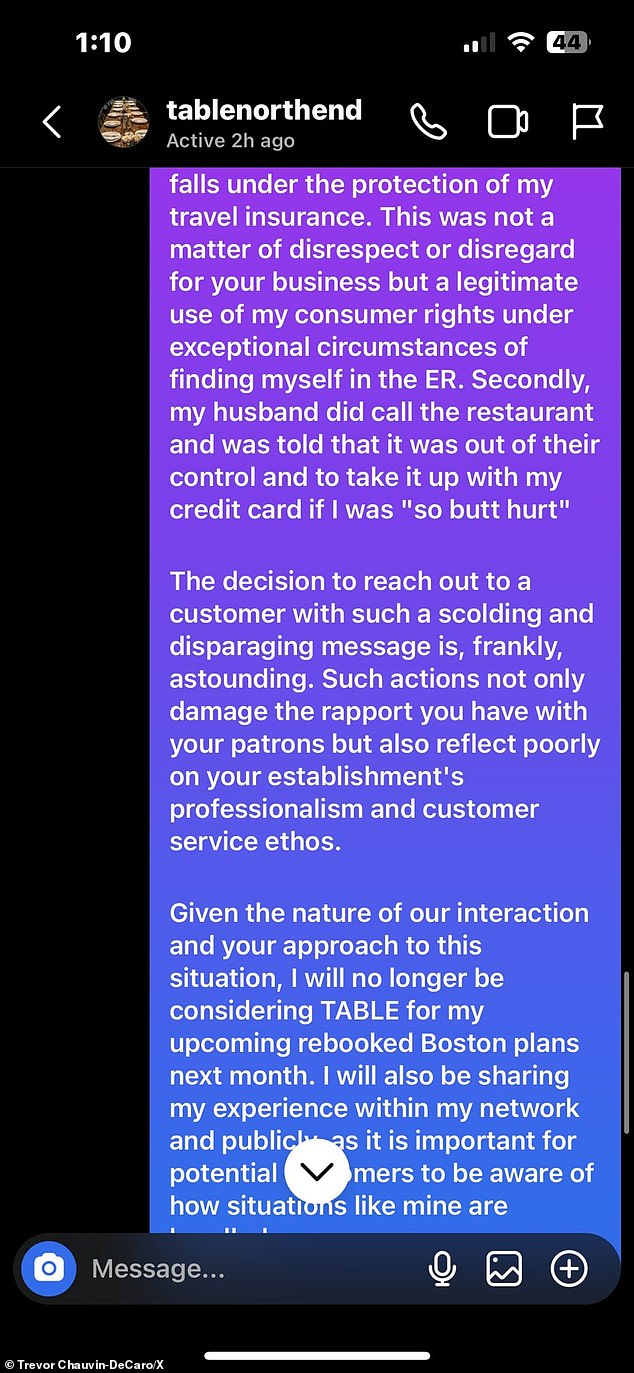

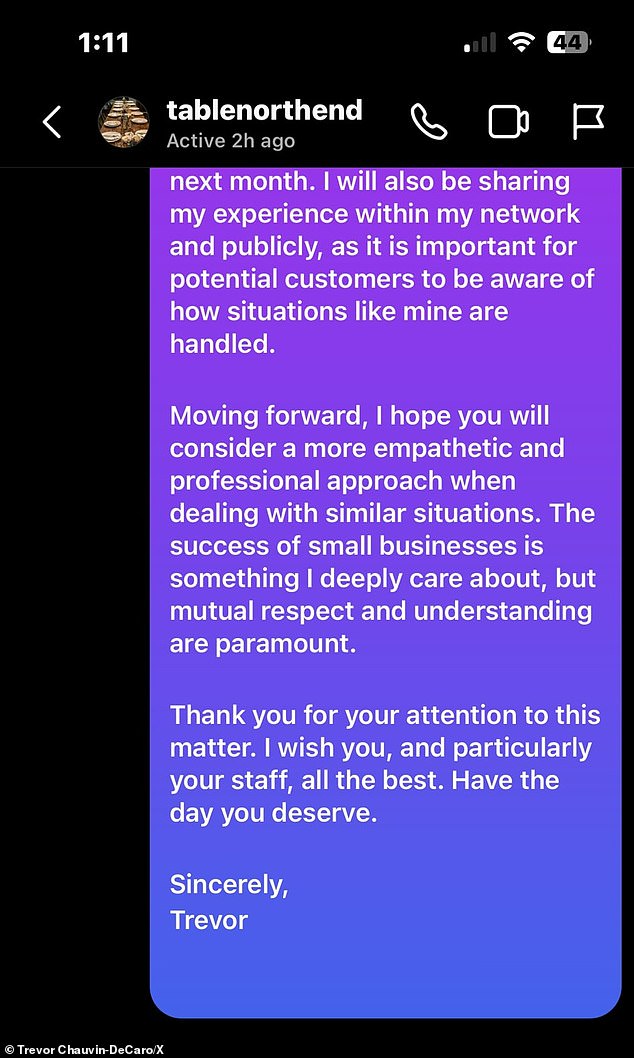

Chauvin-DeCaro was stunned by the content of Royle’s message and sent a lengthy response explaining the situation and expressing his disappointment in the way she had responded.

He told the Herald his response was “simply unnecessary and wildly unprofessional”.

‘Even if you don’t agree with the way a customer cancels a reservation, their response was outrageous and unhinged. There’s no reason to do that to a potential client,” she said.

After the original exchange, the pair went back and forth for a while longer. All of the messages were shared online by Chauvin-DeCaro and have since racked up some 23 million views on X.

At one point, Royle posted on his own Instagram and at the restaurant addressing the fight:

‘BOO HOO. Then call and cancel and explain! DISPUTING A CANCELLATION FEE IS WRONG!!!!

‘Today I spoke to a dozen business owners who shared their frustrations with people walking all over them and disputing their credit card charges. THIS HAS TO STOP! The lack of respect and rights is serious,” he wrote.

He then told Chauvin-DeCaro that he had contacted his legal team.

“We sent you a private message and you chose to make it public,” he wrote via the company’s Instagram.

‘The amount of slander the company is receiving is absolutely horrible. You will hear from our lawyers.

Trevor Chauvin-DeCaro said he was distressed by Royle’s “simply unnecessary…wildly unprofessional” and “unhinged” messages.

TABLE is a family-style Italian restaurant where guests sit at a table with strangers and are served a multi-course meal with no substitutions for $125, which is also the cancellation fee per person.

In previous profiles, Royle, who previously had a successful career as a sportscaster, was noted for aggressively fighting with customers online.

Since the dispute went viral, the restaurant’s social media accounts have gone dark.

After Chauvin-DeCaro posted the exchange, as well as his response, online, the chef now claims he is receiving death threats.

The restaurant’s legal team is threatening action against him as the fallout continues to come. Royle’s attorney, Michael Ford, told the Boston Herald last week that his client “doesn’t want to be hurt any further” by the “false statements, the defamatory statements.” statements, the death threats, the abusive comments that he has supposedly been receiving.

“She’s been facing attacks online and now she’s being bombarded with death threats,” he said, adding that he believes the story of Chauvin-DeCaro’s hospitalization is “false.”

The restaurant and its countless reviews, many of which are now negative, can no longer be found on Google or Google Maps.

A 2021 profile of Royle describes the chef as having little regard for business etiquette or public perception when it comes to criticizing customers she disagrees with.

“She also has no qualms about getting into public arguments with rude customers,” Scott Kearnan wrote for Boston Magazine many years ago.

‘Maybe a diner emails a complaint about your no-excuse cancellation policy, which charges absent guests the full amount unless someone else takes their seat. Maybe someone leaves a nasty review online, all because he told his group that they were getting too loud at dinner.

“If a dispute arises with a guest (as it does in all restaurants) and Royle believes he is right (as he freely admits he almost always does), he has no problem making it clear to customers, former or potential.”