Table of Contents

Information on Tiger Global Management’s latest 13F filings

Coleman Chase (Trade winds, Briefcase), the founder of Tiger Global Management and one of the notable “Tiger Cubs” coached by Julian Robertson, has made significant adjustments to his portfolio in the second quarter of 2024. Known for his penchant for small-cap and technology stocks, Coleman’s investment strategy focuses on fundamentally strong companies poised for long-term growth, driven by strong secular trends and exceptional management teams.

Summary of new purchases

During the quarter, Coleman Chase (Trade winds, Briefcase) introduced six new stocks into its portfolio, including:

-

UnitedHealth Group Inc. (New York Stock Exchange:UNH) with 2,347,600 shares, representing 5.53% of the portfolio and valued at approximately $1.2 billion.

-

Qualcomm Inc. (NASDAQ:QCOM), comprising 1,857,700 shares or about 1.71% of the portfolio, with a total value of $370 million.

-

Applied Materials Inc (NASDAQ: AMAT) with 895,200 shares, representing 0.98% of the portfolio and valued at $211 million.

Increases in key positions

Coleman also strategically increased its holdings in four stocks, with significant improvements in:

-

Grab Holdings Inc. (NASDAQ:GRAB), adding 26,122,000 shares to bring the total to 92,923,788 shares. This represents a 39.1% increase in the share count, impacting the portfolio by 0.43% and valued at $330 million.

-

Mar Ltd (New York Stock Exchange:SE), with 1,045,267 additional shares, bringing the total to 16,041,335 shares. This adjustment represents a 6.97% increase in the share count, with a total value of $1.15 billion.

Summary of sold out positions

Coleman Chase (Trade winds, Briefcase) abandoned several positions entirely, including:

-

Corpay Inc. (New York Stock Exchange: CPAY), where it sold 287,091 shares, representing a 21.53% decrease in shares and a 0.48% impact on the portfolio. CPAY traded at an average price of $283 during the quarter.

-

JD.com Inc. (NASDAQ:JD), reducing its holdings by 2,316,104 shares, a decrease of 73.79%, impacting the portfolio by 0.35%. JD.com’s share price averaged $29.34 during the quarter.

Portfolio Overview

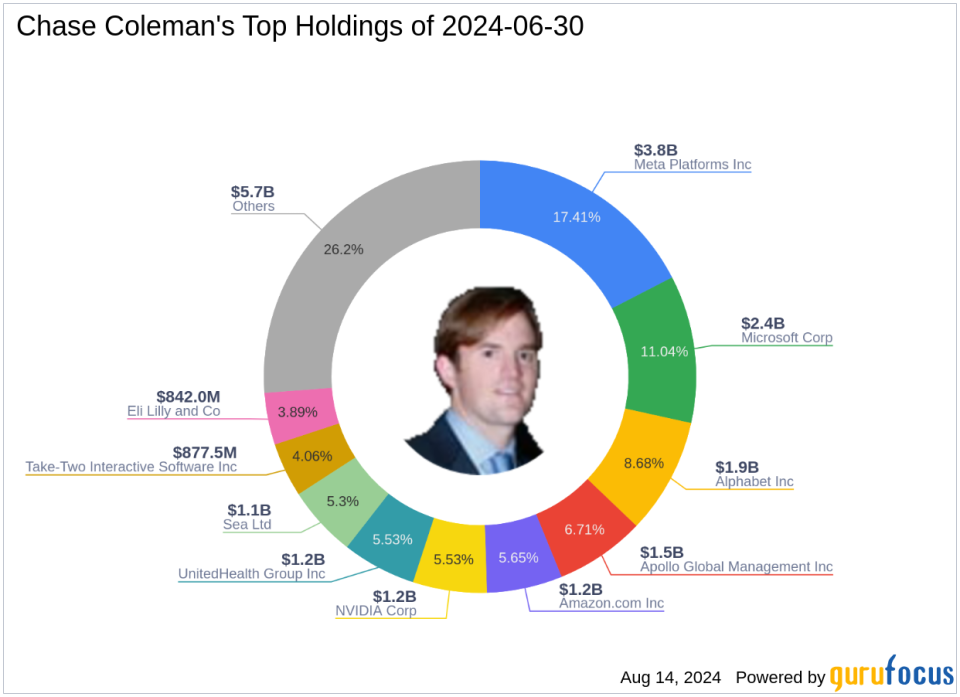

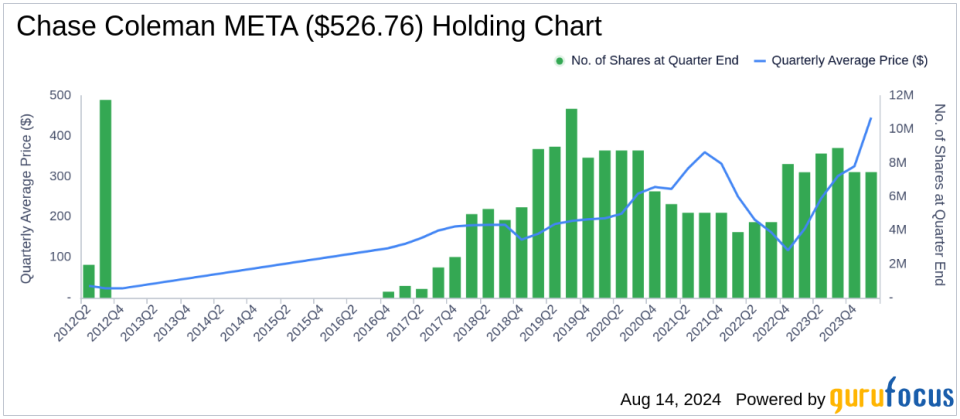

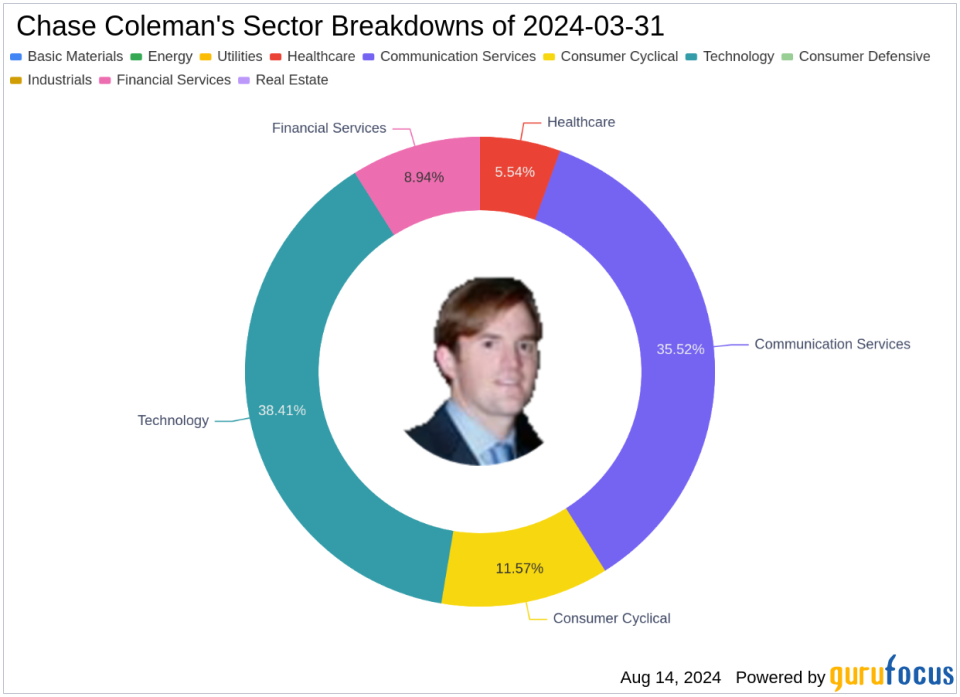

Starting in the second quarter of 2024, Coleman Chase (Trade winds, BriefcaseThe portfolio of ) consists of 44 stocks. Top holdings include a 17.41% stake in Meta Platforms Inc (NASDAQ:META), 11.04% in Microsoft Corp (NASDAQ: MSFT), 8.68% in Alphabet Inc (NASDAQ:GOOGL), 6.71% in Apollo Global Management Inc (New York Stock Exchange: APO), and 5.65% in Amazon.com Inc (NASDAQ: AMZN). Investments are predominantly concentrated in six industries: technology, communication services, consumer cyclicals, healthcare, financial services and utilities.

This article, generated by GuruFocus, is designed to provide general information and is not personalized financial advice. Our commentary is based on historical data and analyst projections, using an unbiased methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to buy or divest from any stock and does not consider individual investment objectives or financial circumstances. Our goal is to provide long-term analysis based on fundamental data. Please note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. GuruFocus does not have any positions in the stocks mentioned herein.

This article first appeared in Guru Focus.