Table of Contents

Ros Altmann: Investors can still put money abroad if they want, but they should not expect taxpayer subsidies to boost foreign economies

Other major countries invest pension funds much more in domestic companies and it is time for Britain to take radical steps to do the same, according to former Pensions Minister Ros Altmann.

Urges Chancellor Jeremy Hunt to take advantage of his Mansion House reforms to use pensions to boost UK growth – which attracted support, but also skepticism from some industry experts.

At the time, Lady Altmann, a veteran pensions campaigner who sits in the House of Lords, said: “It’s time for revolution, not evolution.”

Here are his proposals to promote investment in UK Plc.

The Chancellor must be bold and harness the power of pensions and Isa contributions to revive growth and alleviate the UK’s ailing markets.

Both pensions and Isas come with generous tax breaks, but at the moment taxpayers spend huge sums of money subsidizing people’s investments, but in the UK you don’t need to put in a cent.

Investors can still put their money abroad if they want, but they should not expect taxpayer subsidies to boost foreign economies instead of our own.

Our pension funds and Isas can help the Chancellor dig out of his fiscal hole by investing more in Britain to revive long-term growth, infrastructure and British housing supply.

At this time, they have abandoned the UK stock markets; See below stark evidence of how little pension money is invested at home.

Ensuring 25 per cent of new pension contributions are invested in UK assets and launching a £10,000 UK ISA would help restore support from domestic investors and should be a budget priority.

Put 25% of pension into UK assets or lose tax breaks

In the Budget, the Chancellor should signal his intention to require 25 per cent of new pension contributions to support Britain.

At least 25 per cent of each pension pot comes from tax and National Insurance relief (now costing taxpayers £70bn a year) and 25 per cent of each pension is withdrawn tax-free.

In return for these generous tax subsidies, there is clearly a case for the Government to require more pension assets to support the UK’s markets, infrastructure and economic growth.

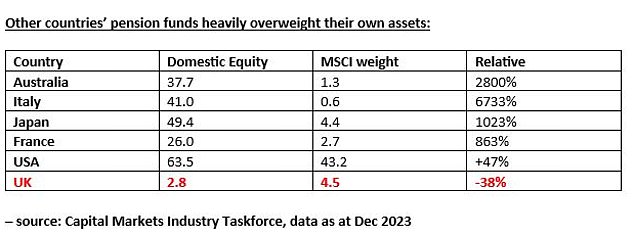

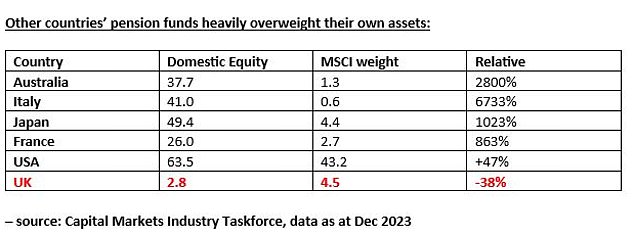

UK pension funds are heavily underweight in UK stocks, unlike other countries.

This could also improve the long-term prosperity of pensioners. If they want to invest more than 75 percent in offshore assets, pension investors can do so, but they should not expect a taxpayer subsidy for this.

UK pension funds are heavily underweight in UK stocks, unlike other countries.

This appears to be a vote of “no confidence” in our business sector, damaging confidence in the UK markets as a whole.

Other countries ensure that their pensions and tax-advantaged mutual funds are heavily overweighted in their own domestic markets. Isn’t it time the UK did the same?

The table below clearly shows how the UK is an outlier in international comparisons.

Meanwhile, the Chancellor’s Mansion House reforms announced last year require pension funds to voluntarily commit 5 percent of their assets to unlisted companies by 2030.

They should be bolder in trying to use pension assets to boost growth. You don’t even need to invest any of the money in the UK.

Surely the Chancellor could be more ambitious and extend these reforms so that pension funds are encouraged to invest more in both small growing listed companies and unlisted (UK-based) start-ups.

This would really boost our promising smaller companies and prevent foreign rivals from snapping up the best cheaply.

Let’s support our businesses with a £10k Great British Isa

There have been strong calls for the Chancellor to announce a new Isa by 2024. Let’s hope he listens.

A £10,000 tax-free allocation to be invested in UK assets could give a boost to British companies, which are languishing due to low market ratings relative to the rest of the world.

This would direct investment tax breaks to support Britain, rather than bolster foreign businesses and markets.

The precursor to the Isa was the Personal Equity Plan (Pep), which had to be reversed in Britain and it is time to revive that idea.

It could be a win-win situation, benefiting UK stock markets, improving investor returns and boosting the UK economy with new investment.

Focus tax incentives and subsidies on UK investments

Investors can still invest in overseas markets, but taxpayer subsidies must once again help maintain the UK as a world-leading financial sector.

UK institutional and private investors used to be a strong and reliable source of domestic support for UK businesses, helping to create a prosperous and world-leading British financial sector.

However, in recent years, especially since 2008, pension funds have abandoned UK shares and other growth-driving investments, buying more fixed income and foreign or alternative assets, leading to poor performance of the funds. UK markets.

Moves to require pensions and Isas to support Britain, using its tax breaks to benefit our own economy, could be a game-changer.

Recapturing stronger domestic demand can begin a virtuous cycle of recovery for British businesses and this week’s Budget offers a real opportunity for a new path.

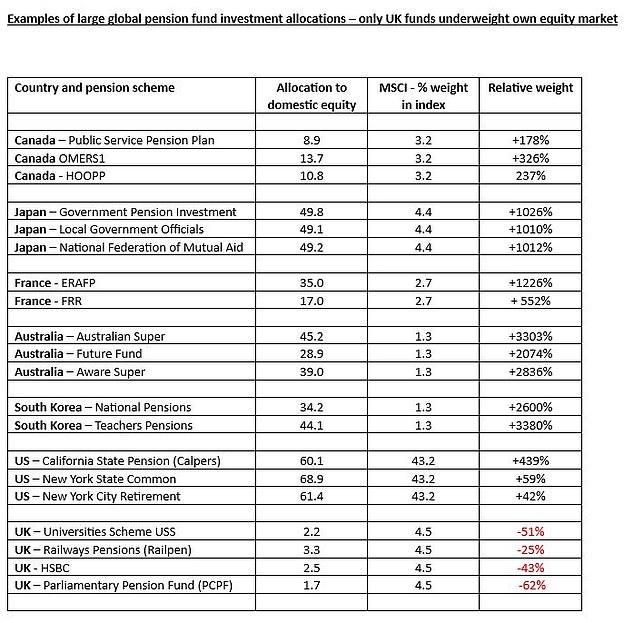

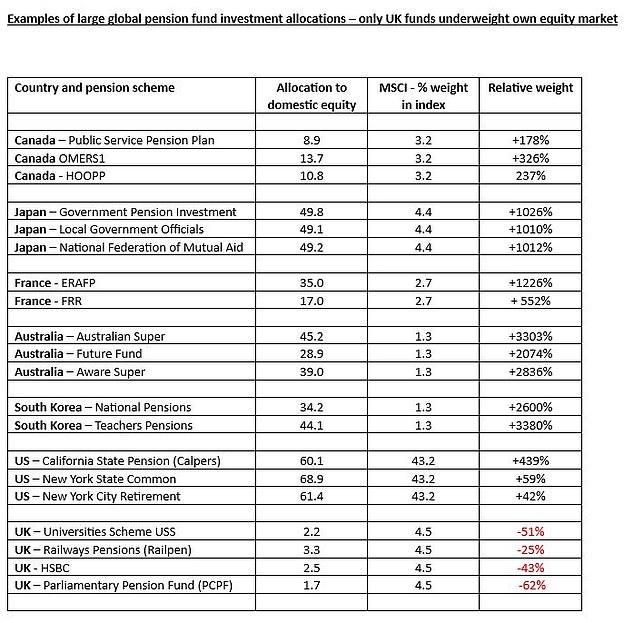

How do large global pension funds allocate investments? According to this analysis of the large schemes, only British funds are underweight in their own share market, says Ros Altmann

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.