Car rental companies have been caught on hidden cameras “using high-pressure tactics to scam customers” by “forcing them to buy unnecessary insurance.”

These “shocking practices” were “exposed” at three already disreputable rental companies in Spain by undercover Which? investigators posing as “regular customers”.

The research follows a survey by Consumer Defenders, which found that nine in ten holidaymakers feel they have been taken advantage of by car hire companies. One in six of those surveyed said they felt under “a lot” of pressure to take out additional car insurance, even if they “already had adequate cover”.

In response to the survey, undercover investigators travelled to Alicante and Malaga airports and filmed interactions with Goldcar, Dollar and OK Mobility – the companies that were of most concern to Which? based on reviews and complaints.

The team says it “caught on camera a range of pressure tactics” including “false and misleading statements.”

An undercover investigation by the Which? team has found that car rental companies are “using high-pressure tactics in an attempt to rip off customers”

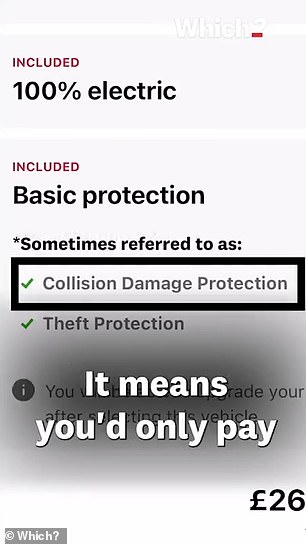

When holidaymakers rent a car in Europe, basic insurance, known as Collision Damage Waiver (CDW), is always included in the rental price, but “the excess payable can be huge,” says Which?. The consumer team recommends customers take out an Excess Reimbursement Policy (ERI) to claim back the excess paid, with “some of the best policies starting from £16.”

Alternatively, car rental companies sell Super Collision Damage Waivers (SCDW) to “remove the excess altogether”, but Which? says these often cost “hundreds of pounds more and generally offer inferior cover”.

Which? claims that car rental companies “make huge profits by selling these SCDW policies to customers” and that an “industry insider” told the team that “car rental staff are often incentivised to sell this additional insurance in return for a commission”.

To test this, Which? pre-booked a rental car, which comes with basic insurance as standard, and purchased a legitimate ERI policy in advance. The team says the ERI was “communicated to the companies during the exchanges”.

At Alicante Airport, OK Mobility, Which? claims that its mystery shopper was “incorrectly told they did not have basic insurance with their booking”. Even when the mystery shopper told the agent that insurance was included, “the rental agent insisted” and said “nothing was included” as the booking was made through a third party, Rentalcars.

Which? claims this is “incorrect” as “booking through a third party has no impact on insurance” and claims Rentalcars confirmed to Which? that “cover is included in all European rentals as standard”. Which? adds that its mystery buyer was “alarmingly told that any damage would cost a flat fee of €760 (£651)”, even if it was a “small scratch”.

Even when the Which? investigator showed the agent his existing ERI policy, the agent allegedly claimed that any “insurance has to be with the car hire company” and “pressed further” for the buyer to buy Ok Mobility insurance. Which? claims it was only when its buyer said he “needed to go away and think about it” that the agent “gave in” and said it was “his choice whether or not to buy a policy”.

When tourists rent a car in Europe, basic insurance, known as Collision Damage Waiver (CDW), is always included in the rental price.

At Goldcar, which has ranked bottom of Which?’s car rental survey for the past six years, a Which? shopper was told by an agent at Malaga airport that they had “no cover” – a claim which was “completely false” as “basic insurance was already included in the rental”.

In Alicante, a Goldcar representative told Which? that the ERI policy would “only cover the other vehicle in the event of an accident”. This “inaccurate claim” was repeated even when the Which? researcher “rejected” his response.

Dollar, a company that also scored poorly in Which?’s latest car rental survey, fared better at Alicante Airport, where the experience was “seamless and pressure-free”, according to Which?. The company is a subsidiary of Hertz and operates from Hertz counters at Alicante and Malaga airports.

However, at Malaga airport, the illegal buyer felt “duped”. The buyer claims he was told his ERI policy was “not valid” and that “what he bought online was of no use to him” – a “false statement that is likely to scare any traveller into buying additional insurance”, says Which?.

The Which? mystery shopper “was also told they would be liable for up to €2,400 (£2,058/$2,628) if anything happened to the car, and that any scratches larger than 1cm would cost €300-€400 (£257-£343/$328-$438) to repair, plus a €50 (£42/$54) admin fee and additional taxes.” The Dollar agent also claimed that “full coverage is always cheaper than minimum damage coverage” – a claim that is “false”, says Which?.

Upselling is not illegal, but “it is illegal to use misleading or aggressive practices that may lead customers to make a purchase they would not otherwise have made under consumer protection regulations against unfair trading practices,” says Which?. The consumer team believes many of “their interactions in Spain fit this description.”

Rory Boland, editor of Which? Travel, said: ‘Every year we hear from countless travellers who have felt ripped off and pressured by their interactions with car hire counter staff, and our undercover filming has uncovered absolutely shocking practices by staff at Goldcar, Dollar and OK Mobility.

‘Anyone renting a car this summer should make sure they book with a reputable company or agent and, to avoid pressure from aggressive agents, should purchase their own excess refund policy before travelling.’

The team says it “caught a variety of pressure tactics on camera,” including “false and misleading statements.”

Goldcar has been at the bottom of Which?’s car rental survey for the past six years

A Goldcar spokesperson said: ‘Goldcar Spain is of course disappointed that the alleged experiences have been identified by Which? Travel.

‘As far as insurance coverage is concerned, the company offers premium coverage to ensure a smooth process should damage occur during the rental of the vehicle. The customer, of course, has the right to choose to purchase their coverage separately; however, if this is the case, they will be charged for any damage that occurs during the rental and will then need to claim reimbursement of the costs from the chosen provider.

‘While the company has not had the opportunity to view the images referred to by Which? Travel, it is committed to investigating any incident where a customer believes they have received a service that does not meet the expectations of a low-cost brand.

‘In 2021, the company implemented a Code of Ethics for Counter Sales and a Guide to Good Sales Practices, both of which are reviewed annually based on customer feedback on their sales experience. If an employee breaches the Code of Ethics, they are immediately warned and financially sanctioned, and if they do so again, they may be subject to termination of employment.’

A Dollar spokesperson said: “While we have not been able to view the footage, the actions described do not align with our corporate values or policies. Providing exceptional customer service is a top priority for Dollar and we regularly take steps to ensure all staff meet our standards.”

OK Mobility has commented to Which?: ‘OK Mobility employees always provide information about the coverage or extras offered by the company that may be of interest to the user. In this regard, OK Mobility employees offer customers the possibility of contracting coverage that allows them to limit their liability in the event of damage to the vehicle and clearly explain both the price of the coverage and what it consists of exactly so that customers can freely decide whether or not it is worth contracting this limitation of liability. It is an optional product that the customer can decide whether to purchase or not.

‘OK Mobility recommends contracting coverage directly with our company, as the owner of the vehicle and therefore the only one capable of directly covering the property, to protect the client from possible additional costs in the event of damage. In 100% of cases, the client is always informed of the coverage contracted with OK Mobility.

‘The amount per damage category and vehicle group is reflected in a price matrix that the company provides to its customers. The deposit is a pre-authorization, not a direct charge. Normally, a hold is placed on the cardholder’s account, although the specific effect on the account will depend on each issuing entity.

‘Once the rental has finished, the pre-authorization will be unblocked. Depending on the operations of the card issuing entity, the time it takes for the unblocking to be reflected will vary, although the average is usually between 14 and 30 days. The rental companies do not influence this process, as it depends on the financial entity issuing the card.

‘We work hard to protect fair competition in the market and the free choice of our customers based on the information presented during their interaction with OK Mobility through our agents or our online communication channels.’