<!–

<!–

<!– <!–

<!–

<!–

<!–

Virgin Atlantic said it is on course to make its first profit since the pandemic after strong demand for winter breaks in the Caribbean boosted business.

The airline – which is co-owned by Richard Branson’s Virgin Group and US carrier Delta Airlines – yesterday reported a loss of £139m for 2023, following a loss of £206m last year.

But revenues rose by £265m to a record £3.1bn as big-spending British holidaymakers took their winter holidays in the Caribbean.

Virgin Atlantic is now benefiting from American tourists booking spring and summer trips to Europe and from its expansion into India.

Flights to the Maldives and Dubai are also in high demand.

In demand: Virgin Atlantic is now benefiting from American tourists booking spring and summer trips to Europe and from its expansion into India

The turnaround comes after a near-death experience when Covid-19 grounded planes around the world and left airlines fighting for their future.

Since then, Virgin Atlantic has been weighed down by the debt it took on to survive the pandemic.

But in a sign that the company is now recovering, chief executive Shai Weiss stressed that this year would be “the turning point for Virgin Atlantic, the culmination of our transformation and the year we can make it count.”

He said the airline has “benefited from continued strong demand for leisure flights and holidays”, although business travel has been slower to recover.

“A loss is never satisfying,” Weiss added. ‘However, our performance and results illustrate that we have made really good progress in 2023, the plan is working and Virgin Atlantic is on track to return to profitability in 2024.’

Virgin Atlantic, which launched in 1984, flew 5.3 million passengers last year to long-haul destinations such as the US, the Caribbean and India.

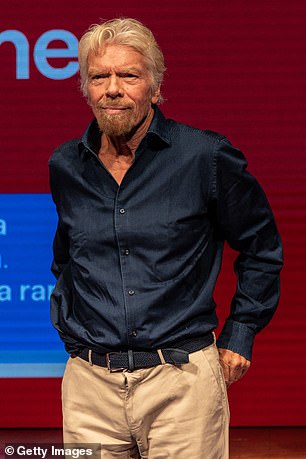

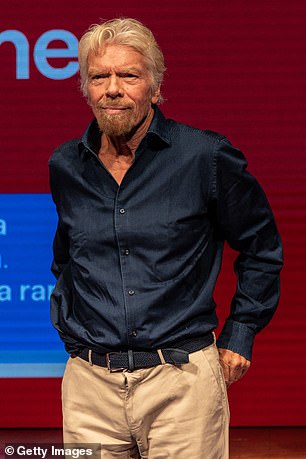

Founder: Virgin Atlantic is co-owned by Richard Branson’s Virgin Group and the American airline Delta Airlines

This is about 10 percent less than before the pandemic, while the number of business travelers is still down about 20 percent.

But it aims to carry 6 million customers this year – a level last reached in 2019 before the Covid pandemic hit.

Chief Financial Officer Oliver Byers said passengers were willing to pay “robust” fares and the start to the new year was “very encouraging”.

He added: ‘We have seen very strong demand from a premium leisure perspective and also a further recovery in business travel.’

Business travel, which unlike leisure has not fully recovered since the pandemic, fell toward the end of 2023, he said.

Virgin Atlantic, which is set to launch a second daily service from London to Mumbai in October, is now aiming to increase operating profits to around £200 million this year, double the record reached in 1999.