Table of Contents

Cash buyers get significant discounts when buying a property, new figures show.

Those who do not need to borrow to buy a home pay 13 percent less than those who take out a mortgage, according to analysis of data from MPowered Mortgages of Land Registry.

Its analysis of September completed sales found that across the UK, cash buyers typically paid £28,189 less per property.

This equates to an average discount of 9.3 percent on the sales price.

This ‘cash buyer discount’ has increased by 12.4 per cent compared to September 2022, when Liz Truss’ mini-Budget slammed the brakes on the property market.

Cash is king: Cash buyers get 13% discounts compared to the typical buyer with a mortgage, according to analysis of Land Registry data

Why do cash buyers pay less for homes?

Cash buyers are more attractive than mortgaged buyers, as the mortgage is one aspect of purchasing a property that can go wrong.

Therefore, sellers and real estate agents perceive them as more secure and with greater chances of success in the sale.

Mortgaging can also be a lengthy process, which can slow down home sales. Therefore, a cash buyer can also offer buyers faster movement.

This puts cash buyers in a strong negotiating position, allowing them to ask the seller for a discount.

Their numbers are also decreasing, which only increases their bargaining power. MPowered analysis found that cash buyers currently account for just a fifth of home purchases in Britain.

Cash buyers accounted for 22.4 per cent of transactions in September, according to Land Registry figures, up from 28.6 per cent two years ago.

Stuart Cheetham, chief executive of MPowered Mortgages, believes this combination of scarcity and speed allows cash buyers to pay less for the home they want.

“As the housing market heats up and interest rates fall, the number of home seekers using a mortgage to finance their purchase is increasing and cash buyers are becoming less common,” Cheetham said.

Stuart Cheetham, CEO of MPowered Mortgages

‘Then there’s the trump card that cash buyers can play: speed. Rising demand is making a slow process take even longer, with the average seller in England and Wales now having to wait 152 days between accepting an offer and completing the sale.

“That’s why buyers who have their finances fully settled when they make an offer are much more attractive to sellers than those who don’t.

‘Sellers often accept a lower offer in exchange for the additional security these buyers represent.

“If you’re not fortunate enough to have the money to buy the home you want outright, you can get almost the same advantage by having a fully underwritten mortgage offer.”

Where cash buyers get the biggest discounts

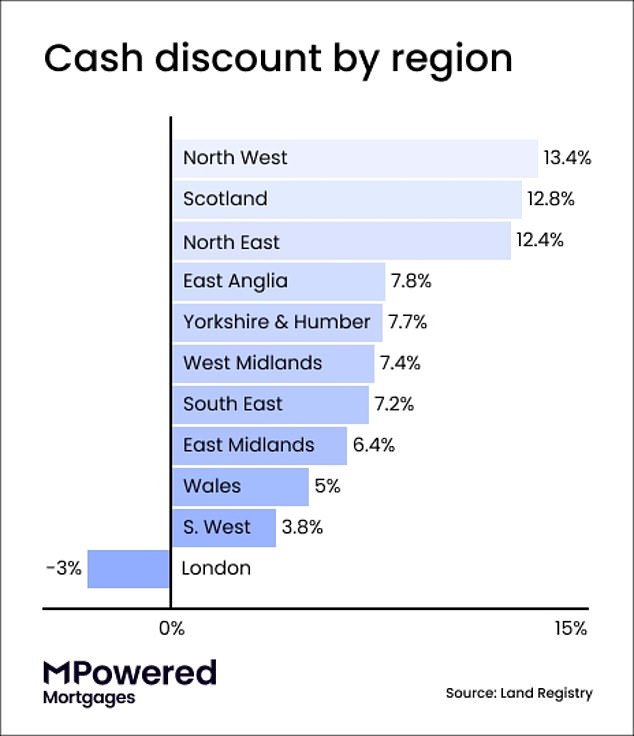

Discounts are considerably higher in northern areas of Britain, according to MPowered analysis.

It found that cash buyers enjoy the biggest discounts in the north-west of England, where they typically pay £31,827 (13.4 per cent) less than buyers using a mortgage.

In Scotland the average ‘cash discount’ is £26,476 (12.8 per cent), and in the North East of England it is £22,122 (12.4 per cent).

Further south, discounts are reduced. In the South East, mortgage buyers paid an average of £392,021 in September, compared to £364,232 among cash buyers – a discount of 7.4 per cent.

In the South West, the average mortgage buyer paid 3.7 per cent more than their cash-buying counterparts – a cash discount of less than £12,000.

Discount offer: Cash buyers get discounts of 13.4% in the North West of England and 12.8% in Scotland.

The only place where cash buyers don’t enjoy lower prices is London.

In September 2024, cash buyers in the capital paid £15,344 more per property than those using a mortgage, a reflection of the high number of foreign property investors – who invariably pay cash – buying homes there.

The discrepancy in London is also likely to be accentuated by the high concentration of cash buyers operating in central London, where property prices are highest.

In central London, cash buyers paid £644,481 on average per property compared to £586,593 among buyers with mortgages in September.

However, it is worth noting that London’s overall “cash premium” of 3 percent has almost halved since September 2022.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.