The White House has announced that it is eliminating another $7.4 billion in student loan debt for 277,000 borrowers, bringing the total canceled by the Biden administration to $153 billion.

It is the second large-scale effort by Biden, 81, to forgive billions in debt in a week, in a plan that his critics say is an attempt to “buy votes” before the general election.

On Monday, the administration launched a combined plan that would affect about 30 million borrowers after the Supreme Court blocked its first offering last year.

Now, more borrowers who see their student loan debt forgiven will receive emails informing them of the move on Friday.

‘From day one of my administration, I promised to fight to ensure that higher education is a ticket to the middle class, not a barrier to opportunity. “I will never stop working to cancel student debt, no matter how many times Republican elected officials try to stop us,” Biden said in a statement.

The debt being canceled Friday is for borrowers of three debt relief programs already in use, including a plan that 18 GOP-led states are suing to block.

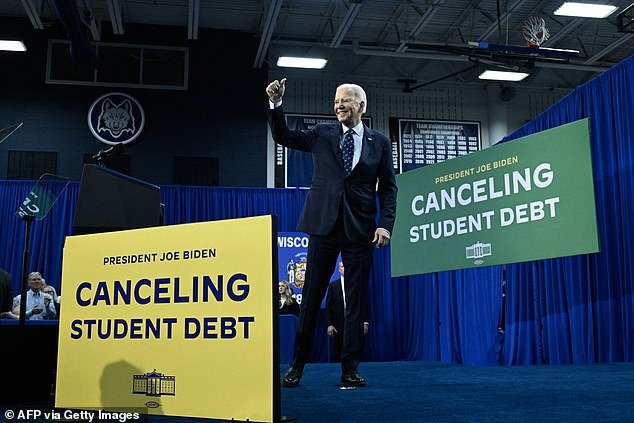

President Biden touts his latest proposals to cancel student loan debt for millions of Americans during a visit to Madison, WI, on Monday. On Friday, the administration announced it would cancel an additional $7.4 billion in debt under programs already in place, bringing the total forgiven so far to $153 billion.

Nearly 207,000 borrowers are seeing about $3.6 billion in debt canceled through President Biden’s SAVE plan, through which the administration began forgiving student loan debt earlier this year.

Another 65,000 borrowers are seeing their debt eliminated through administrative adjustments to Income-Based Repayment (IDR) plans. To date, the administration has eliminated $49 billion in debt through IDR plans.

Third, another 4,600 public servants are seeing their debt forgiven through the Public Service Loan Forgiveness program.

In total, 4.3 million federal student loan borrowers have had their debts forgiven since Biden took office.

“It shows that we are relentless in what we are doing to help millions of hard-working Americans with the burden of student loan debt,” Education Secretary Miguel Cardona said of the multiple rounds of debt cancellation.

The Biden administration has canceled $153 billion in student loan debt through a series of efforts including the SAVE plan, as well as changes to income-based repayment plans and public service loan forgiveness.

Most of the debt being forgiven Friday comes from the SAVE plan, an income-boosting repayment plan that reduces the amount of time and money some borrowers have to repay before their student loan debt is forgiven.

The Biden administration announced it would launch the program last summer.

In February, the White House announced the first group to have their debt canceled under the plan, and the Education Department said it would continue to identify eligible borrowers on an ongoing basis.

To date, eight million borrowers are enrolled in the plan. 4.5 million of those borrowers have a monthly payment of $0, and more than one million have monthly payments of less than $100, the White House said.

However, Republicans have criticized the effort to cancel the debt and accuse the president of trying to “buy votes” before the election.

They have called the cancellation of student loan debt unfair to taxpayers who didn’t take on massive student loans for school or didn’t have the opportunity to go to college.

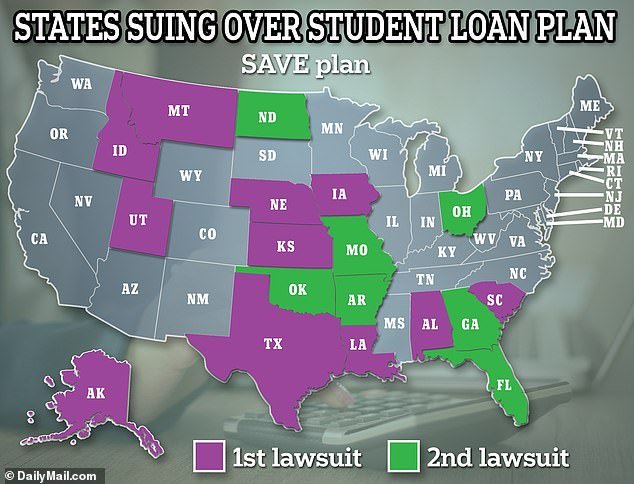

Republican state attorneys general have filed two lawsuits against the Biden administration’s income-based repayment program known as the SAVE plan.

Republican attorneys general from 18 states are suing the Biden administration over the SAVE plan. A lawsuit signed by eleven states was filed in Kansas on March 28, while another with seven states was filed in Missouri earlier this week.

White House press secretary Karine Jean-Pierre criticized the lawsuits, saying Republican elected officials want to make their constituents’ monthly payments go up and keep them under a mountain of debt.

A senior administration official said they firmly believe in their legal authority to take action.

Republican officials acknowledged that they are unlikely to recover the already forgiven debt.

Meanwhile, President Biden traveled to Madison, Wisconsin, on Monday to tout additional new plans to eliminate student loan debt.

Those proposals are being implemented through the more time-consuming rule-making process that the administration turned to after the Supreme Court blocked the original plan.

According to the Biden administration, the new proposals would completely eliminate accrued interest for 23 million borrowers.

It would also cancel the entire amount of student loan debt for more than four million borrowers and provide more than 10 million borrowers with at least $5,000 in debt relief or more.

The top five actions include writing off up to $20,000 in unpaid interest for borrowers who currently owe more on their student loans than they originally borrowed.

It would also eliminate debt for two million borrowers who would have qualified for other forgiveness programs but have not yet applied.

Additionally, college borrowers who started repayment 20 or more years ago and graduate student borrowers who started repayment 25 or more years ago would also have their debt canceled.

Borrowers who have been enrolled in programs of low financial value and those who have faced financial difficulties in repaying loans would also see relief.

President Biden released a video Monday touting his latest student loan debt forgiveness proposals that would cancel millions of accrued interest, erase debt for some borrowers who have not yet enrolled but qualify for other programs, and cancel debt for some. who have been paying for 20 or more years

Protesters outside the Supreme Court on June 30, 2023. Biden’s new student debt forgiveness proposals come after the Supreme Court blocked his original plan to cancel the debt.

The new proposals come after the Supreme Court last June blocked the president’s first massive $400 billion plan to cancel student loan debt.

“The debt of tens of millions of people was literally about to be written off, but then some of my Republican friends, elected officials and special interests sued us, and the Supreme Court blocked us,” Biden said Monday, boasting “that’s not stopped us.” .’

Senior administration officials said they carefully studied the Supreme Court’s 2023 decision and applied the new regulations in a manner consistent with that decision.

The new plans revealed Monday are part of the regulatory process that began last summer and are being carried out under the authority of the Secretary of Education in the Higher Education Act.

Administration officials said they are confident about the future of the new proposals.