Table of Contents

Buying car insurance online is something many of us do very quickly, but rushing the process can mean your policy becomes worthless if you ever make a claim.

The process of insuring a car is a double-edged sword for motorists.

On the one hand, many of us simply want the process to be over as quickly as possible and rush to answer all the questions. Price comparison websites know this and therefore keep your questions to a minimum.

But on the other hand, not fully answering some questions can have serious consequences and even invalidate your car insurance completely.

Distracted: Failure to adequately respond to insurers’ questions can backfire, experts warn

Some questions about car insurers can be difficult to answer on the spot, such as how many miles a car has on it, how many years of no-claims discount it has, or how many years it has been since it passed the test.

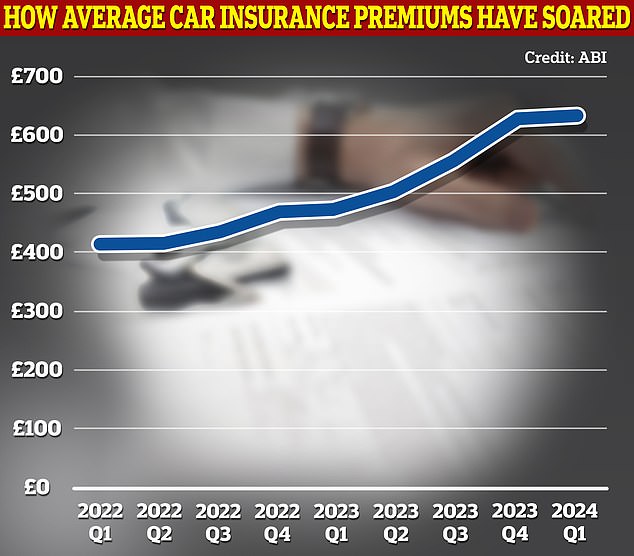

With average car insurance prices at an all-time high of £635 a year, it makes sense not to fall for some of the seemingly innocent insurance questions that can trip up unsuspecting drivers.

Here are some of the key things to make sure you get it right or regret it later.

Mileage

Auto insurers will ask you how many miles you drive per year when you purchase coverage. This is typically done in 1,000-mile chunks, so it can be tempting to come up with a figure that seems right, rather than calculating how many miles a car has driven in a year.

But it’s best to avoid this, according to Louise Thomas, auto insurance expert at Confused.com.

Thomas says: ‘While it’s important to take your time and answer each question honestly, there are some areas that can leave drivers a little stumped when looking for a new policy.

‘If you overestimate your mileage, you may give your insurer the impression that you are on the road more than you really are. And underestimating can make you look inexperienced.

‘So don’t try to guess, always be precise. If you’re not sure, you can find your annual mileage on your latest MOT certificate.’

Get the right kind of car insurance

The ‘class’ of car insurance covers the actual use of the car.

The main categories are “social, domestic and pleasure”, “social, domestic, pleasure and travel”, “commercial use” and “transport of goods for hire and reward”.

Choosing the wrong category can have serious side effects if a claim is ever made on the policy.

A This is Money reader was told they were not covered in the event of an accident as their policy did not cover “travelling”, which they flatly denied they were doing.

Julie Daniels, car insurance expert at Compare the Market, says: “If you travel to work, make sure your cover is for domestic, social, leisure and commuting use.”

No Claim Bonuses

Most price comparison websites offer a drop-down list that allows drivers to select how many years it has been since they filed an insurance claim.

Doing so may mean drivers get a lower premium as a result, although not all insurers offer this.

But many drivers do not know or do not remember how many years they have gone without a claim.

Louise Thomas of Confused.com says: ‘If you haven’t filed a claim, you’ll accumulate your non-claims. The more you accumulate, generally the greater discount you will receive on renewal.

“But you will have to provide proof of this to your insurer every year, so don’t be tempted to lie.”

On the rise: The cost of car insurance is rising, so don’t risk paying for a policy that’s invalid

Get the small details right

It may seem obvious, but experts say many drivers overlook the importance of getting their personal information right when purchasing insurance.

This is very easy to do, whether by purchasing insurance quickly or through simple human error.

Many also forget to update their details if their personal circumstances change, for example when moving house, getting married or changing jobs.

Alicia Hempsted, insurance expert at MoneySuperMarket, says: ‘When you apply for insurance, you need to be as honest and accurate as possible.

‘The Insurance Consumer (Disclosure and Representations) Act 2012 says customers must take reasonable care not to make false representations when applying for insurance, which replaced the duty to disclose material facts. This means that the clarity of the questions asked is taken into account if it is later discovered that you provided incorrect information in your application.’

Hempsted says crucial information to get right and up to date includes:

- Your adress

- Name and marital status

- Occupation

- Registered holder of the vehicle and main driver.

- Involvement in any car accident (even unclaimed) and penalty points added to your license

- Purpose and use of the car

- Modifications to your vehicle

“In most cases, answering questions incorrectly when no attempt has been made to intentionally falsify information will result in claims being denied,” he warned. “Policies may have the opportunity to challenge the decision if they believe the application process was unclear.”

Another detail that is commonly overlooked is the current market valuation of your car. This can change dramatically over time and can go up or down.

Do your research before purchasing insurance to ensure you won’t be left out of pocket if you need to file a claim.

Julie Daniels from Compare the Market says: ‘When you compare car insurance with us and enter your registration number, where possible we will provide you with details of your car’s specification and give you a valuation figure based on its market value current. You can change these details if they don’t look right.’

do not lie

Some drivers may be tempted to deliberately enter incorrect information to try to get cheaper insurance premiums.

But doing so can backfire and lead to policy cancellations, or even accusations of insurance fraud.

Louise Thomas of Confused.com says: ‘While it may be tempting to tinker with a few minor details when shopping for car insurance, it doesn’t always guarantee a cheaper price.

‘In addition, any inaccuracies could invalidate your policy, which could have major consequences if you have to make a claim.

‘Not only do you risk taking a financial hit, but it could jeopardize your chances of getting car insurance in the future. The golden saying is key: honesty is the best policy.”

Alicia Hempsted from MoneySuperMarket says: ‘In more serious situations and cases where there is evidence that you have purposely provided false information, your policy could be invalidated entirely or your case could be treated as insurance fraud.

“Failing to inform your insurance provider when your circumstances change will be treated in the same way as providing false information during the application process.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.