Capital One, the US consumer bank backed by Warren Buffett, plans to buy US credit card issuer Discover Financial Services for $35.3 billion to create a global payments giant.

The deal, which is expected to receive intense antitrust scrutiny, would form the sixth-largest U.S. bank by assets and a U.S. credit card giant that would compete with rivals JPMorgan Chase and Citigroup.

While Discover has a network spanning 200 countries and territories, it is still much smaller than rivals Visa, Mastercard and American Express.

It also brings together two companies whose customers are largely similar: often Americans looking for cash back or modest travel rewards, compared to the premium credit cards dominated by AmEx, Citi and Chase.

“This acquisition adds scale and investment, allowing the Discover network to be more competitive with larger payments networks,” the companies said in a statement.

Capital One will buy Discover for $35 billion, in a deal that would unite two of the country’s credit card companies.

While Discover has a network spanning 200 countries and territories, it is still much smaller than rivals Visa, Mastercard and American Express.

Discover shareholders will receive 1.0192 shares of Capital One for each Discover share, representing a 26.6 percent premium to Discover’s closing price on Friday.

If the acquisition goes through, Capital One shareholders will own 60 percent of the combined company, while Discover shareholders will own the remainder.

A Capital One/Discover combination would have “significant strategic merit,” Baird equity research analysts said in a note to clients, citing the cost-reduction potential that comes with greater scale and the benefits that credit cards Capital One credit use the Discover network.

Capital One is the nation’s ninth largest bank by total assets, with 259 physical branches, 55 ‘Capital One Cafés’ nationwide, and a significant online banking operation.

Discover Financial is a primarily online bank with a single physical branch in Delaware.

“This market dominated by the big players is going to shrink a little bit more now,” said Matt Schulz, chief credit card analyst at LendingTree.

It will also give the Discover payments network a major credit card partner in a way that could make the payments network a major competitor once again. The US credit card industry is dominated by the Visa-Mastercard duopoly, with AmEx a distant third and Discover an even more distant fourth.

The companies said they expect to achieve $2.7 billion in pre-tax synergies in 2027, which would include cost reductions and network savings.

It will be the first major test of bank merger regulation since the Biden administration’s executive order on promoting competition in 2021.

Richard Fairbank is the founder and CEO of Capital One

Capital One, which counts Buffet’s Berkshire Hathaway as its seventh-largest shareholder with a 3.28 percent stake, is valued at $52.2 billion.

It was the fourth-largest player in the US credit card market by volume in 2022, while Discover was the sixth, according to Nilson.

The new board will have three members appointed by Discover. It was not immediately clear how many directors the board would have.

It is unclear whether the deal will pass regulatory scrutiny. Almost all banks issue credit cards to their customers, but few businesses are credit card companies first and banks second.

Both Discover, which long ago was the Sears card, and Capital One began as credit card companies that expanded into other financial offerings like checking and savings accounts.

Regulators are expected to approve the deal in late 2024 or early 2025, Capital One said.

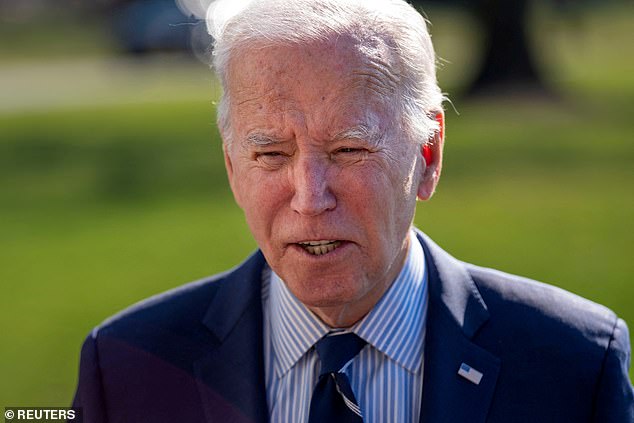

But it comes at a time when Democratic President Joe Biden’s administration has focused on boosting competition in all areas of the economy, including a 2021 executive order aimed at banking deals, merger experts said.

“I predict that this deal … will cause significant pushback and will receive increased regulatory scrutiny,” Jeremy Kress, a business law professor at the University of Michigan who previously worked on bank merger oversight at the Federal Reserve, wrote in an email. . .

“It will be the first major test of bank merger regulation since the Biden administration’s executive order on promoting competition in 2021.”

Democratic progressives have long fought against bank consolidation, arguing that it increases systemic risk and harms consumers by reducing lending.

Pressure intensified following deals aimed at bailing out failed lenders last year, including JPMorgan’s purchase of First Republic Bank.

The Biden administration’s executive order required banking regulators and the Department of Justice to review their bank merger policies.

The Justice Department later said it would consider a broader range of factors when evaluating bank mergers for antitrust concerns, while the Office of the Comptroller of the Currency last month proposed scrapping its expedited review process.

The deal would also come at a time of increased regulatory focus on credit card fees, which are the subject of strict new rules proposed by the Consumer Financial Protection Bureau.

That agency, led by merger skeptic Rohit Chopra, who has a say in banking deals, has flagged concerns about competition in the U.S. credit card market, including higher fees charged by the biggest credit card providers. Credit cards.

“This would almost certainly trigger a Justice Department investigation,” said John Kirkwood, a law professor at Seattle University School of Law.

He added that an investigation would likely focus on the companies’ positions in the credit card issuer market and how that affects competition, as well as potential barriers to entry for new market entrants.

In late 2023, Discover said it was exploring the sale of its student loan business and would stop accepting new student loan applications in February.

The company, led by TD Bank Group veteran Michael Rhodes, has faced some regulatory challenges. In July it revealed a regulatory review into some credit card accounts misclassified since mid-2007.

In October, Discover said it agreed to improve its consumer compliance and related corporate governance as part of a consent order with the Federal Deposit Insurance Corp.

While oversight issues are generally a hurdle for deals between financial companies, regulators are more receptive when the issues are related to the target company and the acquirer is considered a good actor, according to legal experts.

In the fourth quarter, Discover and Capital One reported profit declines of 62 percent and 43 percent respectively.

Banks have increased provisions for bad loan losses as rising interest rates increase consumers’ risk of defaulting on credit card and mortgage debt.