<!–

<!–

<!– <!–

<!–

<!–

<!–

A maverick senator has called for changes to a key property tax exemption used by Australian homeowners, in a move likely to outrage many of his Liberal and National colleagues.

queensland Senator Gerard Rennick said he would support removing the 50 per cent capital gains tax (CGT) discount, as long as there is no change to negative gearing.

Labor previously had a policy of halving the CGT discount, but abandoned it after the Coalition’s scare campaigns on the issue contributed to election losses in 2016 and 2019.

A capital gain occurs when an asset is sold for more than what it cost you, or a capital loss when it is sold for less than what it cost you. Australians pay tax on any net capital gains, that is, the total capital gain minus any capital losses and minus any discounts.

Australian People who own an asset for 12 months or more receive a 50 per cent CGT discount, meaning they pay tax on just half of the net capital gain they make when they sell a home.

The Greens have resurrected the issue of the CGT discount in negotiations with Anthony Albanese’s government over its Help to Buy plan, currently blocked in the Senate.

“If the Greens said they would remove the 50 per cent discount on CGT earnings… and use it for an income tax cut, I could live with that,” Mr Rennick told the Australian financial review.

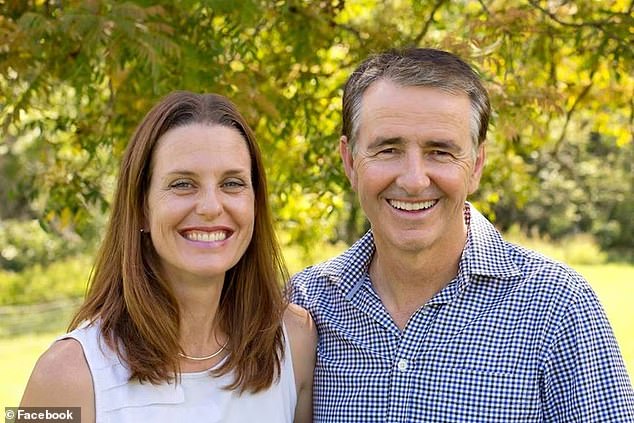

Queensland senator Gerard Rennick (pictured with wife Lauren) said he would support removing the 50 per cent capital gains tax discount as long as there is no change to negative gearing.

He said the Greens’ policy of limiting negative gearing would only lead to higher rents, but that changes to CGT were worth considering because it amounted to a “discount on passive income, not active income”.

But Albanese has said he is unwilling to revisit the CGT issue to win Green support to back the Help to Buy scheme, saying it “stands on its own merits”.

Labor took the housing policy to the 2022 federal election but has not yet been able to sign it into law.

If passed in the Senate, where Labor needs the support of minor parties to pass laws, the government would pay 30 per cent of an established property or 40 per cent of a new build.

Albanese defended his housing policy on Monday morning, telling ABC radio that the Government has “a whole set of programmes, this is just an additional one and what it effectively does is allow shared capital, shared ownership, so that people only need 2 percent. of a deposit”.

‘It makes it much easier to pay and in the future the person can buy out the government at a time that suits them if they choose.

‘It has worked effectively in Western Australia for over 50 years and has made a difference. It’s just a measure.’

The Prime Minister said the plan was unlikely to pass the Senate soon, as “the Greens and the Liberals are going to go against the comprehensive housing plan.”

“They can be held accountable for this: why they would vote against a plan that would help more people acquire their own home, about 10,000 a year,” he said.

However, Mr Rennick’s intervention in support of part of the Greens’ conditions for supporting Labor’s bill is unlikely to win the backing of many more Coalition politicians.

When Malcolm Turnbull was Prime Minister and Scott Morrison was his Treasurer. considered changes to CGT concessions to improve housing affordability.

They considered halving the discount or introducing a version in which the discount would increase the longer the property was owned.

Labor previously had a policy of halving the Capital Gains Tax discount, but abandoned this after the Coalition’s scare campaigns on the issue contributed to election losses in 2016 and 2019 (in the photo, a house for sale).

But the idea was soon abandoned and the Coalition continued to use the notion of any change as a stick to defeat Labour.

The CGT discount saved taxpayers around $25.2 billion in 2022-23, for sales of assets such as property and shares, which was a huge increase on the $9.3 billion it saved taxpayers in 2020-21.

The richest 10 per cent of taxpayers got more than 80 per cent of the CGT benefit.

Daily Mail Australia has contacted Rennick for comment.