Table of Contents

I am 68 years old and most of my funds are in both a business and my pension. My house is worth around £600,000 and is freehold.

I would like to help my daughter buy her first home by giving her the money she needs for a deposit.

I have already deducted the 25 per cent tax-free element from one of my pensions.

Mortgage Help: Our weekly column Navigate the Mortgage Maze features broker David Hollingworth answering your questions

The challenge is that if I withdraw, say, £40,000 from any of these sources, I will have to pay tax at the highest rate.

Alternatively, are there senior mortgages (a form of equity release) that can be used to raise money?

The collateral would be the house and a pension of more than £500,000. The mortgage could then be paid off in, say, five to ten years using funds withdrawn at a level that keeps them below the higher tax threshold.

SCROLL DOWN TO FIND OUT HOW TO ASK DAVID HIS MORTGAGE QUESTION

David Hollingworth replies: Conditions remain extremely difficult for first-time buyers in the current market.

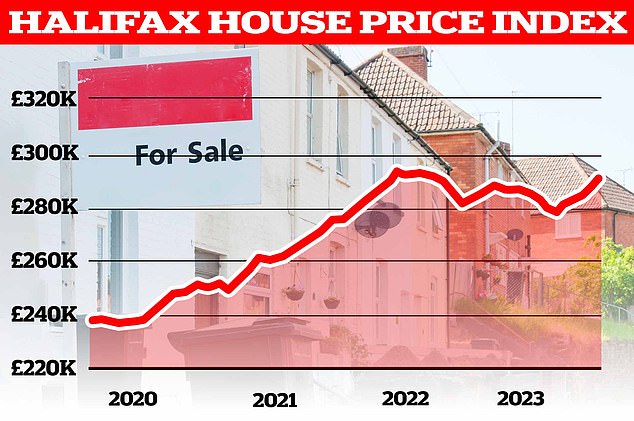

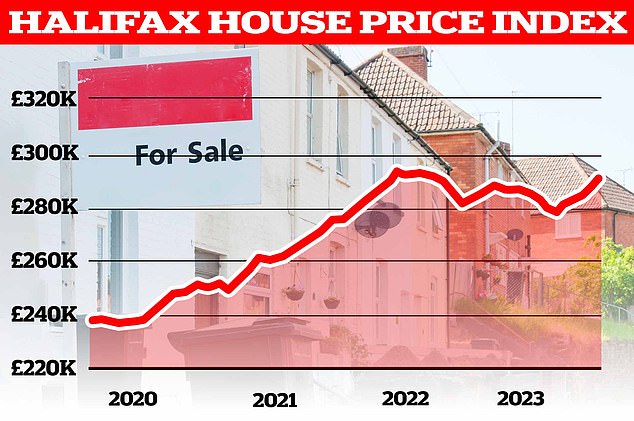

House prices have fallen to some extent, but in many cases that has barely affected the large price increases driven by high demand during the pandemic period.

Higher interest rates have only increased pressure on first-time buyers’ budgets and affordability.

High house prices come with the need for a substantial deposit. Although there are a wide variety of mortgages offered to those with as little as 5 per cent to pay, all too often a larger deposit will be needed to make up the difference between the maximum loan available based on your salary and the price of the house. buys.

> How to remortgage your house and find the best offer

Is a deposit needed?

There are even some mortgages that allow a first-time buyer to borrow up to 100 percent of the purchase price.

Generally, there will be more complexity in how these different arrangements work, but it might be worth considering whether there may be a solution that does not require the payment of a deposit.

The Skipton Track Record mortgage, for example, would depend on your daughter being able to demonstrate a history of paying rent higher than the mortgage payment, as well as demonstrating that the mortgage would be affordable based on her income.

On the rise again? House prices have fallen to some extent, but in many cases that has barely affected the huge rise in prices driven by high demand during the pandemic period.

Other lenders, such as Buckinghamshire BS and Loughborough BS, offer schemes that can lend up to 100 per cent of the purchase price, but use the equity in the parent’s home as additional security for the mortgage.

You would still need to prove that the mortgage would be affordable based on your daughter’s income.

Although some lenders will allow a parent’s income to be used to increase the loan amount, there may be limitations on the maximum term of the mortgage due to age.

> True cost mortgage calculator: check what a new fixed rate would cost

Mortgages for older borrowers

Lenders have become more flexible in their options for older borrowers. They have always been able to consider lending until retirement, but often impose a maximum age at the end of the mortgage term.

This can often be limited to 75, but there are now more lenders who will consider lending at 80 and 85, which could be enough to meet your needs.

Some lenders may consider lending at an even older age depending on individual circumstances.

This would effectively allow a traditional mortgage to be taken out, and the lender would want to be sure that the property would have adequate collateral and that the mortgage would be affordable.

Pension income should be acceptable to demonstrate that affordability.

> What’s next for mortgage rates? Should they be fixed for two or five years?

Retirement interest-only mortgages

An alternative option that would potentially give you even more flexibility over your mortgage term would be a retirement interest-only mortgage (Rio).

As the name suggests, the monthly mortgage payments would only cover the interest on the mortgage, not the balance, but there is no set term either.

Instead, the mortgage would be repaid upon sale, upon death, or upon moving into a long-term care facility.

There is still a monthly payment to make, so it is necessary to demonstrate adequate income for the mortgage.

Several building societies, such as Leeds BS and Nottingham BS, offer RIO mortgages, as do some specialist lenders such as Livemore, Perenna and Hodge Bank.

If meeting monthly payments may be difficult, then it would make sense to explore equity release solutions, such as a lifetime mortgage.

This would allow you to tap into the equity in the property, but instead of having to maintain monthly payments, the interest would accrue over time.

In summary, there may be options available and it would be worth initially considering whether you can allow your daughter to buy without the need to take out a mortgage on your home.

There are a number of reasons that may not work for you, in which case using a mortgage to raise funds could also be a possibility, provided affordability is met.

The cost of any borrowing would then need to be considered to make a judgment and advice on how it would compare with the potential cost implications of releasing cash from other sources.

NAVIGATE THE MORTGAGE LABYRINTH

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.