Table of Contents

Debra Crew, head of Diageo, the distiller behind Baileys, Guinness, Smirnoff and Don Julio tequilas, may need a stiff drink this weekend.

Interest rates may be falling, but people in the UK, US and elsewhere seem to have lost some of their taste for treating themselves, whether it’s to top-shelf spirits or exclusive handbags.

The new normal may be more moderation and less premium alcohol.

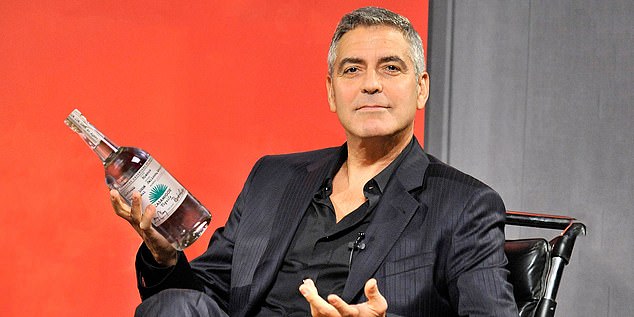

Why celebrate with a £50 bottle of Casamigos tequila (the brand founded by George Clooney and now owned by Diageo) when you can drink a pint of Guinness 0.0, a non-alcoholic treat for just over £1 a can?

The spirits supercycle is stalling: Casamigos tequila was founded by George Clooney and bought by Diageo in better times

As a result of this newfound sobriety, the FTSE 100 company reported its first global drop in sales since 2020.

The announcement followed a profit warning in November following a backlog of unsold alcohol in Mexico and Brazil.

Diageo shares fell as much as 7 percent on Tuesday. The stock has fallen 30 percent over the past year.

Shareholders are wondering how Crew, a 53-year-old Texan, will manage to steady the ship.

People close to the chief executive, a former US military intelligence officer, say she remains “confident” in Diageo’s ability to recover, and that the company is “confident that when the consumer environment improves, organic net sales growth will return”.

It is unclear when this shift will occur, however, given that young people are giving up alcohol, in a move accentuated by weight-loss drugs such as Ozempic, which can make drinking less appealing.

Others may still drink, but higher inflation means they are opting for cheaper brands.

Fintan Ryan, a drinks analyst at stockbroking firm Goodbody, largely blames the pandemic for creating “perfect conditions” that could not be sustained.

In what he calls a “spirits supercycle,” consumers were willing to spend money on expensive spirits so they could make homemade cocktails to liven up the lockdown.

This was especially true in the United States, Diageo’s largest market, where generous stimulus checks were distributed to millions of people.

While beverage companies can typically expect sales growth of around 4 percent each year in North America, growth has reached more than 10 percent through 2021 and 2022, Ryan said. But hopes that this would continue have been dashed.

Tough job: Diageo chief executive Debra Crew replaces Sir Ivan Menezes

Russ Mould, an analyst at investment platform AJ Bell, suggests Diageo’s share price is simply retreating from astronomical heights.

He said: “The growth seen during lockdowns was not sustainable as consumers cut back on spending, drank less, returned to work or a combination of the three.”

As a result of this trend, suppliers to shops and pubs have been “destocking” (pausing their orders due to excess stock), leading to a 2.5 per cent drop in US sales during the year to the end of June.

But it is not just Diageo that is being affected by the new sobriety.

An analysis by AJ Bell estimates that more than £78bn has been wiped off the value of the five largest listed drinks companies since the start of 2024. This includes Diageo, Heineken and Budweiser maker AB InBev, as well as Chinese giants Kweichow Moutai and Wuliangye Yibin.

Crew inherited the role from Sir Ivan Menezes, who died in June last year, just weeks before he was due to retire. Menezes was one of the most respected CEOs in the FTSE 100 index and increased Diageo’s value by around £30bn during his 10-year tenure.

This was achieved through a series of high-profile acquisitions, including Don Julio tequila in 2015 and Casamigos tequila two years later. Menezes also drove growth in emerging economies such as Greater China and India, and Diageo now sells more than 200 drinks brands in 180 markets.

But Sir Ivan’s death at the age of 63 meant Crew was catapulted into the driving seat without help from the man who knew the business best.

After his time in the U.S. Army, Crew worked at consumer giants such as PepsiCo, Kraft Foods, Nestlé and Mars.

She briefly ran cigarette company Reynolds American in the run-up to its acquisition by British American Tobacco, then joined Diageo as a non-executive director in 2019.

A year later, she took over Diageo’s North American division and moved to London where she was appointed COO in October 2022.

Looking ahead, some experts have suggested that the company’s performance depends on broader economic and political circumstances. Ed Mundy, an analyst at stockbroking firm Jefferies, said: “If the outcome of the US election is an improvement in the macroeconomic environment, this will be a boost for the US consumer and also for Diageo.”

But there is also a sense that the fate of beverage groups hinges on something less predictable.

The chief financial officer of luxury giant LVMH, which owns Moet Hennessy, recently said the lack of celebration was causing a drop in champagne sales.

“Champagne is very much associated with celebration, happiness, etc.,” says Jean-Jacques Guiony. “Perhaps the current global situation, whether geopolitical or macroeconomic, does not encourage people to open bottles of champagne.”

So whatever happens next for Diageo, Crew will no doubt be looking for something to toast to very soon.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.