Table of Contents

The US Federal Reserve came under pressure on Tuesday to make an emergency interest rate cut to stem panic over a possible recession in the world’s largest economy.

Global markets were in turmoil yesterday as investors fretted over the prospect of a US economic slowdown.

Traders were betting the U.S. central bank would announce an emergency rate cut ahead of a meeting scheduled for September, as stocks fell around the world.

This came after Japan’s stock market suffered its biggest one-day drop in more than 30 years and bourses in London, New York and Europe also took a hit.

Panic: Global markets plunged yesterday as investors fretted over the prospect of an economic slowdown in the United States.

But some analysts said the drop was partly a “healthy” market correction for overvalued tech stocks, as shares of companies including Apple and Nvidia fell after months of gains.

Fears that the benefits of massive investments in artificial intelligence could take longer than expected to materialize sent tech stocks tumbling.

The ‘Magnificent Seven’ – Meta, Alphabet, Amazon, Apple, Microsoft, Tesla and Nvidia – were expected to lose almost $900bn (£704bn) of market value yesterday.

Goldman Sachs said the chances of a US recession had risen to 25 percent from 15 percent.

However, the investment bank also said the risk of an economic slowdown was “limited” and the market reaction was a “healthy correction.”

This came after the US Federal Reserve was accused of keeping borrowing costs high for too long following a weak jobs report and data showing a contraction in manufacturing activity last week.

Money markets have bet there is a 60 percent chance that the Fed will announce a 0.25 percent rate cut within a week. Such a move would be unusual, but not unprecedented.

Jeremy Siegel, a professor at the Wharton School of the University of Pennsylvania, told CNBC: “The market knows a lot more than the Fed. They have to respond.”

The major New York indices plummeted yesterday: the Dow Jones Industrial Average fell 2.6% and the S&P 500 3.4%. The technology-focused Nasdaq Composite plunged 3.9%.

Apple shares fell 7.1 percent after investor Warren Buffet halved his stake over the weekend.

Recession fears: Traders are betting the US Federal Reserve will be forced to announce an urgent rate cut before a meeting scheduled for September, as stocks fall around the world.

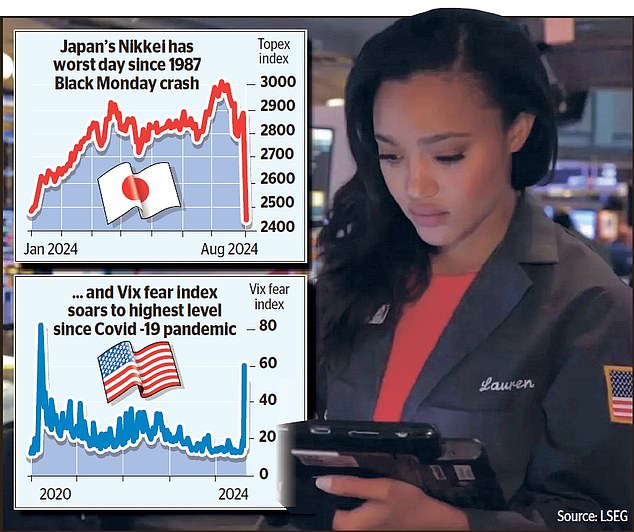

Wall Street’s fear gauge (the CBOE Volatility Index, a closely watched measure of investor anxiety) soared to 61.65, its highest level since April 2020.

The index fell back to 33.6 points later in the day, which is still a sharp increase.

The return of volatility comes after an unusually long lull, in which the S&P 500 went 356 sessions without a downward move of 2 percent or more, the longest such streak since 2007.

Richard Hunter of Interactive Investor said: “Letting a little air out of the tyres after a recent breathless run is often considered a healthy correction.”

John Moore, senior investment manager at RBC Brewin Dolphin, added: “The sell-off over the past few days is part of the recent froth that has developed on the share prices of fading tech companies.”

Tokyo’s benchmark Nikkei 225 index fell a staggering 12 percent, its worst day since Black Monday in 1987.

Also in Asia, Hong Kong’s Hang Seng fell 1.5 percent, Taiwan’s Taiex fell 8.4 percent and Korea’s Kospi fell 8.8 percent.

Deutsche Bank analyst Jim Reid said: “Markets are collapsing in Asia.”

“Markets were nervous before Friday, but weak payrolls have really caused a deep move across the world,” he said.

London’s FTSE 100 index, one of the largest publicly traded stocks in the UK, closed down 2.04 percent.

And in Europe, the Stoxx 600 continental index fell 2.2 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.