Landlords are increasingly avoiding London and other towns and cities in the south of England to invest in the midlands and north of England.

Last year, portfolio owners – those with four or more properties – flocked to cities including Manchester, Birmingham and Nottingham, according to analysis by buy-to-let mortgage lender Paragon Bank.

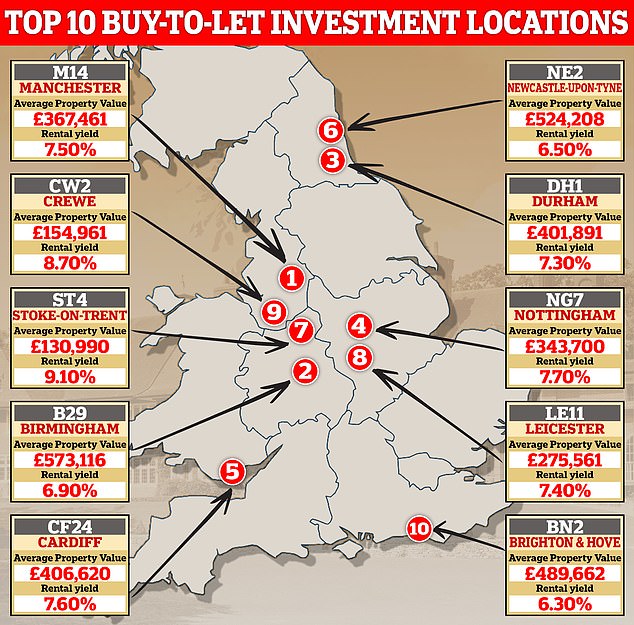

It revealed the 10 most popular buy-to-let postcodes of 2023, with only one located in the southern region of England.

Buy-to-let hotspots: Paragon Bank revealed the top 10 places to invest for buy-to-let portfolio owners – those with four or more properties

Richard Rowntree, CEO of Paragon Bank, said: “Our data shows that portfolio owners have a strategy of targeting the major towns and cities of England and Wales, from Brighton and Hove on the south coast, through the Midlands and Wales. to Newcastle.

“Something that unites many of these diverse areas is their proximity to universities or large employers, such as the NHS or manufacturing and distribution centres.”

What locations are portfolio owners targeting?

Manchester’s M14 postcode was the most popular place for buy-to-let homeowners to invest, according to Paragon Bank.

The M14 postcode covers the districts of Fallowfield, Ladybarn and Rusholme in south Manchester and is located between the University of Manchester and Manchester Metropolitan University.

The owners are attracted to the area by the high student population, according to Paragon, along with the abundance of restaurant and nightlife options, including Rusholme’s famous curry mile.

The postcode also has a number of green spaces and is connected by a metro system along with road and rail infrastructure.

Those investing in the area will be able to achieve gross rental yields of up to 7.5 per cent, Paragon said.

Gross rental yield is the percentage return an investor can expect to earn on the purchase price each year before taking into account taxes and other costs.

For example, a 5 per cent gross yield on a £200,000 property would be equivalent to £10,000 a year in rental income.

Manchester’s M14 postcode was the most popular place for rental home owners to invest.

Jason Watkin, chief executive of Manchester estate agency Lomond, says: “The M14 postcode has historically been popular for buy-to-let investment due to the fact that it is perfectly located between two of the city’s major universities and continues being an area of great interest for today’s investors.

‘Like most university cities, Manchester simply does not have a sufficient level of purpose-built student accommodation to facilitate its growing student population and so many students continue to rely heavily on buy-to-let properties.

“This high level of demand, together with the short settlement periods and high yields on offer, provide a very attractive proposition for today’s investors.”

Lisa Stephenson, regional director at estate and lettings agency Entwistle Green, adds: “The buy-to-let market in Manchester is stronger than ever.” Rents are at an all-time high and tenant demand has increased to record levels.

“Following a slowdown in the sales market due to high interest rates, this has presented a unique opportunity for potential investors to maximize rental yields and generate strong income from their property portfolio, and we have seen a clear increase in homeowners investing here over the last few years.’

‘After Covid, more and more tenants are moving to the city from all over the world.

‘A mix of UK and international students coming to study at the city’s multiple universities, combined with workers from Europe coming to work in the city’s thriving bar and restaurant scene, as well as the growing presence of large companies moving to Manchester. has resulted in a surplus of tenants and a shift in supply versus demand that greatly favors any potential landlord.’

Birmingham’s B29 postcode was the second most popular area for portfolio owners last year.

The B29 postcode mainly covers the Selly Oak district and extends to Edgbaston in the east of the city and Shenley Fields in the west.

Again, this area is home to a sizeable student population due to its location close to the University of Birmingham.

Nearby, in neighboring Edgbaston, is the Queen Elizabeth Hospital, a notable local employer as one of the largest single-site hospitals in the UK.

Properties in the postcode are the most expensive on the list, with an average purchase price of £573,116.

While some parts of the postcode and surrounding areas can be considered affluent, the sizeable proportion of large homes, which are well suited to shared living, is also likely to contribute to above-average property values.

According to Paragon, returns of up to 6.9 percent can be generated in the B29 zip code.

Postcode B29 was the second most popular area for wallet owners last year

Richard Crathorne, chief executive of Birmingham estate and lettings agency John Shepherd, says: “While the University of Birmingham and a strong level of student rental demand is a factor attracting Birmingham investors to the code postal B29, is not the only reason why the area is popular.

‘The proximity of the Queen Elizabeth Hospital also means that there is a high level of housing need from professional tenants, as the hospital is not only one of the largest in the UK but is also a major local employer.

“As a result, landlords not only benefit from very strong returns when investing within the zip code, but they also have the luxury of choosing which tenant segment they want to rent to.”

Nathan Nock, Connells lettings area director in the Midlands, adds: “As always, Birmingham’s buy-to-let market remains busy and demand continues to outstrip supply.

‘That said, applicant levels have reduced since the post-pandemic peak and landlords need to ensure their properties are priced correctly and presented in the best light.

“Rents have risen significantly over the last two years and now that there is a little more certainty around mortgage rates, landlords are buying again, attracted by the impressive yields available.”

Durham’s DH1 continues the theme of thriving student markets and is the third most popular place to invest.

The third most popular buying point for investors last year was DH1 in Durham, where properties can offer yields of up to 7.3 per cent.

Although it differs from the M14 in Manchester and the B29 in Birmingham due to the postcode covering both suburban and rural areas, DH1 continues the theme of thriving student markets.

Durham University’s membership in the Russell Group of the UK’s leading research-intensive universities and its consistent ranking in the top 10 nationally contribute to the postcode’s popularity among students.

James Needham, director of Alesco Property Investments, says: ‘It’s a common trend in the market at the moment. Money moves away from capital in search of better returns.

“This also aligns with massive increases in rental prices across the UK, where there is a significant lack of available rental properties.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.