Table of Contents

Frasers Group boss Michael Murray warned that “business taxes are holding us back” and called on Labor to reduce the tax burden.

Chief executive and son-in-law Mike Ashley made the comments as he announced a “breakout year” for the Sports Direct owner.

Business taxes are a local tax paid based on the value of a commercial property, meaning stores pay a premium compared to online giants like Amazon.

Many traditional retailers have urged the government to deliver on its stated promises to reform this broken system.

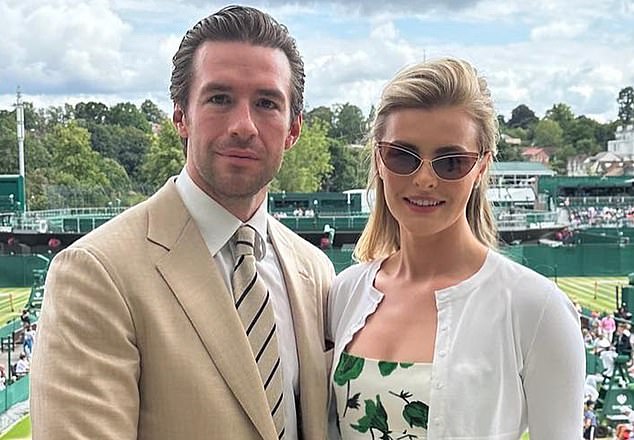

Tax call: Frasers chief executive Michael Murray (pictured with wife Anna), who is Mike Ashley’s son-in-law, has heralded a “hugely successful year” for the Sports Direct owner.

“We hope the new government will consider cutting business rates which are holding us back,” Murray said.

He added: “They say they are committed to the business so we hope they will help retailers. It will be a battle of the strongest and we are confident we are in a good position to continue growing.”

Murray took over in May 2022 after his father-in-law stepped back from the business he created in 1982. Shares have since risen by a third, from 670p to 897p yesterday.

Her demands echo those of other well-known companies such as Marks & Spencer, Next and Kingfisher, which owns B&Q. Rachel Reeves wants to become the most “pro-growth” chancellor in the UK’s history.

And Labour’s manifesto promised to “replace the corporate tax system, so we can raise the same revenues but in a fairer way”.

He added that the system “discourages investment, creates uncertainty and places an undue burden on our main streets.”

Murray also criticised Labour’s promise to ban zero-hours contracts, saying some employees “would be upset”.

He told Sky News: “We’ve done surveys and the zero-hours contract has had very positive feedback, and that’s because it gives people the flexibility to decide when they want to work and when they don’t.”

Despite the pressure on business, Frasers has taken a positive step and its shares have risen 20 per cent in a year.

It is considered a High Street flagship due to its huge catalogue of brands, including House of Fraser, Flannels, Game, Jack Wills, Agent Provocateur and Sofa.

It also owns stakes in other retailers including Hugo Boss, Currys, Asos and Boohoo.

Profits rose to £545m in the year to April 28, up 13 per cent on the previous year, boosted by strong results from Sports Direct.

But this was offset by a poorer performance at its gaming retailer Game, planned closures of House of Fraser stores and a tough luxury market.

“While sport has gained momentum, our premium and luxury division has experienced the weakening of the global luxury market felt by most high-end retailers and brands,” Murray said.

Overall, annual sales fell 0.9 percent to £5.5 billion.

Clive Black, equity analyst at Shore Capital, said: “It’s a distinctive business with a rich history of growth by any measure and while it’s not everyone’s cup of tea for a variety of reasons, we expect growth to continue and for Frasers to become more, not less, relevant in the future.”

Frasers bought ailing high-end fashion retailer Matches for £52m in December but had to put it into administration a few months later.

This resulted in a £12.5m loss in its annual profits. Last month it bought THG’s luxury goods websites.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.