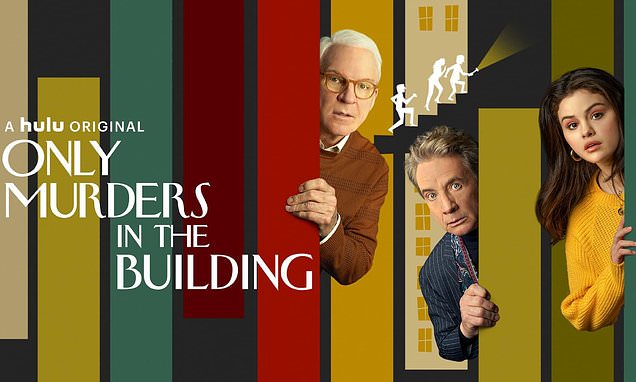

514 Disney+ streaming service finally turns a profit as cost-cutting efforts pay off

Parliamentarian condemns ESG debanking when “legitimate” companies are denied accounts

Table of Contents

The FTSE 100 will open at 8am Companies with trading reports and updates today include Boohoo, JD Wetherspoon, Workspace, Direct Line and Informa. Read the Business Live blog from Wednesday 8 May below.

> If you are using our app or a third-party site, click here to read Business Live

‘Wetherspoon’s commitment to low prices and doing the basics right is helping to keep punters loyal’

New Workspace Head Appointed

Disney+ streaming service finally turns a profit as cost-cutting efforts pay off

Wetherspoon’s raises profit expectations

“It doesn’t look like a miraculous recovery is around the corner” for Boohoo

Parliamentarian condemns ESG debanking when “legitimate” companies are denied accounts

Boohoo sales drop