Through live commentary

Updated: 04:09 EDT, March 26, 2024

<!–

<!–

<!– <!–

<!–

<!–

<!–

The FTSE 100 opens at 8am. Companies with reports and trading updates today include Bellway, Revolution Bars, Ocado, Asos, 888, Flutter, Fevertree and Pets at Home. Read the Business Live blog from Tuesday, March 26 below.

> If you use our app or a third-party site, click here to read Business Live

‘Fevertree presents mixed results’

Aarin Chiekrie, equity analyst at Hargreaves Lansdown:

‘Fevertree presented the markets with a mixed set of annual results. Sales rose 6% to £364.4 million as the group made market share gains across all its major regions. In line with the January trading update, cash profits were just £30.5m. But that was still right at the low end of the group’s previous target range, which had already been lowered.

‘This was largely due to the high exposure to higher energy costs, as the majority of sales are bottled in glass. In combination with the high freight costs, profitability really came under pressure. Trade in Great Britain remains disappointing. The region seems saturated with premium mixers, with Fevertree already dominating market share here, so growth is unlikely to blow it out.

‘This means that the US will have to continue to catch up in the future. The US is now Fevertree’s largest region by revenue, yet still offers exciting growth opportunities given the sheer size of this market.

‘The balance sheet is in very good shape thanks to the low debt burden. And following a one-off stock buyback in Australia, it appears the biggest operational challenges are now behind us.

‘But this year’s profit targets appear large, so Fevertree will need to keep a tight rein on costs if it wants to almost double its profit margins. And due to the sky-high valuation, much of that has already been priced in. Many investors will want to see more concrete signs that U.S. expansion is improving earnings before they get too excited about this mixer manufacturer.”

US performance boosts Fevertree’s profits

Fevertree Drinks’ profits exceeded market expectations last year thanks to robust performance in the US market and increased regional production to offset inflationary pressures from higher glass production costs.

The London-listed tonic maker, which sells most of its drinks mixers in glass bottles, said on Tuesday that adjusted core profit in the 12 months to December 31 was about £30.5m, narrowly beating forecasts of £30m.

‘2023 was a year in which the Fever-Tree brand once again grew in breadth and depth, with market share gains around the world. Perhaps the most important milestone was establishing the US as our largest region, expanding our market leadership position in both the US tonic water and ginger beer categories.

‘The G&T obviously remains an integral growth driver for the Group, but 2023 was a year in which we saw a step change in our non-Tonic portfolio. Not only did our Gingers and Soft Drinks continue to see strong growth, but over the past 12 months we have also seen the launch of our Cocktail Mixers range, in addition to the launch of our adult soft drinks range in the UK.

“Given easing inflationary pressures, the operational efficiencies we are achieving mean I am confident we enter 2024 in a very strong position from an operational perspective and have an excellent platform for strong profitable growth going forward.”

Will an American activist revive Scotland’s mortgage investment trust?

Scottish Mortgage Investment Trust (SMIT) was once the toast of the town, but its fall over the past two and a half years has upset many private and institutional investors.

SMIT is known for its stock selection led by star investment manager James Anderson, who left in 2022 after 21 years at the helm. SMIT was the source of funding for British investors seeking access to fast-growing global technology companies.

Asos sales fall amid business revival plans

Asos’ sales fell 18 percent in the first half, with the struggling online fashion retailer on track for a sales decline of as much as 15 percent this year as it tries to revive its fortunes.

The group, which has struggled since the pandemic ended, called 2024 a transition year, focusing on accelerating processes, launching new collections and getting rid of a buildup of excess inventory.

It also reiterated expectations that it would post positive adjusted core earnings (EBITDA), generate positive cash flow and return inventories to pre-Covid levels.

“I am excited about the performance of our new collections, while we have also made great progress in monetizing inventory built up during the pandemic and improving the core profitability of our operations,” said boss Jose Antonio Ramos Calamonte.

‘Bellway has a track record of under-promising and over-delivering’

Anthony Codling, Managing Director at RBC Capital Markets:

‘Bellway delivered results in the first half of the year that were in line with our expectations. Looking ahead, the reporting is difficult, but it is getting better.

“This year is likely to be the low point in terms of volumes and profits for Bellway, with growth in both returning in fiscal 2025.

“Bellway’s activity in the land market is increasing, indicating that Bellway is seeing the light at the end of the tunnel, supporting its 2025 growth thesis.

‘As always with Bellway, the wording of the guidance is cautious, but we note that Bellway has a track record of under-promising and over-delivering. We expect the Group to continue quietly building homes and delivering value to shareholders.”

London lags behind in battle for Unilever ice cream truck: Boss says Amsterdam has a ‘great chance’ of winning the race

Unilever’s boss has indicated that Amsterdam is ahead of London in the race to win the stock market listing of his £15 billion ice cream company.

Hein Schumacher, the consumer goods giant’s Dutch CEO, said the Netherlands has “a good chance” to host the division if it is spun off.

His comments came a week after he pitted the two stock markets against each other with the announcement that Unilever would spin off its ice cream business behind household names such as Ben & Jerry’s and Magnum.

Ocado received a boost as its customer base grew

Ocado Retail’s revenues rose 10.6 percent in the most recent quarter, driven by customer growth.

The company, a 50:50 joint venture between Ocado Group and Marks & Spencer, said on Tuesday that retail sales in the first quarter to March 3 were £645.3 million, while the number of active customers rose 6.4 percent to 1 .02 million.

Volume, or total number of items sold, grew by 8.1 percent to 242.1 million, average orders per week rose by 8.4 percent to 414,000 and average basket value increased by 2.1 percent to £125.47 .

“Our strategy is resonating with customers and volume growth is growing well,” said CEO Hannah Gibson.

Ocado Retail stuck with guidance for full-year sales growth in the ‘mid-single digits’ range and an underlying profit before bad business margin of around 2.5 percent.

Revolution Bars is weighing options

Revolution Bars Group may ask investors for more money and is exploring the possibility of selling itself to a new owner, the company told shareholders this morning.

The London-listed bar company, which also owns Revolucion de Cuba, said it was exploring “all available strategic options” after what it called “a period of external challenges”.

Bosses said they are looking at ‘a restructuring plan for certain parts of the group, a sale of all or part of the group, and any other option to maximize returns for stakeholders’.

It also says it is talking to “major shareholders and other investors”, including Gail’s bakery chairman and entrepreneur Luke Johnson, about raising funds.

Revolution Bars added: ‘The company is not in discussions with, nor is it receiving any approach from, any potential bidder in relation to an acquisition of the issued and to be issued share capital of the company.’

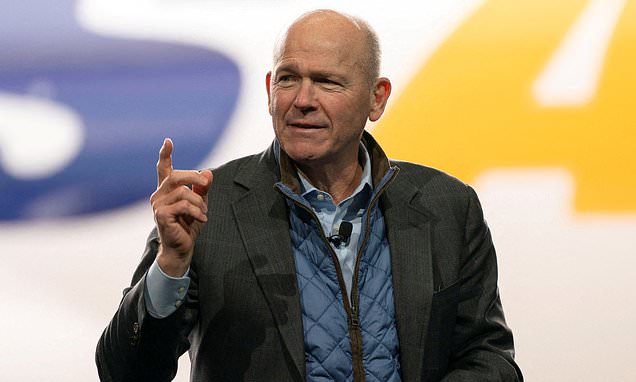

Cleaning out the boardroom at Boeing, as the safety crisis causes the share price to plummet

Boeing has announced it will oust its leadership team as it grapples with a safety crisis that has enraged airlines and sent its stock price tumbling.

Chief executive Dave Calhoun will step down by the end of the year, while chairman Larry Kellner and commercial aircraft boss Stan Deal will also be bailed out.

Bellway’s profits are falling

Bellway’s profits fell by almost 60 percent year-on-year in the first half, but the housebuilder signaled an improvement in demand, fueling hopes for an improvement in the UK property sector.

The UK housing market has seen signs of stability in early 2024 with mortgage rates easing after experiencing subdued demand for most of last year, but the Bank of England’s delay in cutting rates and persistent macroeconomic concerns have dampened hopes for a positive outcome. a faster recovery.

The number of private bookings at Bellway has increased by 20.7 percent to 163 per week in the six weeks since February 1, compared to the same period a year earlier.

“While the economic backdrop remains uncertain, the gradual reduction in mortgage rates in the first half has helped to ease affordability constraints… encouraged by the improvement in reservations since the start of the new calendar year,” said Jason Honeyman, CEO of Bellway.

Share or comment on this article: BUSINESS LIVE: Bellway’s profits fall; Revolution Bars weighs options; Ocado’s customer base is growing

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.