Joe Biden and Donald Trump will make dueling visits to the border on Thursday as illegal immigrants remain a major issue ahead of the 2024 election.

The president will travel to Brownsville, Texas, to meet with U.S. Border Patrol agents, law enforcement officials and local leaders, according to a White House official.

Trump will visit Eagle Pass on Thursday, where he will criticize Biden for the record number of illegal crossings and discuss the arrest of undocumented Venezuelan immigrant in recent high-profile murder of a 22-year-old nursing student in Georgia

The two rivals are not expected to cross paths while in Texas.

Joe Biden and Donald Trump to make dueling visits to the border on Thursday when both are in Texas

On his visit, Biden ‘reiterates his calls for congressional Republicans to stop playing politics and provide needed funding for additional U.S. Border Patrol agents, more asylum officers, fentanyl detection technology and more,’ the White House official said.

White House press secretary Karine Jean-Pierre said Biden will push for House Republicans to pass the bipartisan border security bill.

‘He said he was going to take action. He’s going to do that. We’ll see him on Thursday on the field doing that. “And look, there was a deal that came out of the Senate on a bipartisan basis that took four months, Republicans got in the way because of what Donald Trump told them to do,” he said.

Biden and his team have been trying to take control of the narrative when it comes to the border issue, as polls show voters consider it a top priority and it is an issue on which the president remains politically vulnerable.

It is Biden’s second trip to the border. In January 2023 he traveled to El Paso. Trump has made multiple trips to the border region.

‘Corrupt Joe Biden has had three years to visit the border and solve the crisis he created. “Now Biden’s handlers are sending him there on the same day as President Trump’s publicly reported trip, not because they really want to solve the problem, but because they know Biden is losing badly,” the campaign press secretary said. of Trump, Karoline Leavitt, in a statement.

The trips come as the issue of immigration comes to the forefront of the campaign. They also come just days before the Super Tuesday primaries on March 5, when more than a dozen states hold elections for the Republican nomination.

Both men have criticized each other on the border issue as they try to make it an election year issue.

There have been record border crossings during the Biden administration, a fact that Trump and Republicans have stressed to him.

People cross the Rio Grande to surrender in Brownsville, Texas, to the authorities to begin their immigration process

Migrants arm in arm as they enter the Rio Grande River with the intention of crossing to Eagle Pass, Texas.

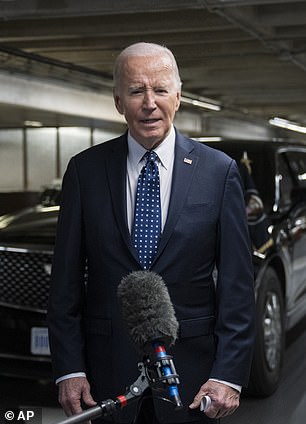

President Joe Biden has only visited the border one other time: El Paso in January 2023 (above)

For his part, Biden blamed Trump for the Republican chaos at the Capitol after GOP lawmakers thwarted a border security deal.

In February a The bipartisan border security bill officially failed in the Senate after conservative Republicans trashed long-negotiated compromise legislation

They argue that the bill did not go far enough to secure the border. Trump, who is Biden’s likely competitor in the November election, had been lobbying against it, calling it a “death wish” for the Republican Party.

Biden originally supported the bill to try to get the border issue off the table as he prepares for the 2024 general election. But Trump wanted to keep the issue alive so he could press Biden.

Trump expected to speak about UGA murder victim Laken Riley

Trump has repeatedly accused Biden of being soft on the border and has demanded the president build his wall.

It will be in Eagle Pass, about 330 miles from Biden’s stop.

During his visit, the former president will deliver remarks from the border to highlight the immigration crisis and blame Biden for it.

The Republican governor of Texas, Greg Abbott, has stationed the National Guard in Eagle Pass to prevent the passage of migrants. The state fenced off approximately 2.5 miles of the U.S.-Texas border at Shelby Park.

Trump will also discuss the arrest of José Antonio Ibarra, 26, for the murder of Laken Riley, 22.

Riley, a nursing student, found dead by police Thursday after failing to return from her morning run. University of Georgia police found her near where she had been running on the campus intramural fields with “visible injuries.”

‘Corrupt Joe Biden’s border INVASION is destroying our country and killing our citizens! The horrific murder of 22-year-old Laken Riley at the University of Georgia should NEVER have happened! “The monster who took his own life entered our country illegally in 2022…and then was released AGAIN by radical Democrats in New York after hurting a CHILD!!,” Trump wrote on Truth Social on Monday.

‘When I am your president, we will immediately seal the border, stop the invasion, and on day one, begin the largest deportation operation of illegal CRIMINALS in US history! May God bless Laken Riley and his family!!! Our prayers are with you!’

U.S. Customs and Border Protection has tracked more than 1 million migrant encounters since fiscal year 2024 began, according to the It is the first time that this mark has been reached.

The figure is approximately 100,000 higher than the same period last year and is the first time the United States has reached the million encounters mark.

An NBC News poll from January found that 57% said Trump would do a better job of securing the border, while 22% said the same of Biden.