Older Australians have pleaded with the government to abandon plans to phase out cheques, with the once popular payment system to be history by 2030.

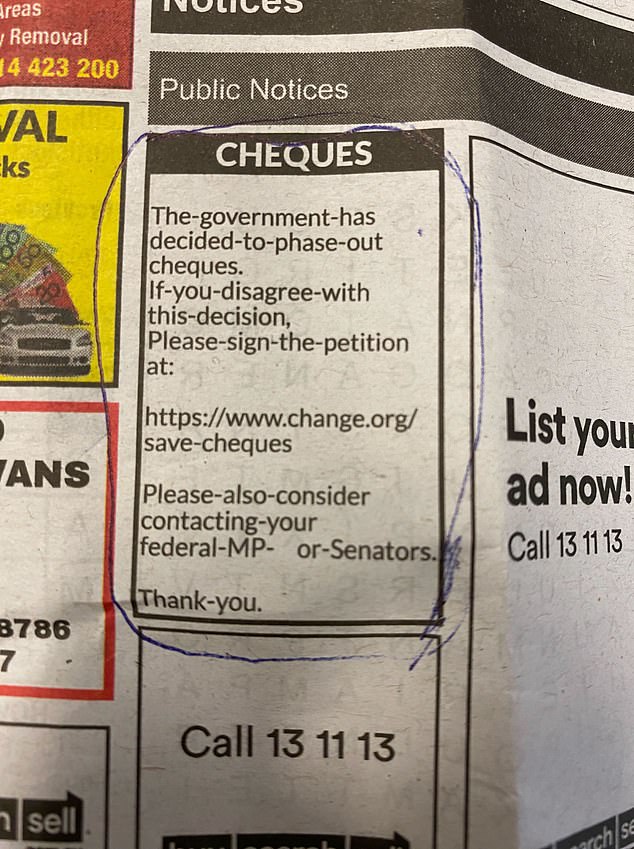

The move has prompted one fed-up Australian to publish his opposition to the reform in the public notices section of a newspaper.

‘The government has decided to progressively eliminate checks. If you disagree with this decision, please sign the petition,” reads the public notice posted Wednesday.

Readers were also encouraged to lobby their local MPs or senators.

He requestwhich was started by David Miller on March 7, has garnered more than 11,670 signatures.

“Australians already lose billions of dollars a year due to online scams and electronic theft, and those are just the reported losses,” he wrote.

Miller argued that millions of older Australians, who do not use online banking, will be “severely disadvantaged” if checks are scrapped.

“Check processing has already been simplified and streamlined, and check transactions are now transmitted electronically between financial institutions,” he said.

A furious Australian placed an ad in a newspaper’s classifieds section (pictured) on Wednesday in an attempt to oppose the check ban.

“There is no need to discontinue the use of checks.”

Miller argued that getting rid of check payments will increase the likelihood of older Australians becoming victims of sophisticated online scams as they will be forced to use technology they are not familiar with.

He said it will be more expensive to transact in rural areas and will prevent larger payments from being made “during blackouts and power outages.”

Australians lost $20 million to bank impersonation scams in 2022 and phone and text message scams claimed a whopping $169 million in 2021, according to figures from the Australian Competition and Consumer Commission (ACCC). .

Dozens of those who signed the petition said checks are an essential payment method that many use to access everyday items and services.

‘It is necessary to leave this as it is. “Many people in the country need checks because they do not have internet coverage and therefore rely on checks to pay bills,” one person wrote.

“It’s very unfair to everyone and another example of the bank withdrawing essential services, especially from seniors,” another person wrote.

“Not everyone can or wants to pay online and if there is a breakdown in the electronics there has to be an alternative,” added a third.

Dozens of commentators criticized the government’s decision to phase out cheques, saying the payment method is essential for millions of Australians (file image)

Others said the phasing out of checks was another way the government was indirectly infringing on people’s “freedom of choice” as Australia transitions to a cashless society.

“My money, I choose how I use it,” one person commented.

‘Our concerns about our choices and preferences are not taken into account. Cash is king,” wrote another.

“People should have the right to choose, not have it taken away from them,” a third agreed.

The federal government announced it would phase out the payments system in its check transition plan released last month.

The plan includes a two-step schedule that will stop issuing checks by June 30, 2028 before the payment method will no longer be accepted starting September 30, 2029.

The controls will be abandoned completely at the beginning of 2030.

A decision has been made to reform Australia’s financial system in a bid to make it more “modern, competitive and efficient” in an increasingly digital economy.

The government also published a consultation paper in December last year to seek feedback on efforts to ease the transition to electronic payments.

AusPayNet chief executive Andy White said the phasing out of check payments was a step in the right direction towards a more secure way of carrying out financial transactions.

“It is clear that checks are no longer suitable as a payment method when there are so many secure, efficient and convenient digital alternatives available,” he said.

Check use in Australia has fallen by around 90 per cent in the last ten years and currently accounts for just 0.1 per cent of all payments nationwide.

Checks accounted for about 85 per cent of non-cash payments in Australia in the 1980s, according to Reserve Bank findings.