Table of Contents

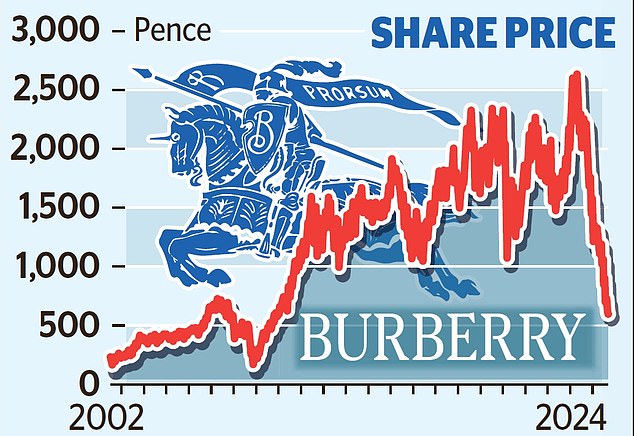

Burberry shares have fallen to their lowest level in 15 years amid fears it will struggle to remain a “high-end luxury brand”.

Shares fell as much as 8 percent yesterday to their lowest level since 2009 after Barclays analysts warned its status as a major player in the industry was under threat.

On a dismal day for the British fashion brand, shares closed down 4.9 per cent, or 29.4 pence, at 575 pence, giving it a value of just £2 billion.

Advising clients to sell shares, Barclays said the downgrade came despite it being “already one of the worst performing names in our space”.

Burberry shares fell as much as 8% yesterday to their lowest level since 2009 after analysts at Barclays warned its status as a major player in the industry was under threat.

The report added: “We are concerned about Burberry’s ability to remain a high-end luxury brand in line with our coverage given its lack of a disciplined full-price strategy.”

And he said the company is on track to make a loss for the first time in the first half of the current financial year.

The latest setback comes after Burberry fell off the FTSE 100 index last week, and speculation is mounting that the stock is so cheap that the company could become a takeover target.

The latest sell-off, which left the stock down 78 percent from last year’s peak, is another headache for new boss Joshua Schulman.

He took office in July after Jonathan Akeroyd was ousted after seeing his so-called “elevation strategy” fail.

While other luxury goods groups have also struggled, Burberry has fared much worse than many of its rivals because consumers have found its high prices (such as £1,900 for its famous cheque)

Trench coat: Hard to swallow. Even wealthy shoppers have cut back on spending on high-end clothing and accessories as the pandemic luxury boom lost its luster.

Demand in China, a huge market for luxury goods, has slowed due to economic problems and ostentatious displays of wealth are falling out of fashion.

And Burberry can’t compete with the marketing machines of big names like LVMH, which signed Dune and The Greatest Showman star Zendaya as its celebrity ambassador.

There have been concerns that the 186-year-old British name could be snapped up by private equity predators.

Fashion experts say a bid is unlikely to be imminent, given that the brand appears to have lost its way so much.

The task of halting its decline falls to Schulman, the fourth chief executive in ten years. On his arrival, he received a “golden greeting” worth up to £9.2m.

The company is facing an identity crisis, according to Mamta Valechha, equity analyst at asset manager Quilter Cheviot.

She said: ‘Management’s commitment to maintaining a luxury positioning while striving for inclusivity raises concerns about potential brand dilution.

‘Striking the right balance between exclusivity and inclusivity is essential to avoid undermining the brand’s prestigious image.’

High prices have discouraged the ambitious shopper, while heavy discounts have damaged the products’ “must-have” status.

‘This confused approach, combined with a slowdown in demand from China and the removal of

“VAT refunds for UK tourists and rising global costs of living have led to a drop in sales and a possible loss in its upcoming November results,” said Jonathan De Mello, founder of JDM Retail.

Creative director Daniel Lee, 38, will be looking to set a new tone with his London Fashion Week show on Monday.

But Burberry is not the only luxury company to suffer. Gucci owner Kering was also downgraded yesterday by analysts at Barclays, who said the flagship brand “continues to suffer from a sharp decline in sales in China, more so than its peers.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.