Table of Contents

- UK GDP growth revised down in Q2 following construction slump

- Economists say government investment could improve morale

The new Labor government’s first budget will be tasked with reviving expectations for the British economy as confidence begins to sour.

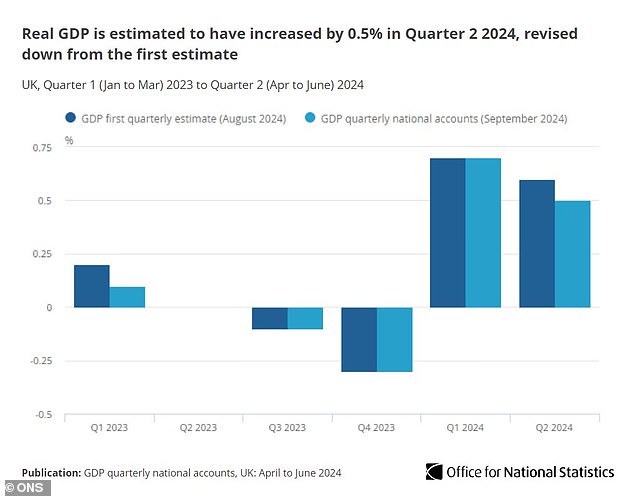

Revised figures from the Office for National Statistics on Monday showed the British economy grew less than expected in the second quarter of the year, following reports that business and consumer confidence weakened in September.

The UK’s second quarter GDP was revised down from 0.6 to 0.5 per cent, largely as a result of the decline in the manufacturing and construction sectors.

Improving mood: Economists hope impending October 30 budget will revive sentiment

Construction industry data released later this week will provide further clues about the health of this crucial industry.

Thomas Watts, investment analyst at Abrdn MPS, said: “Given that one of the key parts of Labour’s manifesto is to relax building regulations and build more homes, it will be interesting to see where the sector currently stands.”

Economists say Chancellor Rachel Reeves will have to walk a fine line on both spending and taxes, providing enough stimulus without spooking bond markets while ensuring households are not overburdened.

Separate data from Lloyds Bank on Monday showed business confidence fell in September after hitting an eight-year high in July and August.

ONS revises second quarter GDP growth downwards after construction sector slump

The result, which follows GfK data showing a sharp drop in consumer confidence in September, has been attributed to concerns over the possible ramifications of the upcoming budget on October 30.

Both businesses and consumers are showing caution as they weigh the consequences for their tax burden and public spending.

UBS economist Dean Turner said in a note that budget expectations and “tough messages from the Government” were on clients’ minds in September, adding that “fears about bad times ahead for the economy are high.” “.

But Turner believes Reeves will finally reach a deal in the face of the worst fears on both taxes and spending.

He said: ‘A notable (Labour) commitment is to invest in the economy, suggesting adjustments to current fiscal rules are very likely.

‘The extent of these changes and the money this frees up for investment is still unknown, but various estimates suggest it could be between £10bn and £60bn – wide enough to fit a bus.

‘As always when a new Budget is approaching, expectations about what will be announced swing from one extreme to the other.

«The smart money suggests that we will probably end up somewhere in between. This “somewhere in the middle” will probably also apply to the other side of the balance sheet: taxes.’

Turner added that the Budget is “unlikely” to trigger a recession or begin a period of fiscal austerity, meaning “the general mood should start to see some improvement”.

Thomas Pugh, economist at RSM UK, added that consumer confidence should improve from its September “slump” as the impact of rising real wages “seeps into people’s pockets”, ultimately would ultimately lead to a boost in household spending.

He said: ‘What’s more, increased business confidence and lower interest rates should eventually translate into greater business investment.

‘Last but not least, we are likely to see a new wave of government investment announced in the Budget, which would further boost growth over the next year.

“As a result, even if growth slows in the second half of this year, the economic outlook looks much brighter than at any time since the pandemic.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.