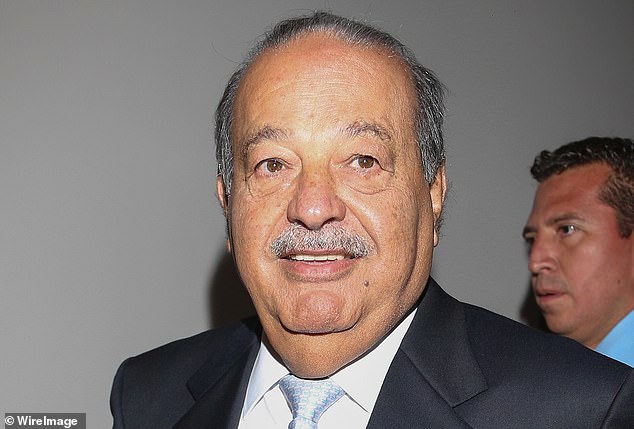

BT shares hit their highest level of the year after Mexican billionaire Carlos Slim took a 3 percent stake.

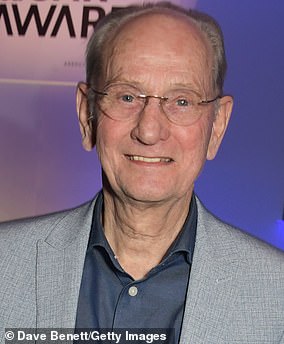

The British telecoms giant rose 4.3 per cent, or 5.6p, to 135p (giving it a value of £13.4bn) as it made gains since Allison Kirkby became director executive in February up to 20 percent.

The rally came after Slim – at one point the world’s richest man – acquired a 3.2 percent stake through his family business Inbursa.

The Mail understands that BT only became aware of the investment when it was revealed to the authorities.

Slim is the latest high-profile investor on the share registry alongside billionaire telecoms tycoon Patrick Drahi and German group Deutsche Telekom.

What’s at stake: BT shares rose 4.3%, or 5.6p, to 135p, valuing it at £13.4bn, after Mexican billionaire Carlos Slim (pictured) ) was made with a 3% stake.

The backing of one of the world’s richest men can be seen as a vote of confidence in BT under the Kirkby government.

But Slim’s motive remains unclear and, according to sources, he has not yet contacted BT, although a spokesman for the Mexican simply stated that it is a “financial investment like many that the group makes.”

So who is Slim and why is he eyeing the company?

The 84-year-old businessman made his fortune through the telecommunications giant América Móvil, which dominates the Latin American market with 384 million customers.

His parents are Lebanese but moved to Mexico when they were children. His father, Julien Slim Haddad, opened a textile store in Mexico City before acquiring property on the cheap.

He passed this financial skill on to his children and, at the age of 12, Slim had shares in the Bank of Mexico and was eager to be an entrepreneur.

Slim started out as a stockbroker and bought major stakes in Mexican construction, consumer goods, mining and property companies.

At one point he had a 17 percent stake in The New York Times newspaper.

But its real money maker was América Móvil, which was formed in 2000 and saw Slim become the world’s richest man in 2010.

His empire suffered after Donald Trump’s victory in the 2016 US presidential election, when global markets plummeted and the Mexican peso fell to a record low.

He fell in the wealth rankings and is today the 17th richest person in the world, with a fortune of £72 billion.

However, those close to Slim say that despite his mega-wealth, he remains relatively frugal. He has reportedly lived in the same six-bedroom house for 40 years and has maintained the family businesses by dividing his estate between his three sons and his three daughters.

His push for BT will raise questions about whether British telecommunications is becoming a foreign affair.

The United Arab Emirates-based E& Group recently bought a 14 percent stake in Vodafone, while Xavier Niel, the French billionaire founder of Iliad, owns 2.5 percent.

In BT, Switzerland-based Drahi is the largest shareholder with a 24.5 percent stake, while Deutsche Telekom has a 12 percent stake.

Slim’s 3.2 per cent stake is valued at £430m. stake, while Deutsche Telekom has a 12 percent stake. Slim’s 3.2 per cent share is valued at £430m.

On the rise: BT rose 4.3%, or 5.6p, to 135p, valuing it at £13.4bn, as it made a profit since Allison Kirkby (pictured) took over as director executive in February up to 20%.

Enders Analysis telecoms expert Karen Egan said Slim could take power away from Drahi, whose involvement has fueled speculation that he may want to launch a takeover bid.

“This will further dilute any prospect Drahi had of having influence at BT,” he said.

CCS Insight analyst Kester Mann said Slim could have his sights set on a larger stake and could even buy out Drahi.

“Slim’s decision on BT could provide a bridgehead as he recently reduced his interest in Dutch operator KPN,” he said. “If that were the case, perhaps I would find a willing seller in Patrick Drahi.”

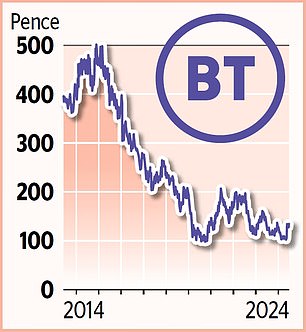

BT’s share price is still down more than 70 per cent from its 2015 peak and Slim’s investment comes at a crucial time.

Some analysts believe the move is a vote of confidence in Kirkby.

Last month, it outlined its plan, which included another £3bn of cost cutting, sending shares up more than 17 per cent in one day.

As such, the latest rise thanks to Slim’s investment will no doubt be welcomed by Kirkby and his lieutenants.

However, the board of directors, led by chairman Adam Crozier, will want to know exactly what Slim is planning.

Sophie Lund-Yates, an analyst at Hargreaves Lansdown, said: “This potentially opens the door to some interesting developments in the future.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.