Table of Contents

Britons have been piling cash into bank accounts in 2024, attracted by higher interest rates and relative security in a year characterized by political uncertainty.

But while savers may have enjoyed more generous interest rates than have been available for much of the past two decades, they have missed out on extraordinary returns from stocks and risk being tied to falling rates.

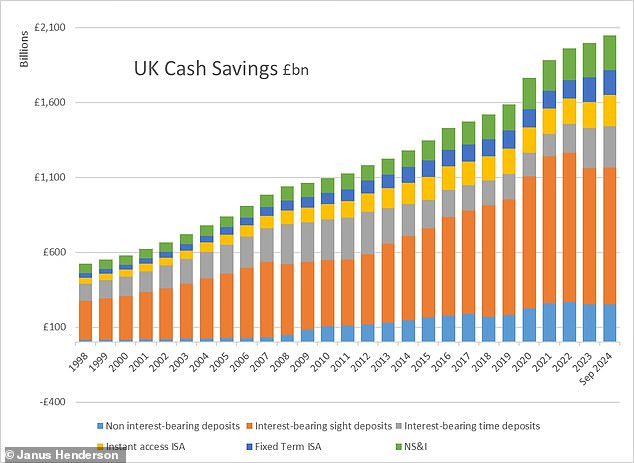

Research from Janus Henderson Investors shows that cash savings have increased by £51 billion so far this year to £2.05 trillion, the equivalent of 80 per cent of the UK’s national debt.

Banks raise savings rates as central banks raise interest rates to encourage customers to hold deposits, but the value of cash is eroded by inflation over time and savers can often find better returns elsewhere.

Interest on cash has returned less than a third of what global shares have returned this year, according to the asset manager’s research, and savers have missed out on £165bn in returns.

Over the past 30 years, cash and interest have lagged inflation by 3.4 percent, while global stocks have risen sevenfold in real terms.

Cash stash: Data shows Britons have increasingly turned to interest-paying bank accounts as interest rates have risen

Dan Howe, head of investment funds at Janus Henderson Investors, said that while high interest rates and market uncertainty make cash savings “a more attractive offer”, Britons’ money “could be doing more for them.”

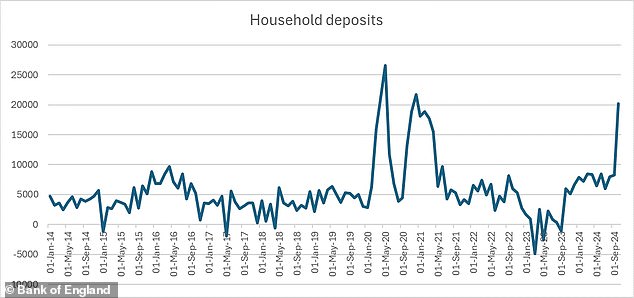

Separate data from the Bank of England last week showed Britons amassed more than £20bn in cash savings in October alone, marking a record outside of the Covid era.

Laura Suter, director of personal finance at AJ Bell, said uncertainty around the budget and possible tax changes was “likely to cause jitters”, noting that investors also made gains on their portfolios during the month.

He added: ‘The challenge for the nation now is determining what to do with those levels of cash. We know that cash is not a good place for money in the long term, as inflation erodes its purchasing power.

“Savers therefore need to think about whether to put their money into the markets, keep it in cash as a tactical measure or simply spend it now.”

Data from Janus Henderson shows that only £1 in every £6 of newly deposited cash has been allocated to fixed-term accounts, leaving investors exposed to falling interest rates.

The Bank of England’s recent interest rate cuts have already hit savings rates, which experts expect to continue falling in the coming months.

Janus Henderson’s Howe said: ‘Cash savings are being eroded in real terms by inflation and, as we have seen recently, are largely held in instant access savings accounts where interest rates continue to fall.

“Beyond the recommended cash cushion, we have many opportunities to put our cash savings to work for us rather than letting them languish.”

Cash savings have risen to record levels, with bank deposits reflecting the largest share.

Better income options?

Morningstar analysts suggest that bond markets offer a relatively low-risk alternative to excess savings, which “has historically led to lower long-term portfolio returns compared to almost all other fixed income asset classes.” .

They added: ‘The benefits of holding cash are fading in a world of falling global yields. By definition, cash cannot offer any price appreciation when rates fall, unlike longer-term bonds.

‘This leaves income as the sole contributor to cash returns, a factor that will decline as (central banks) continue to lower rates. “Now is a good time to move from cash to longer exposures.”

Similarly, Invesco analysts said: “As we approach 2025, we believe the case for the (fixed income) asset class is the strongest it has been in years, and the potential peak of interest rates offers the opportunity to secure a higher level. income level for the years to come.

Below, experts offer their best fund picks for income-seeking investors.

Bank of England data shows UK household deposits have risen sharply over the past year

Darius McDermott, CEO of FundCalibre:

‘Artemis Global High Yield Bond Fund is a high-conviction fixed income portfolio that invests in between 60 and 100 high-yielding issuers worldwide. Managers David Ennett and Jack Holmes seek to increase the value of shareholders’ investments through a combination of revenue and capital growth.

‘To do so, they focus on under-researched and under-priced opportunities further down the high-yield spectrum, while their global approach seeks to unlock opportunities and insights that their regionally focused peers may overlook.

‘Their approach of focusing further down the index has allowed them to consistently find hidden gems with a strong advantage, helping them achieve better results. “They are also backed by one of the strongest teams in their asset class.”

‘Twenty four dynamic link It pays an attractive yield and is managed with an emphasis on credit risk to ensure investors’ capital and income are protected wherever possible.

‘The fund has a very flexible approach to taking advantage of changes in market conditions. You will be able to invest in the entire range of fixed income assets. The income generated is typically one of the highest in the industry, but will fluctuate as investments and market conditions change.

Josef Licsauer and Alan Ray, investment trust research analysts at Kepler Partners:

“Japan is often overlooked as a source of income, but as its dividend culture evolves, driven by corporate governance reforms, CC Japan Revenue and Growth (CCJI) emerges as an outstanding option for investors.

‘While seeking strong total returns, considering both capital and income growth as two key components, CCJI has achieved an unbroken track record of annual dividend increases since its inception, achieving compound annual growth of 8.5 percent.

‘At the time of writing, the trust’s fully covered dividend yield of 3 percent exceeds the TOPIX yield of 2.3 percent.

‘We believe CCJI offers investors an attractive income profile, strongly aligned with Japan’s ongoing corporate governance transformation, without sacrificing the quality or growth potential of its underlying holdings. For investors looking for diversified sources of income outside of traditional equity markets such as the US or UK, we believe CCJI is an attractive option.

Morningstar says there is better value on offer in global bond markets

‘Listed real estate REITs have struggled in a higher interest rate environment and are trading at deep discounts and consequently offering high yields.

‘Recently, there has been a steady stream of REITs reporting that the value of their properties has increased, or at least stopped falling, for the first time in more than two years, as the market begins to respond to the decline in rates, although painfully slow. .

“But with a wide range of REITs offering specialized exposure to particular sectors, it can be confusing deciding which one to choose from. However, help is available because TR Property (TRY) is a specialist REIT investor in the UK and Europe, offering investors a ready-made portfolio managed by a team of experts.

‘TRY, which currently produces c. 5.0 percent, it invests for total return rather than pure income, but its dividend growth has far outpaced inflation over the roughly 25 years its current top manager, Marcus Phayre-Mudge, has been at the helm. command.

“While TRY itself does not trade at a particularly wide discount, currently around 8%, it owns many REITs that do, so an investor will still benefit if the discounts for REITs in general are eventually reduced.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.