Table of Contents

- Barclays report shows ‘candy’ purchases increased in September

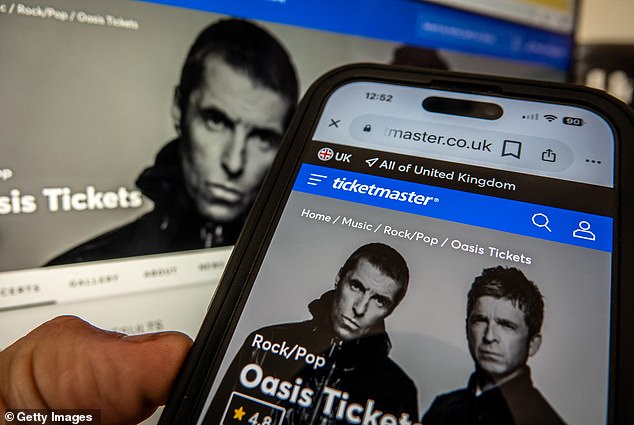

Britons cut back on buying “essential” items last month but splurged on treats like Oasis tickets, according to new data.

Barclays’ consumer spending report, which analyzes millions of customer transactions, reveals that overall spending rose 1.2 percent year-on-year in September.

The biggest increase came from “non-essential” spending, at 2.7 percent, as discounts encouraged shoppers to spend money on clothing, health and beauty.

Supersonic spending: Britons spent the most on luxury shopping and entertainment last month

Spending on clothing rose 23.6 percent month-on-month and 4.5 percent year-over-year, its biggest growth since July 2022.

A quarter of shoppers say they are prioritizing new clothes and accessories, spending an average of £73.

Department stores saw their biggest boost since August 2023, with shoppers spending 5.5 percent more last month.

Figures suggest households are feeling more confident about their finances due to the cost of living crisis, with half saying there are treats and luxury purchases they continue to buy, even as they cut back on other items.

It was a strong month for entertainment, which rose 14.4 per cent to hit a 14-month high, boosted by the release of tickets for the long-awaited Oasis reunion.

Spending on the day of the general launch was six times higher than average daily spending for the rest of the month.

It was the biggest increase on record since July 2023, when the window leading up to the launch of Taylor Swift’s Eras Tour caused a spike in spending.

The Barclays report found that a fifth of those who prioritize sweets spend on theater and concert tickets.

Subscriptions to streaming platforms continue to be popular with consumers looking to save money with ‘inexperiences’ in the colder months. Spending increased 10.6 percent during the month.

Meanwhile, theaters saw 18.2 percent growth for the month, amid the success of blockbuster films like Beetlejuice Beetlejuice, Deadpool and Wolverine and Finish with us.

By contrast, pubs, bars and nightclubs saw a limited drop in growth from 3.2 per cent in August to 0.6 per cent in September.

In addition to the weather likely being a factor, 40 percent said they were reducing their alcohol consumption to save money.

Discerning shoppers are also finding room for treats and small luxuries within their budget, showing that consumers are prioritizing spending on things that bring them joy.

Karen Johnson – Barclays

Consumers are also reducing their purchases of essential items, with spending falling 1.7 percent and groceries suffering their first drop since June (-0.8 percent).

The report found that 70 percent of consumers continue to look for ways to get more value from their store or reduce their spending, higher than the annual average of 67 percent.

Karen Johnson, head of retail at Barclays, said: “The retail recovery emerged as a bright spot in September, despite colder weather and darker nights on the horizon.”

“While shoppers” remain cost-conscious, it is clear that they respond to retailers’ promotional activity. Discerning shoppers are also finding room for treats and small luxuries within their budget, showing that consumers are prioritizing spending on things that bring them joy.

“While many anticipate an expensive Christmas, there are encouraging signs that people are confident in their ability to manage their household finances and take control of their Christmas spending.”

SAVE MONEY, MAKE MONEY

Investment boost

Investment boost

5.09% on cash for Isa investors

5.05% solution after one year

5.05% solution after one year

Prosperous momentum for Al Rayan

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.