Table of Contents

- Chipmaker mulls full sale of Taiwan unit after planned IPO

IQE has launched a strategic review of its assets in an effort to bolster its capital position, as a slow recovery in key markets continues to weigh on the British chipmaker.

The Cardiff-based company, which makes epi wafers for use in laser hair removal and facial recognition sensors in iPhones, told shareholders on Monday that it expects revenue to remain flat year-on-year at around £115m.

It had previously signaled moderate growth for the year after returning to profit in the first half.

IQE said it “continues to see a slower-than-expected recovery in key sectors driven by weak consumer demand in end markets.”

It now expects full-year adjusted core profits to reach £5m for the 12 months to December 31, well below the £12.5m expected by analysts.

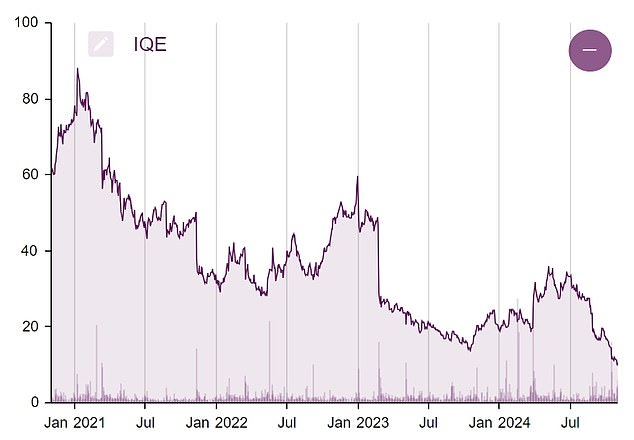

IQE shares fell 6 per cent to 10.04p by mid-morning, having lost more than half their value over the past year.

IQE manufactures epi-wafers for use in laser hair removal and facial recognition sensors in iPhones

The group said there is “significant value in IQE that is not currently reflected in its market capitalisation” of around £100m.

In response, IQE is launching a “comprehensive” strategic review of its asset base to ensure it has “a strong capital position to continue investing” in its core operations.

Mark Cubitt, chief executive of IQE, said: ‘The impact of the slow pace of recovery in the semiconductor industry can be seen across the sector and is reflected in our revenue expectations.

‘We remain committed to delivering maximum value for our shareholders and serving our customers. “We are confident in the long-term prospects and inherent value of IQE.”

This follows the sudden departure of CEO Américo Lemos last month.

The strategic review will include an expansion of the proposed initial public offering of its Taiwan operations to include “all strategic options”, including an outright sale, rather than a minority stake it would have retained under previous plans.

Analysts at Peel Hunt estimate that the full sale of IQE’s Taiwan operations could represent an enterprise value of £160 million to £190 million, compared with a market capitalization of £103 million and a gross of non-current assets of £205 million in June.

The broker said: “We believe the strategic review will result in a more agile company, more focused on the future and with a stronger balance sheet.”

Weak recovery in IQE’s key markets has continued to weigh on its share price

IQE also announced on Monday that it was negotiating a proposal from key shareholder Lombard Odier on “short-term financing to help IQE address the current market weakness.”

Lombard Odier has offered to raise up to £15 million via a convertible loan note with a conversion price of 15 pence per share, reflecting “a strong demonstration of Lombard Odier’s confidence in the value embedded within the Group”, IQE said.

Peel Hunt said the funding offer “underlines the potential value that needs to be unlocked”.

He added: ‘Given the evolving situation, we will re-evaluate our (IQE target price) and reinstate a recommendation in due course.

‘We are still Under Review. “It is clear that the risks have been reduced.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.