Table of Contents

The Government has snubbed a British pharmaceutical giant by choosing a blockbuster respiratory vaccine from an American rival.

GSK lost out to Pfizer in a deal that will see the US group provide 4.9 million Abrysvo shots to older adults and pregnant mothers in England and Northern Ireland over the next two years.

The vaccine rollout will begin next month to protect against respiratory syncytial virus (RSV), which causes cold-like symptoms but can be dangerous for the elderly and vulnerable, as well as newborn babies.

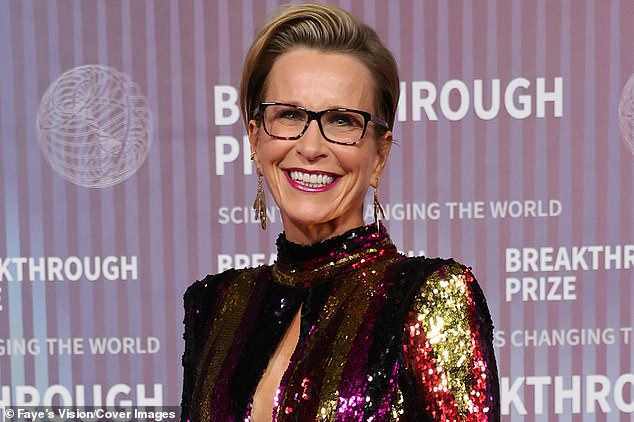

Rejection: GSK boss Emma Walmsley (pictured) pushes ahead with her turnaround strategy in the FTSE 100 group

The vaccine has the potential to prevent thousands of hospital admissions each year.

But the Government’s decision to back Pfizer is a resounding setback for GSK amid a battle to dominate RSV protection.

GSK appeared to get ahead of its rival last year when its RSV Arexvy vaccine became the world’s first to be approved.

Having gained approval from US regulators, Arexvy generated around £1.2bn in sales in 2023, well ahead of the £699m generated by Pfizer’s rival drug.

The GSK vaccine also accounted for about two-thirds of all RSV vaccines administered.

Arexvy’s success so far has been a big boost for GSK chief executive Emma Walmsley as she pushes ahead with her turnaround strategy in the FTSE 100 group.

His plan called for GSK to divest its consumer healthcare division, Haleon, while refocusing the pharmaceutical giant on vaccines and infectious diseases.

The pivot came after GSK fell behind rivals Astrazeneca and Pfizer to create a Covid vaccine during the pandemic.

But the Government’s decision to award the lucrative RSV contract to Pfizer has significantly undermined GSK’s rise.

A GSK spokesman said the group was “disappointed” by the result but remained “very confident” in its strategy.

The Department of Health and Social Care did not explain why Pfizer won, but it is understood that the US company offered an extremely competitive price.

Pfizer’s drug is also approved for both seniors and pregnant women. The GSK one only has approval for older people.

Derren Nathan, head of equity research at Hargreaves’s Lansdown, said that while “GSK may have been hoping for a home advantage”, the broader approvals of the Pfizer vaccine “have probably been the deciding factor”.

The contract setback will add to the concerns of GSK investors. This month, the company was plunged into crisis after a US judge opened the floodgates for 70,000 lawsuits alleging that the heartburn drug Zantac causes cancer.

This wiped more than £7 billion off GSK’s value in just one day.

The group has also come under pressure over its pipeline of new drugs. This has held back its share price in recent years as it struggles to replicate the success of the Shingrix shingles vaccine.

In a separate update, GSK announced that it has received approval from Japanese regulators for its Omjjara treatment for myelofibrosis, a type of bone marrow cancer, and revealed that the European Medicines Agency has accepted its application to expand the use of the drug against Jemperli cancer.

GSKK shares rose 0.6 per cent, or 9.5p, to 1,608.5p yesterday.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

eToro

eToro

Stock Investment: Community of over 30 million

Trade 212

Trade 212

Free stock trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you