<!–

<!–

<!–

<!–

<!–

<!–

Donald Trump’s social media company has lost a third of its value since its share price peaked on its stock market debut last week.

Trump’s share alone has fallen more than $2.4 billion since its March 26 debut amid claims that Truth Social is just a meme stock and fresh concerns about its ability to ever make money.

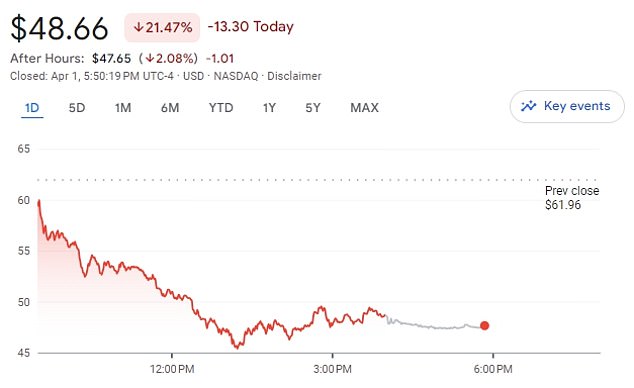

On Monday, shares, already off the high, plunged another 21 percent after parent company Trump Media disclosed in a filing that it lost $58 million in 2023 on just $4 million in revenue. The bosses also admitted that they would soon not be making profits.

‘Truth Social was overvalued and that reality is dragging down the shares. “With the service having no clear path to profitability and little revenue, its high debut was unsustainable,” said Insider Intelligence analyst Ross Benes.

In its stock market debut last Tuesday, Truth Social’s parent company, Trump Media, soared to a valuation of $10.7 billion at one point last week, when shares hit $79.38. Trump’s 58 percent stake was worth $6.2 billion.

Shares fell $13.30, or 21 percent, to $48.66 at market close Monday.

As of Friday, Trump Media, when it had a market capitalization of more than $8 billion, had a price-to-sales ratio more than 50 times that of chipmaker Nvidia.

Donald Trump’s 58 percent stake in Trump Media is now worth more than $5 billion and his net worth has soared, but he may struggle to access cash.

Last week’s surge was driven by enthusiasm from retail shoppers, including supporters of Trump, the likely Republican nominee in the 2024 presidential election.

Monday’s disclosure reversed that trend, sending shares down $13.30, or 21 percent, to $48.66. That reduced the company’s value to $6.6 billion.

Trump owns 78.75 million shares, which could be a huge windfall for the former president if their value stops falling.

At the stock’s peak last week, its stake would have been more than $6.2 billion, but after the liquidation it is valued at $3.8 billion.

Trump is not allowed to sell or borrow any of his shares for six months, and any move on his part to try to alter that deal would likely trigger more selling.

“TMTG enjoyed a breakthrough in terms of hype and enthusiasm, but is a long way from becoming a true social media challenger to X (Twitter), Instagram, TikTok and other platforms,” said Running analyst Michael Ashley Schulman. . Crux.

Truth Social’s revenue was $4.13 million last year, up from $1.47 million in 2022, it said. In comparison, Reddit generated revenue of $800 million in 2023.

The latter has 73 million active users, while Truth Social only reveals its total number of registrations, which amount to 8.9 million.

In its filing on Monday, TMTG said it has no plans to disclose key metrics generally used by similar companies.

The filing also said: “As of December 31, 2023 and 2022, management has substantial doubt that TMTG will have sufficient funds to meet its liabilities as they become due, including liabilities related to notes previously issued by TMTG.”

The filing adds that the company “expects to incur operating losses for the foreseeable future.”

Trump Media is also embroiled in a legal battle with co-founders Wesley Moss and Andrew Litinsky.

On Monday, a Delaware judge said he wanted the parties to set a hearing date this month to determine whether the two should receive the 8.6% stake in the company they say they are owed.

Trump Media and the couple have sued each other in Delaware and Florida state courts. The co-founders accused Trump Media of trying to improperly dilute their stake, while the company said they had failed to recover their shares and it wants to strip them of their ownership.