Childless couples now make up more than 40 per cent of family households in the UK, official statistics have revealed, and some have been reaping the benefits of more flexible hours and financial freedom.

The rise of British DINKS, which stands for “double income without children”, has seen young couples sharing the benefits of their often lavish lifestyles on social media.

Many boast that they can afford luxurious getaways without needing to find a babysitter, and others emphasize the importance of adjusting their spending habits to optimize their enjoyment of the money they have.

However, some also admit that they face judgment from their peers.

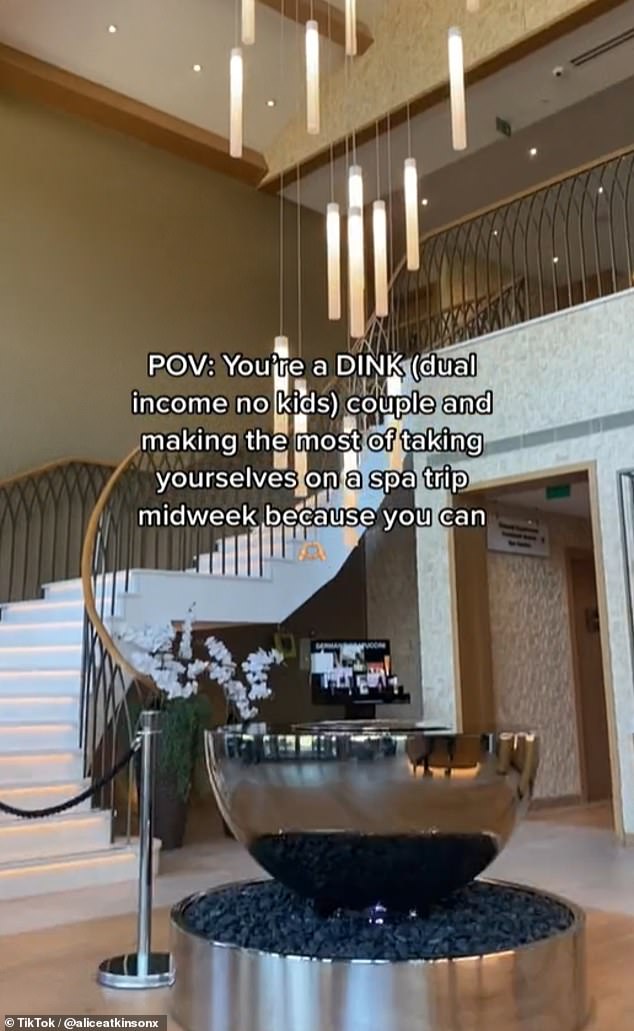

In February of last year, influencer Alice Atkinson (@aliceatkinsonx), who appears to live in Manchester, shared videos of a trip she and her fiancé took to Carden Park Spa in Cheshire West and Chester.

In August, influencer Angel Shakespeare (@angelshakes1) took to her TikTok to document a ‘DINK day out’ in London with her husband.

‘POV: You’re a DINK couple (double income, no kids) and you’re making the most of a midweek spa trip,’ she wrote. ‘Because you can.’

Elsewhere in a recent video, British vlogging couple Hannah and Charlie (@esetravelpareja) made a video recounting his adventurous vacation in the Arctic Circle.

“When you’re a dual-income couple with no kids, you’re in an igloo in the Arctic Circle,” they wrote, while dancing in the luxurious accommodation.

The couple, who also survived cancer and cardiac arrest, also recently shared another clip saying that you have to ‘travel when you are young and without worries because when you are older or with children it is not the same’.

They also have in a post from march He explained that traveling is apparently where most of his money goes, instead of prioritizing “houses, cars, clothes and kids.”

In August, influencer Angel Shakespeare (@angelshakes1) took to her TikTok to document a ‘DINK holiday’ in London with her husband.

He filmed a fun outing filled with a trip to Shakespeare’s Globe, a delicious lunch, and plenty of drinking.

in a January videoThe couple told viewers about their relationship in a video, where they said they met when they were at school together: she was 15 and he was 17.

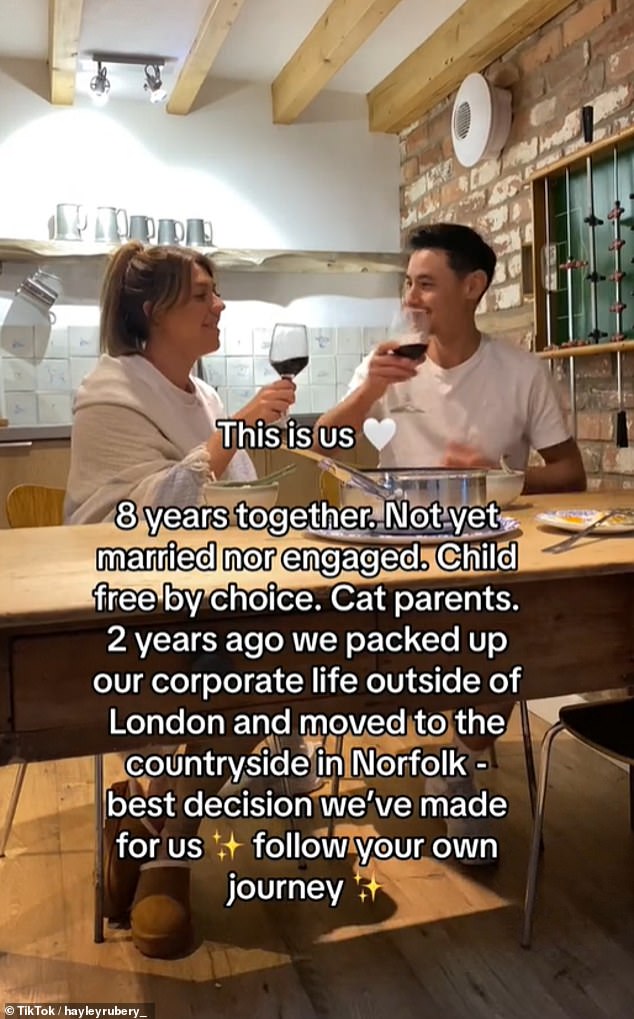

Elsewhere last year, influencer Hayley Rubery (@hayleyrubery_) shared a post about the childless life she and her partner have chosen to lead.

And in April, TikTok couple Harriet and Adam (@harrietandadam) filmed an insight into their financial habits while detailing how much they had “spent as a DINK couple” two weeks after payday.

Angel was 22 when the couple got engaged and bought their first apartment in 2020. The couple finally tied the knot, in a very intimate ceremony on Lake Como, after 11 years of being together.

“We have no plans to have children at this time,” Angel added. “We definitely just want to enjoy our freedom.”

Meanwhile, last year, influencer Hayley Rubery (@hayleyrubery_) shared a post about the childless life she and her partner have chosen to lead.

“This is us,” he wrote. ‘8 years together. I’m not married or engaged yet. Free child by choice. Cat parents.

‘Two years ago we left our corporate life outside London and moved to the countryside in Norfolk.

“The best decision we have made for us.”

In the caption, she added: “There is no one or right way to do your relationship, only what feels good for YOU.”

And in April, TikTok couple Harriet and Adam (@harrietadadam) filmed an insight into their financial habits and detailed how much they had “spent as a DINK couple” two weeks after payday.

In one week, the couple were able to splash out £515.72. They spent £108.19 on food.

“A good part of this was a grocery refill,” Harriet said. ‘And we also spent £13.60 on fish and chips.

On TikTok in February last year, influencer Alice Atkinson (@aliceatkinsonx), who appears to live in Manchester, shared videos of a trip she and her fiancé took to Carden Park Spa in Cheshire West and Chester.

Elsewhere in a recent video, British vlogging couple Hannah and Charlie (@thattravel Couple) made a video chronicling their adventure vacation in the Arctic Circle.

‘£50 went towards our lifetime ISAs. We had bills worth £139.53 and committed expenses like birthday presents.

“Finally, £218 went towards sanitary products and the garden centre.”

In April, the couple also shared their payday budgeting routine. in a video.

The couple’s fixed expenses amount to just under £1,400.

“We started saving £100 to rebuild our emergency fund,” Harriet added. ‘Then we set aside £75 a month for car insurance and servicing.

‘And we’ve also been saving £75 a month for Christmas. We have decided to change the amount we put into our investment, so we have increased it to £300 and we have also increased our cashbox contribution to our lifetime ISA to £200, so £100 each.

‘So that £250 goes on my credit card. This month we have a mammoth £650 for variable expenses, however £100 is for my birthday and we probably won’t spend it anyway.

‘We have recently decided that we want to get rid of one of our car loans. We make the decision to withdraw some of the money from one of our savings accounts and then look at how much we can overpay over the next three or four months to make sure it’s gone before summer.

‘So, depending on what we spend or don’t spend on my birthday, we will overpay between £150 and £250 on the car loan.

‘This next one is new for us and comes from a place where we don’t want to spend our money on ourselves just to benefit ourselves. We decided that we were going to put some money each month towards donations and generosity, so this could be making a donation to a church or charity or it could simply be buying someone a coffee.

“We’ve been together for nine years, we’ve invested every penny we’ve earned into preparing for the future and now we want to have the ability to give back and share it with others.”

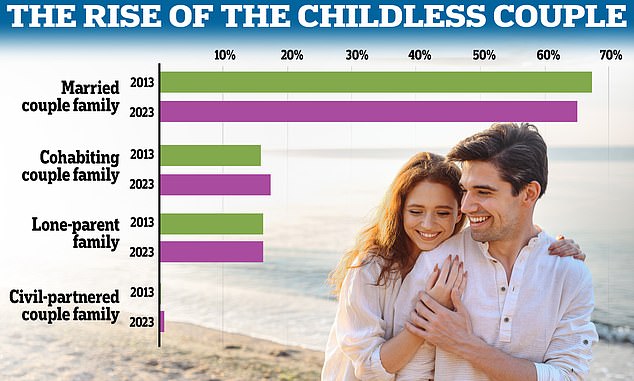

According to the Office for National Statistics, there were 469,000 more families in the UK last year compared to 2013, and two in five were childless.

The figures were published as part of the ONS annual bulletin on the composition of families and households across the UK.

It defines a family unit as a married couple, in a civil union or in a free union, who lives with or without their unmarried children.

It is estimated that last year there were 19.5 million families living in households in the UK.

The increase was around 1.1 million (6 per cent) compared to 2013, when the ONS estimated there were around 18.4 million families.

It reflected overall UK population growth, which stood at 6 per cent over the decade 2012-2022, the most recent data available.

Figures also revealed that a third of young men aged 20 to 34 lived at home with their parents last year.

This compared to less than a quarter (22 percent) of young women.

ONS data shows that married couples remain the most common family type in the UK in the decade since 2013.

In 2023 there were 198,000 de facto couples, triple the number in 2013 (64,000). Stock image used

They represent 3.6 million young people living at home with their parents: 28 percent of all young people.

It was a 2 percent increase compared to 2013, although the trends were broadly the same.

In 2023, less than half of men were living with their parents by age 25, one year more than in 2013.

The trend was the same for women of whom less than half were living with their parents at age 22 in 2023, again a one-year increase compared to 2013.

And there was an increase in single parents with adult children.

In 2023 there were 3.2 million single-parent families, an increase of 200,000 compared to 2013.

But among those families, those living with adult children accounted for 130,000, more than half the increase recorded during the decade.

The ONS defines adult children as ‘non-dependent’, meaning they are over 18 but live with their parents and do not have a partner, spouse or children.

It also includes young people aged 16 to 18 who are not in full-time education.