Russell Crowe has sparked engagement rumors when his partner Britney Theriot stepped out with a huge diamond ring in Italy on Thursday.

The couple, who began dating in 2020, set tongues wagging when Britney was first spotted wearing a dazzling diamond band on her ring finger as they arrived at the Ariston Theatre.

Russell traveled to the country for the Sanremo Music Festival, where he will perform on stage with his band Russell Crowe & The Gentlemen Barbers.

The actor, 59, appeared in high spirits as he smoked a cigarette with Britney, 31, before greeting fans.

But all eyes were on Britney’s hand and the stunning round diamond set in a yellow gold band.

Russell Crowe has sparked engagement rumors when his partner Britney Theriot stepped out with a huge diamond ring in Italy on Thursday.

The couple, who began dating in 2020, set tongues wagging when Britney was first seen wearing a dazzling diamond wedding band on her ring finger.

All eyes were on Britney’s hand and the stunning round diamond.

MailOnline has contacted Russell’s representative for comment.

The couple confirmed their long-rumored romance with a kiss on the tennis court in November 2020.

Russell and Britney are regularly seen flying between Sydney and Coffs Harbour, where the actor is building a $400 million film studio called ‘Aussiewood’.

The Beautiful Mind star owns a 400-hectare farm in nearby Nana Glen and divides her time between this rural estate and her home in Sydney.

He is believed to have met Britney, a former actress who is the spitting image of Russell’s ex-wife Danielle Spencer, on the set of their 2013 film Broken City.

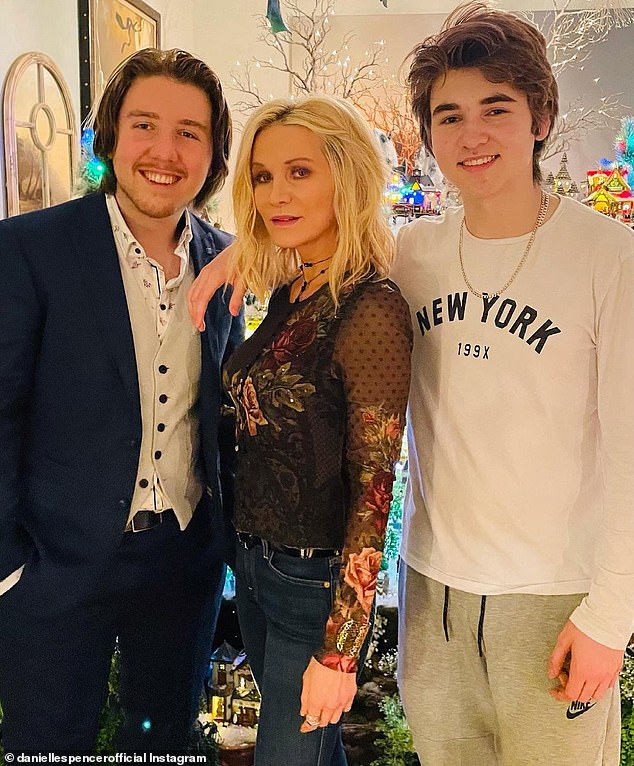

Russell shares Charles, 20, and Tennyson, 17, with his ex-wife Danielle.

Danielle and Russell were married in April 2003 at their Nana Glen farm. They separated in 2012 and finalized their divorce six years later.

Despite their high-profile split, Danielle previously told Stellar magazine that the couple are still friends and see each other as “family.”

“We have a lot of respect for each other and I consider him a member of my family,” she said.

The actor, 59, smoked a cigarette before heading to rehearsals.

Russell has traveled to the country for the Sanremo Music Festival, where he will perform on stage with his band Russell Crowe & The Gentlemen Barbers.

The actor, 59, appeared in a very good mood while greeting fans.

‘The marriage ended, but that didn’t mean our friendship ended. We’ve spent holidays together in the past and we can sit and chat happily.’

The Oscar winner rose to fame playing Maximus in the 2000 epic Gladiator, directed by Ridley Scott.

He is also known for other films such as Ron Howard’s A Beautiful Mind (2001) and Man of Steel.

The Hollywood star previously revealed at the 57th Karlovy Vary International Film Festival in Karlovy Vary, Czech Republic, last year that he is considering retirement, according to Variety.

Russell took note of his aging in the business and contemplated the next step in his career.

“You’re standing in front of the mirror and you’re like, ‘Who the fuck is that?'” he told reporters at the festival.

“I’m in that period now.”

The Gladiator star continued to weigh his options, taking note that director Ridley Scott, 85, continues his work as he ages.

‘I’ll take Ridley Scott as my role model: he’s still discovering new things in his work. Or I’ll just stop doing it and you’ll never hear from me again,” he continued.

‘I haven’t decided what it’s going to be. “These are two very valid options.”

Russell and Danielle Spencer were married in April 2003 at their Nana Glen farm. They separated in 2012 and finalized their divorce six years later (pictured in 2002).

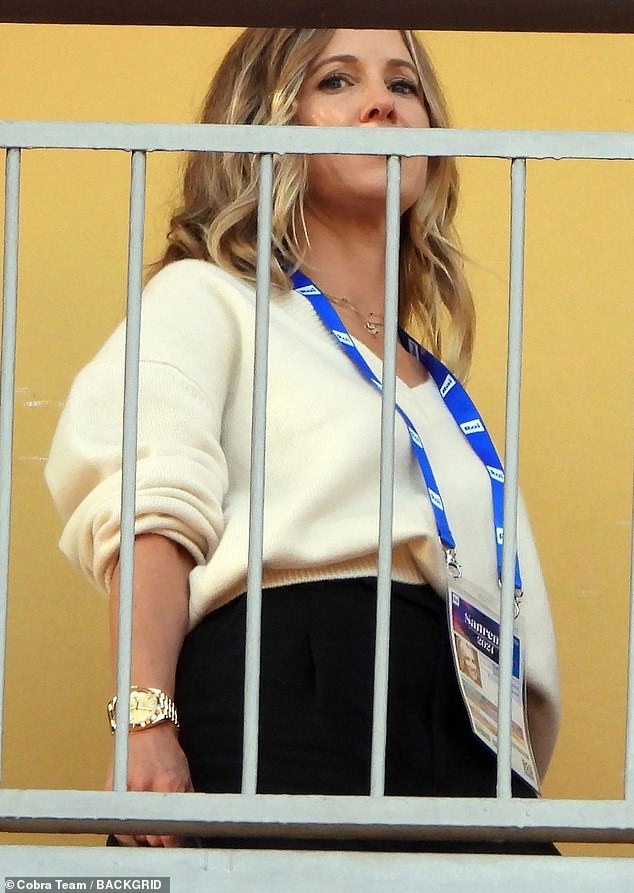

Britney looked chic in a white wool sweater and black leggings.

Russell had a smile on his face as he prepared for his performance at the Aritson Theater during the Sanremo Festival.

Britney was also photographed smoking on the balcony before heading to rehearsals to watch Russell perform.

Russell cut a casual figure in a black padded vest and Nike sweatpants.

The couple were accompanied by a group of burly security guards as they took a break.

Russell traveled to Italy to perform with his band.

Britney enjoyed a drink while the couple sunbathed.

The couple confirmed their long-rumored romance with a kiss on the tennis court in November 2020.

He looked in good spirits as he prepared for his performance.

Russell shares Charles, 20, and Tennyson, 17, with his ex-wife Danielle.