Medicare and Social Security are in crisis and face significant challenges, according to a U.S. Treasury Department report that indicates both programs are underfunded to the tune of $175 trillion.

The report suggests that if current trends continue, the programs may not be available when the current generation of American children reaches retirement age unless substantial changes are implemented.

Projections suggest that Medicare and Social Security could struggle to meet all of their benefit obligations over the next decade, and that factors such as inflation and economic output add pressure due to insufficient funds coming in to support these. programs.

‘If you take into account all the economic production of each country on planet Earth, it is about 100 trillion dollars. The unfunded liability American taxpayers will face over the next 75 years is $175 trillion,” said Adam Andrezejewski of openthebooks.com fixed.

Showing the magnitude of the situation, Andrezejewski compared the unfunded liability to all federal spending since the creation of the United States in 1787.

Medicare and Social Security face a major underfunding crisis, amounting to $175 trillion, according to a recent U.S. Treasury report.

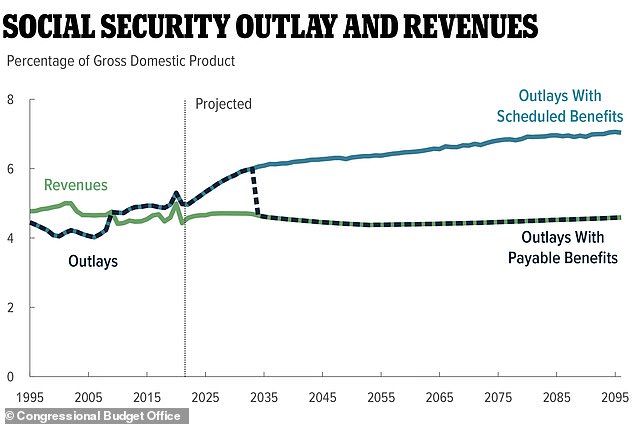

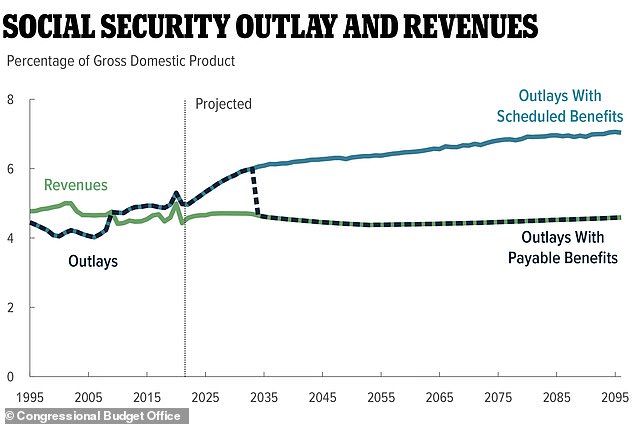

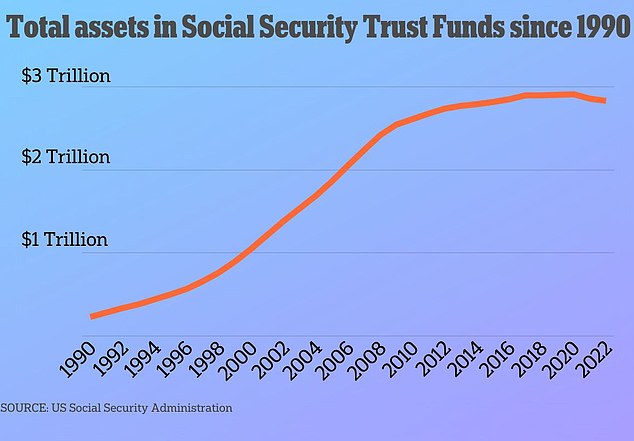

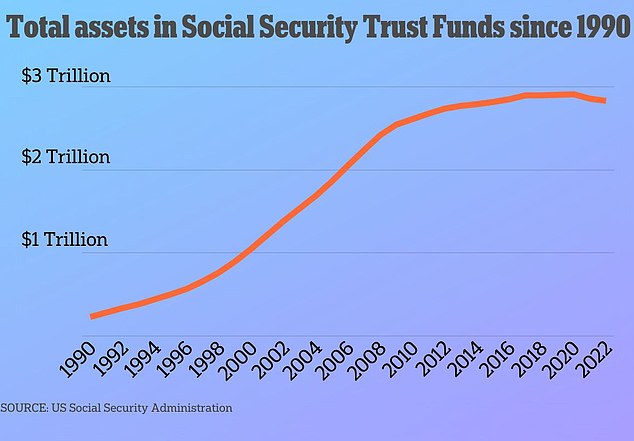

In a recent forecast, the Congressional Budget Office said the gap between outlays and revenues meant cash reserves would be depleted within a decade, forcing payments to be reduced to levels that matched incoming money.

The CBO’s latest projections found that the current gap between fund disbursements and revenues received, if it continues over the next ten years, will cause the fund to officially reach zero.

‘Here’s another way to look at it. “If you look at all the federal spending since the beginning of our country, when the Constitution was written in 1787, if you add it all up, this figure rivals all the federal spending since the beginning of our country,” Andrzejewski said. ” “Therefore, it is a huge unfunded liability and threatens to bankrupt our country.”

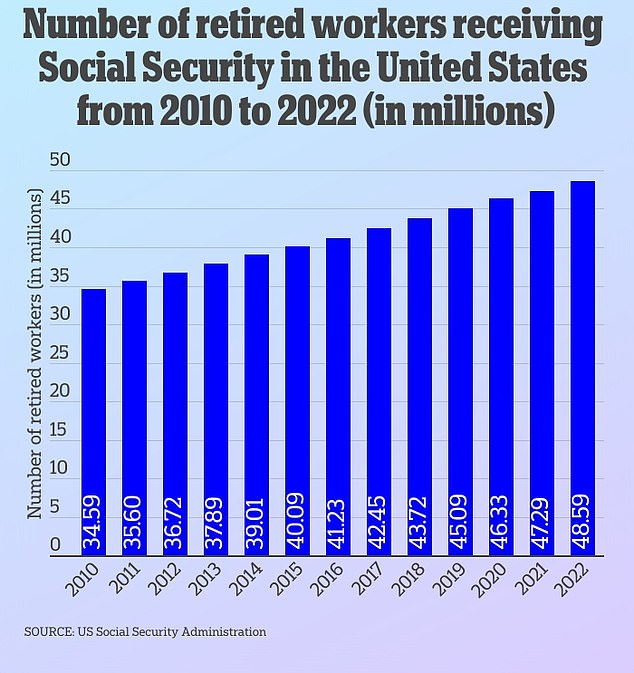

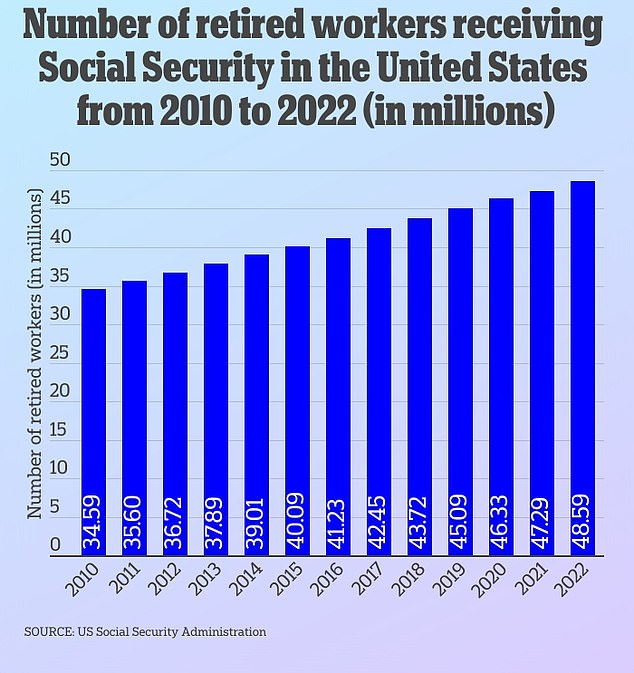

Spending on Social Security has been rising as more Americans reach retirement age and leave the workforce, relying solely on the fund’s benefits.

The Congressional Budget Office (CBO) says Social Security’s cash reserves will be depleted in 2033 and, without reforms, will no longer be able to pay full benefits.

Experts have warned that when that happens, the payments won’t disappear entirely, but will likely be reduced by about 25 percent.

The Bureau spelled out the problem with the stability approach in its most recent forecasts.

“In those projections, Social Security spending increases rapidly relative to gross domestic product (GDP) over the next decade as the large baby boom generation retires,” he concluded in a December analysis.

The number of retired workers receiving Social Security in the US has steadily increased. Meanwhile, the pool of people who contribute to the Social Security trust fund is shrinking.

“That growth then slows as members of that generation die, but spending continues to increase over the 75-year projection period because of increasing life expectancy.”

But tax revenues remain stable, he said. That means that by 2033, cash reserves (in Social Security trust funds) will be depleted and payments would have to match tax dollars, which means cuts.

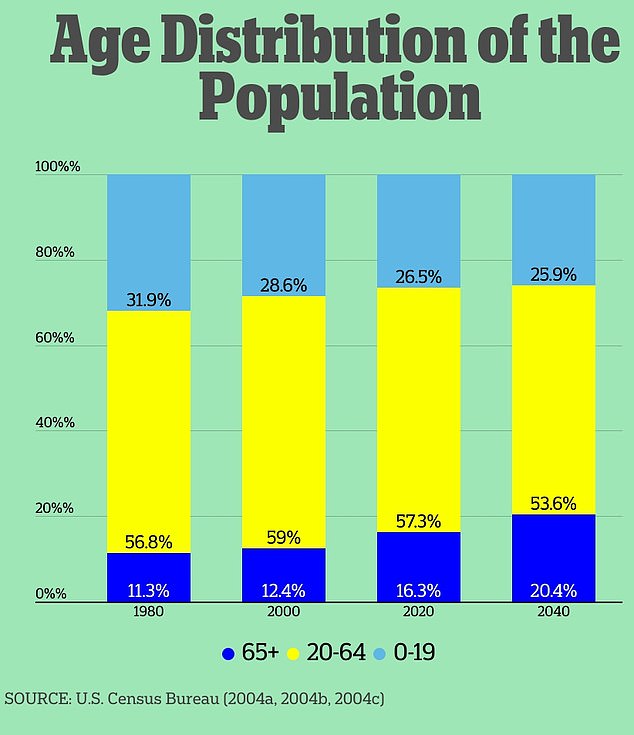

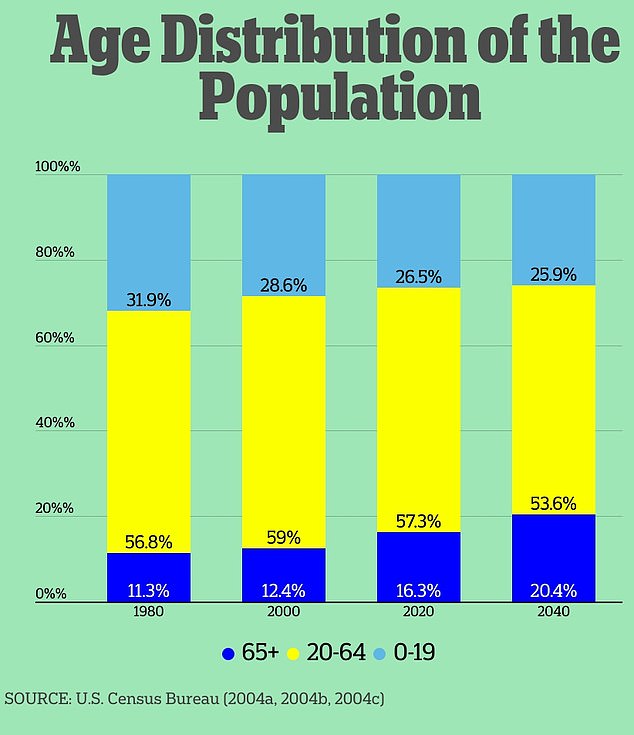

Making matters worse is the reality that the group of working-age people, ages 20 to 64, who share the cost of supporting Social Security recipients is also shrinking.

The latest projections from the Social Security Administration indicate that there will be 2.1 workers per Social Security beneficiary in 2040, up from 3.7 in 1970, according to the Urban Institute.

Another report from the Administration on aging found that more than one in six Americans were 65 or older in 2020, a 35 percent increase from a decade earlier.

The projections come as Social Security beneficiaries saw a big increase in their payments in early 2023.

The latest projections from the Social Security Administration indicate that there will be 2.1 workers per Social Security beneficiary in 2040. The percentage of the population over age 65 is expected to increase by about 4 percent over the next 20 years.

The CBO also predicts that the fund will continue to spend five percent of US GDP. The fund will eventually increase to seven percent in 2096.

Social Security increased benefits by 8.7 percent starting in January 2023 to combat record inflation. The increase marks the The largest increase in the cost of living since 1981.

This January benefits increased another 3.2 percent. Inflation currently stands at 3.09 percent.

The CBO’s latest projections found that the current gap between fund disbursements and revenues received – if it continues over the next ten years – will cause the fund to officially reach zero.

If that happened, the Social Security Administration would not be able to pay full retirement benefits to retirees when they become eligible.

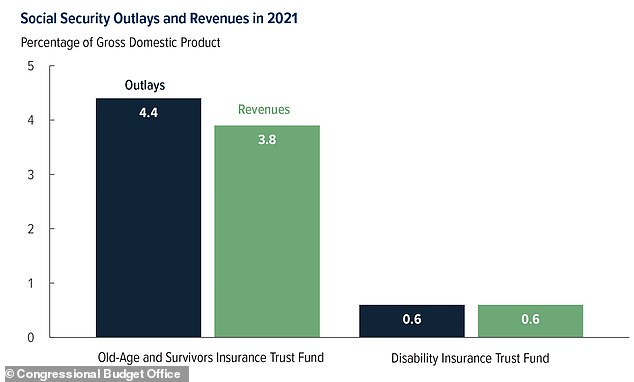

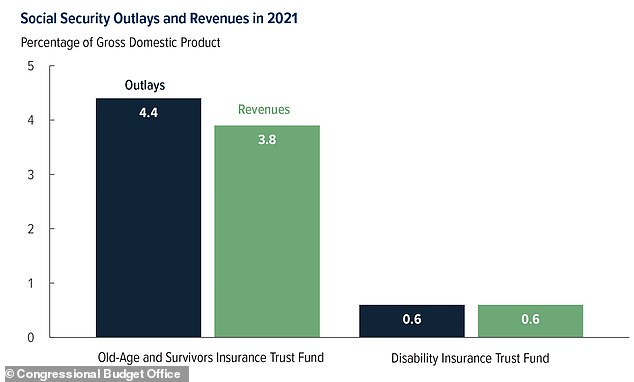

Even if the Disability Insurance Trust Fund and the Old-Age and Survivors Insurance Trust Fund were combined, the fund would still be depleted in 2033.

The payments have also been affected because they were used to pay payroll tax revenue to retirees.

The CBO also predicts that the fund will continue to spend five percent of US GDP. The fund will eventually increase to seven percent in 2096.

The actuarial deficit is projected to rise to 1.7 percent of GDP or 4.9 percent of taxable payroll over the next 75 years.

The forecast means the balance of funds could be maintained if there was an immediate increase of nearly 5 percent in payroll taxes.

Social Security funds could also be maintained if there were a reduction in overall benefits for retirees.