Buy-to-let homeowners planning to sell have today received a tax cut from the Chancellor.

In the Budget, Jeremy Hunt announced that the rate of capital gains tax (CGT) applied to the sale of second homes will be slashed.

He revealed that from April 6, the Government will reduce the CGT rate for higher rate taxpayers from 28 per cent to 24 per cent.

The rate for basic rate taxpayers will remain unchanged at 18 percent.

CGT is charged on the profits that homeowners and second homeowners make on a property that has increased in value when they sell it.

Reduced for owners: Capital gains tax (CGT) can be charged on any profit someone makes from an asset that has increased in value, when they come to sell it.

It brings the band of higher rates for CGT on properties closer to the level charged on other investments.

For investments such as stocks and shares, higher rate and additional rate taxpayers pay 20 per cent, while basic rate taxpayers pay 10 per cent.

Hunt said the move to CGT was made to support the property market.

He believes it will encourage more landlords and second homeowners to sell their properties, making more properties available to buyers, including those looking to get on the property ladder for the first time, while also increasing tax revenue.

Nicky Stevenson, managing director of national estate agent group Fine & Country, said: “Reducing the top rate of capital gains tax should inject some extra energy into the property market by increasing the number of properties for sale. “.

‘This advert will encourage floundering homeowners who are unsure whether to take the plunge and sell their property.

“This should offer hope to first-time buyers, who are the bedrock of the property market but have been particularly hard hit by high interest rates.”

Buy-to-let boost: Jeremy Hunt announced that the capital gains tax (CGT) rate applied to the sale of second homes will be slashed

However, not everyone agrees that it will have the desired effect.

Jeremy Leaf, a north London estate agent and former residential chairman of the Royal Institution of Chartered Surveyors, said: “Will there be a rush of sales from homeowners because they will save on capital gains tax?” No, they do it for long-term profits, capital appreciation combined with income yield.

‘Of course, that performance has been hit hard by higher interest rates and more regulation, as well as the inability to offset mortgage interest, but professional landlords are committed and are not going to start selling due to a slight CGT reduction.

“Perhaps, with rents so high, the last thing we need is a reduction in the number of rental properties.”

How much taxes will owners save?

Currently, Britons are only required to pay CGT if the profit they make exceeds their tax-free allowance of £6,000 in a single tax year. If they fail to comply with this assignment, they will be obliged to pay it.

However, from the start of the next tax year, which begins on 6 April, this annual tax-free allowance will be reduced to £3,000 each year.

As property profits often far exceed these annual allowances, most landlords will almost always end up paying CGT unless they can offset sufficient property-related expenses such as conveyancing costs, surveys and stamp duty.

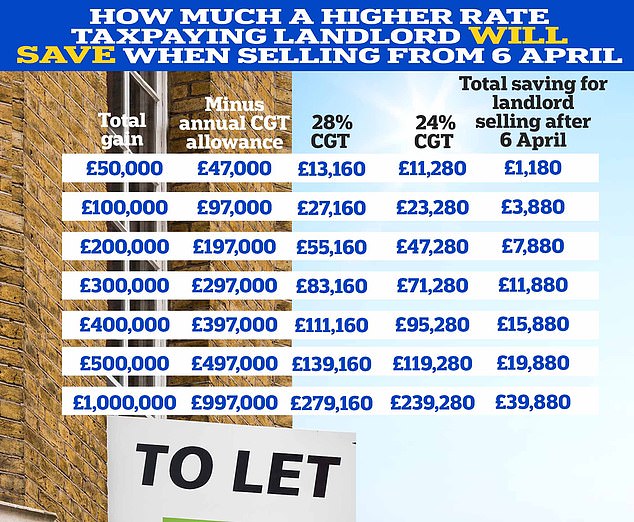

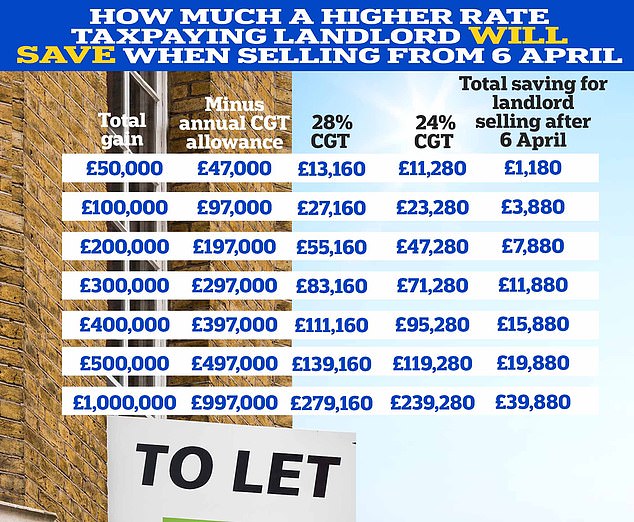

This means this new cut to CGT by Hunt could result in thousands of pounds of savings for homeowners when they sell.

Previously, someone selling a buy-to-let property for £300,000, having previously purchased it for £200,000, would have made a profit of £100,000. After their annual allowance, this taxable profit would have been reduced to £94,000. .

From April 6, your taxable profit will increase to £97,000, after the annual allowance is reduced to £3,000. That’s if they haven’t already breached their annual allowance through other means, such as selling shares outside of an Isa.

Before today’s announcement, a higher-taxed homeowner, charging 28 per cent on a profit of £97,000, would have paid £27,160 in CGT.

Now, the equivalent owner would pay £23,280, the equivalent to a saving of £3,880.

Why do most landlords pay the highest rate of CGT?

CGT is added to a person’s normal income to decide the tax rate at which they are charged.

Therefore, even if someone is a basic rate taxpayer, the impact of a large capital gain is likely to push them to pay a higher rate.

For example, if someone makes a capital gain of £100,000 from selling a buy-to-let property, after their annual tax-free allowance of £3,000 this gain becomes £97,000.

The basic rate tax threshold is £50,270, so if you are a basic rate taxpayer earning £30,000 a year, £20,270 of your capital gain will be calculated at 18 per cent and the remaining £76,730 of the gain will be They will be taxed at 24 percent. .

CGT will not affect homeowners unless they have rented their home in the past.

This is because when selling a main home, people are fully protected from CGT through what is known as main private residence relief.

It could potentially affect homeowners who have had multiple tenants during their tenure or who have rented their home outright for a period of time, although certain exemptions apply.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.