Table of Contents

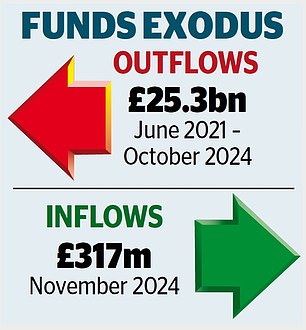

Britain’s beleaguered stock market enjoyed a respite after a three-and-a-half-year exodus, as investors piled into £317m in equity funds last month.

Figures released yesterday by fund network Calastone showed London-listed shares enjoyed inflows for the first time since May 2021.

However, it barely made a dent in the £25.3bn withdrawn since then. And Calastone’s global head of markets, Edward Glyn, warned it was likely to be a temporary respite.

“The entry is likely to be a pause rather than a break in the trend,” he said. “There is no major catalyst on the horizon that will cause a widespread resurgence of interest in the much-unloved UK stock market.”

In November, investors flocked to equity funds – both in the UK and abroad – and total inflows soared to a record £3.1bn.

That reversed record withdrawals in October as they tried to escape capital gains tax increases in the Budget.

Crucial moment? Figures released by fund network Calastone provided a rare positive for London-listed shares as the market enjoyed inflows for the first time since May 2021.

Steven Fine, chief executive of brokerage Peel Hunt, last week expressed alarm that money was “leaking” from UK funds.

The trend reflects the declining market, which has struggled to attract IPOs and seen an exodus of listings due to acquisitions and defections to overseas stock exchanges.

Yesterday, Bloomberg data showed that 45 companies have delisted in London this year, up 10 percent from last year.

By comparison, the latest figures from EY show that only ten companies joined the London Stock Exchange or AIM, its junior market, in the first nine months of the year.

Companies that have left this year include Virgin Money – bought by Nationwide for £2.9bn – and cybersecurity group Darktrace and Keywords Studios, acquired by private equity firms in deals worth £4.3bn and £2.1bn. pounds respectively.

The exodus will continue as Czech billionaire Daniel Kretinsky’s £3.6bn takeover of Royal Mail awaits government approval, while Carlsberg has a £3.3bn deal in place to acquire Britvic.

And yesterday, digital training group Learning Technologies agreed an £802m takeover by a US private equity firm.

AJ Bell investment director Russ Mold said: “The acquisitions are the result of 15 or 20 year trends and it’s going to take something big to reverse this.”

Veteran City commentator David Buik said: ‘Britain has many innovative, world-class small and medium-sized businesses and this is where we need to focus as it is where the future lies.

“If we give them support, we will drive growth.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.