- US inflation data and higher economic output push back rate cut forecasts

- Investors now expect less than 50 basis points of rate cuts by end-2024

<!–

<!–

<!– <!–

<!–

<!–

<!–

Hopes of an imminent Bank of England base rate cut are fading due to improving global economic growth and resurgent inflation pressures.

Markets had increasingly priced in the Bank of England’s first base rate cut to come in June, following a surprisingly dovish vote at the March Monetary Policy Committee meeting, but more recent data has pushed back expectations for more. later in the year.

Current market prices now suggest that the Bank of England’s first cut will not come until August, while the expected scale of cuts in 2024 is less than 50 basis points, meaning the current base rate of 5.2 per percent will not fall below 4.75 percent this year. end.

The Bank of England’s base rate is now expected to remain above 4.75 percent by the end of the year.

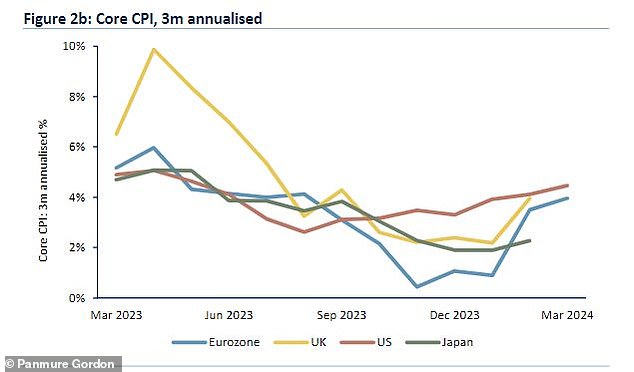

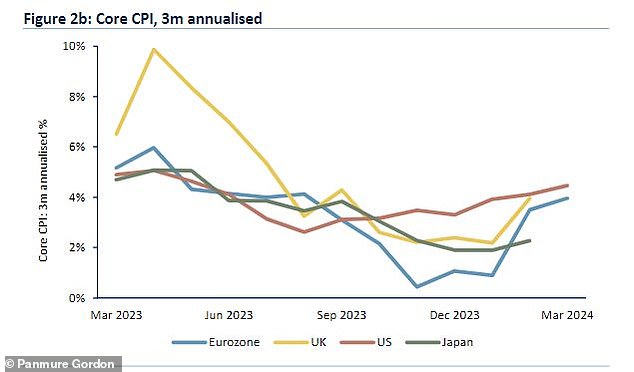

The higher-than-expected US consumer price inflation figures released on Wednesday followed recent PMI data showing all major UK sectors have returned to growth for the first time in almost two years, while eurozone PMIs have also improved.

All of this suggests that the Bank of England will be in no rush to cut rates, as it will not want to risk another spike in price growth with efforts to stimulate the economy.

Panmure economist and head of research Gordon Simon French said Thursday that his firm’s initial decision to back off its first Bank of England rate cut forecast from August to June “increasingly looks like a mistake.”

He added: ‘We should have had more guts.

“The recent pick-up in economic momentum across all major geographies and a recovery in underlying price growth means the balance of risks is changing rapidly for central banks – led by a Federal Reserve facing incontinent US fiscal policy and a Positive wealth effect of a strong current stock market.

“For the Bank of England, which faces a quite different domestic context, there is a narrow political and rhetorical path that it must travel in the coming months and which may generate some flexibility in domestic interest rates.”

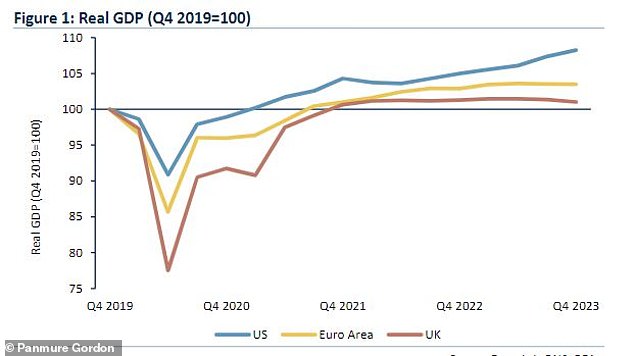

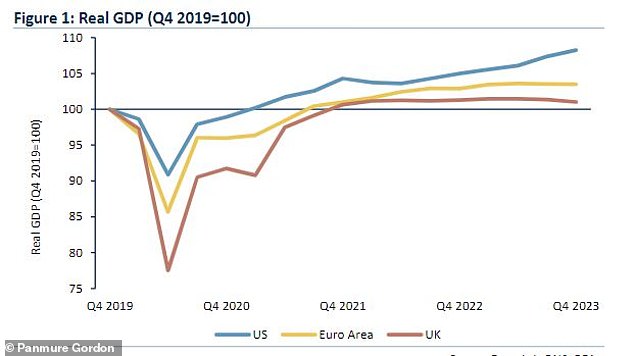

Economic output is improving

French said the investment bank still believes the Bank of England will cut the base rate by 50 basis points to 4.75 percent this year, “but the timing remains deeply uncertain.”

He added: “Two key judgments will be needed: how much easing can be applied in the UK without removing policy from a restrictive environment? [And] How much pressure on imported prices would crystallize if the Bank of England eased policy at a faster pace than the Federal Reserve?

The Federal Reserve usually leads the way on global interest rates, but some experts now believe the European Central Bank could be the first to make the move.

French’s comments are in line with warnings from Bank of England chief Megan Greene, who on Thursday warned that UK rate cuts should remain “far off” amid persistent inflation pressures.

She wrote in Financial times: ‘Markets now expect the Bank of England to cut rates earlier and by more than the Federal Reserve this year.

‘Macroeconomic fundamentals and inflation dynamics differ in the UK and the US, and there is a greater risk of persistence in the former. Markets are moving rate cut bets in the wrong direction.

‘Lower potential UK growth means higher inflationary pressures, all else being equal. But everything else is not equal. Demand in the UK is also much more limited.

‘The UK economy has faced the double whammy of a very tight labor market and a terms of trade shock due to energy prices. Therefore, the persistence of inflation is a greater threat to that country than to the United States. But market prices for interest rates do not reflect this.’

Core CPI data points to resurgence in inflationary pressures