Scientists believe they have discovered a missing link between how eating junk food increases cancer risk.

A study in Singapore looked at the effect of methylglyoxal, a compound released when the body breaks down sugary and fatty foods, on a gene that helps fight tumors.

For the first time, academics discovered that methylglyoxal could temporarily disable the BRCA2 gene’s ability to protect against cancer formation and growth.

Doctors have known for decades that eating junk food is linked to a much higher risk of cancer, even if the person is not obese, but the exact mechanism is still unknown.

It could explain, at least in part, why cancers among young, apparently healthy Americans are becoming so common, particularly colon tumors.

Researchers at the National University of Singapore found that methylglyoxal, which the body produces in greater quantities when eating junk food, could inhibit the function of cancer-protective genes such as BRCA2.

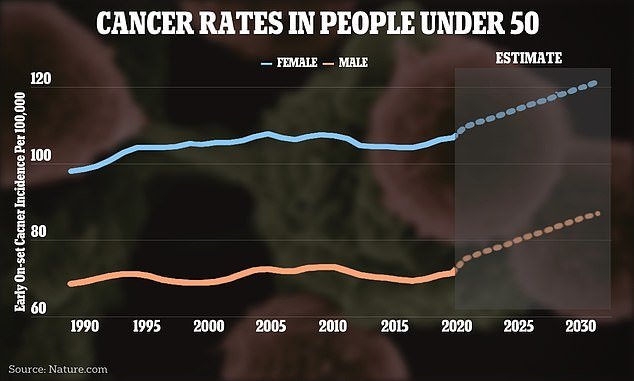

The graph above shows the change in cancer case rates around the world.

The team also noted that the study contradicts a long-standing theory called Knudson’s “two strikes” paradigm, which said that genes like BRCA2 must be completely inactive in the body to increase cancer risk.

These genes are intended to help protect the body against cancer, although patients who inherit defective copies from their parents have been shown to have a higher risk of certain cancers, such as breast and pancreatic cancer.

Dr. Ashok Venkitaraman, study author and director of the Cancer Research Center at the National University of Singapore, said Medical news today: ‘[M]Ethylglyoxal triggers the destruction of the BRCA2 protein, reducing its levels in cells.’

“This effect is temporary, but may last long enough to inhibit the tumor-preventing function of BRCA2.”

He noted that repeated exposure, for example by eating processed foods and red meat, among others, would increase the amount of damage to genes like BRCA2.

The team examined the effect of methylglyoxal on cells from people who had inherited a defective copy of BRCA2 and were therefore more likely to develop cancer.

They found that exposure to methylglyoxal disabled tumor suppression.

“It is well documented that some people are at high risk of developing breast, ovarian, pancreatic or other cancers because they inherit a defective copy of the cancer-preventing gene (BRCA2) from their parents,” Dr. Venkitaraman said.

‘Our recent findings show that the cells of these individuals are particularly sensitive to the effects of methylglyoxal, which is a chemical produced when our cells break down glucose to create energy.

“We found that methylglyoxal inhibits the tumor-preventing function of BRCA2, eventually causing faults in our DNA that are early warning signs of cancer development.”

Additionally, Dr. Venkitaraman noted that elevated levels of methylglyoxal are common in people with diabetes and prediabetes.

“Our latest findings show that methylglyoxal can temporarily inactivate these cancer-preventing genes, suggesting that repeated episodes of poor diet or uncontrolled diabetes can ‘stack up’ over time and increase cancer risk,” he said.

However, the team cautioned that since the study was carried out in cells and not people, more research is needed on the topic.

The research adds to a long list of studies suggesting that diet could have an impact on cancer risk, particularly colorectal cancer.

Research from the Cleveland Clinic, for example, found that people under 50 who ate diets rich in red meat and sugar had lower levels of the compound citrate, which is created when the body converts food into energy and has been shown that inhibits the growth of tumors.

The new study was published last week in the journal. Cell.