Table of Contents

Black Friday is almost here, and with it the promise of cheap online shopping deals, but are these deals all they seem and how do you know?

Black Friday is a sales period that has become the unofficial start of the Christmas shopping season.

The trend started in the US and has grown from a single day of sales to several weeks, with many major retailers participating. This year, Black Friday falls on November 29.

While the Black Friday festival of consumerism may offer some genuine bargains, research has found that most advertised “deals” do not offer shoppers any significant savings that they cannot get at other times of the year.

Not only this, but the shopping period also carries a higher risk of fraud, overspending, and debt.

Here’s everything you need to know to safely browse the Black Friday sales and how to tell a real deal from a fake one.

An arm and a leg?: Black Friday sales have been criticized by retail experts, who say they are often not the incredible deals that consumers are led to believe.

Does Black Friday really have the best prices?

Most Black Friday deals seem too good to be true for one simple reason: they are.

In fact, nine out of 10 Black Friday deals are the same price or cheaper at other times of the year, according to a study by consumer organization Which?.

While retailers rarely claim that Black Friday deals offer the biggest savings, which ones? He said that “shoppers could be forgiven for believing this” due to the intense marketing during the sales period.

Which? analyzed offers on 227 products in the Black Friday fortnight last year between November 20 and December 1.

It found that 92 percent of these deals – all from major retailers – could be found at the same price or less at other times of the year.

Surprisingly, which one? It also found 14 “deals” in which the supposed “before” price of a discounted item had never been charged in the previous year, meaning the deal was not as good as advertised.

Even more surprising is that many websites host “fake sales” in which prices are deliberately inflated before Black Friday, to make later “discounts” look better, according to price-checking website PriceSpy.

PriceSpy analyzed nearly five million prices and found that since October 1, prices have increased by 33 percent (1.6 million). Sixteen percent of prices increased more than 10 percent.

How do I know if a Black Friday discount is a good deal?

There are two ways to approach this question.

The easiest way is to say that if you see an item on a Black Friday sale that you wanted anyway and you’re happy with the price, then it’s a good deal.

The most economical way is to ask yourself whether the advertised Black Friday sale price is the best possible price and whether it is worth buying the item now or waiting.

If you take the latter view and shop online, then your best friend should be price tracking tools that compare the cost of items over time.

If you’re shopping on Amazon, the Camel Camel Camel website tells users when items are cheap, as well as when prices have changed and by how much.

The websites Idealo, Pricechecker, Pricerunner and PriceSpy compare the cost of the same item at various retailers, and even in brick-and-mortar stores.

If you’re shopping in a physical store, the Idealo app allows you to scan a barcode on an item and check if it can be purchased cheaper elsewhere.

If you know exactly what you want and don’t need it right away, the Alertr website can track an item and start giving you updates on the best prices after 48 hours.

Beware of Black Friday scams

With so many Brits looking for a bargain on Black Friday, experts are urging shoppers to be wary of scammers trying to fleece them of their money.

It’s especially important to be careful when shopping online, as you’re much more likely to get scammed.

The Black Friday period is tailor-made for online scammers, especially as the time-limited nature of the sales period can encourage shoppers to purchase items without much thought.

Consumer expert Helen Dewdney and security professional James Bore say Black Friday is the “best time” for fraud.

Their tips for staying safe from fraud include:

1) Beware of cloned and fake shopping websites. A possible sign that a website is legitimate is if it has a secure padlock, especially on any page that involves payments, although this is no guarantee of security when purchasing.

2) Check out comments and reviews about online stores you haven’t used before.

3) Consider using a credit card for online purchases, as they offer more consumer protection than debit cards. Section 75 protection means that if a consumer buys something on a credit card worth between £100 and £30,000, the lender and the seller are equally responsible for fixing the problem if something goes wrong.

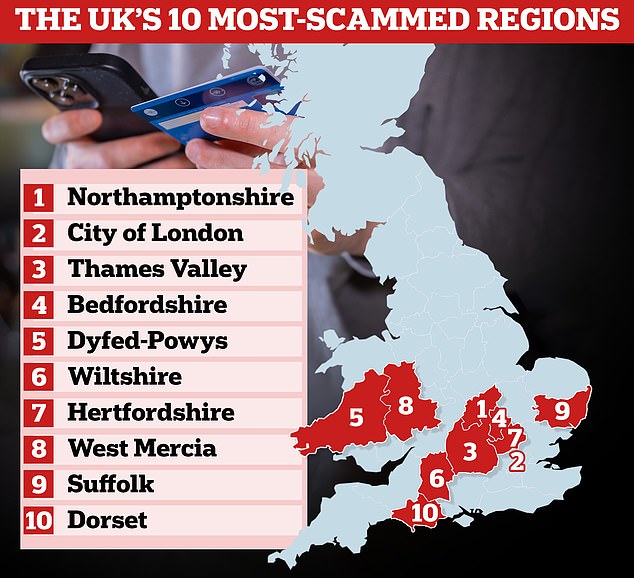

At risk: Northamptonshire residents most scammed in UK, says Idealo

4) If it seems too good to be true, it probably is. Dewdney says: ‘Companies will not offer 50 to 80 per cent discounts on products that are in high demand.

“Scammers will use these offers to try to provoke arousal and an emotional response, which limits critical thinking and makes people more likely to buy before thinking things through.”

According to Idealo, Northamptonshire residents are most at risk of online shopping scams.

Even once you have successfully purchased an item, you may still have to think about the risk of it being stolen before you receive it.

Dan Smith, security specialist at Checkatrade’s Smith & Greens Security, said “porch pirates” can easily steal packages left unattended by delivery drivers.

Smith recommended that homes install a lock box where packages can be safely left, and that they should consider home improvements such as lighting, doorbell cameras and gravel driveways.

Stay within your spending limits

Even though Black Friday is supposedly all about bargains, the variety of discounts can end up leaving shoppers worse off financially if they overspend.

Tesco Bank payments and savings director Chris Henderson said: “With new discounts and deals every day in the run-up to Black Friday and Cyber Monday, it can be tempting to spend, spend, spend.”

“And while shopping during sales can mean savings, especially when it comes to holiday shopping, it’s important to take a step back and check that you’re sticking to your budget and what seems affordable.”

Effective ways to stay on top of this are things that are common sense, but can easily be forgotten when faced with a pressured and urgent sales situation.

These included avoiding impulse purchases, only buying what you really need, comparing prices and making sure you are really getting a good deal.

The only thing financially worse than spending too much is going into debt too.

This is a particular risk when purchasing items with credit cards.

While credit cards offer a degree of financial protection for purchases, they also pose the risk of not being able to make payments, which also incurs interest.

Moneyfacts finance expert Rachel Springall said: “Consumers expecting to make big-ticket purchases will no doubt be keeping an eye on the Black Friday and Cyber Monday sales.”

“However, it is vital to take a step back to ensure they can comfortably afford any purchase or have a sensible payment plan to cover the costs, especially if they are purchasing electronics.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.