New York Mayor Eric Adams has called for a radical overhaul of its sanctuary city status in a dramatic 180-degree turn as the city buckles under the weight of an influx of immigrants.

The Democratic leader has faced a furious backlash as schools, hotels and community centers have been handed over to the 180,000 migrants he warned will “destroy” the city.

He has been a strong defender of its decades-old sanctuary status that prohibits city officials from asking questions about a person’s immigration status or disclosing it to federal authorities.

But he revealed his major policy change after angry residents questioned him about crimes committed against immigrants, including the brutal January Times Square attack on two police officers, in which most of the suspects were released on bail within hours of his arrest.

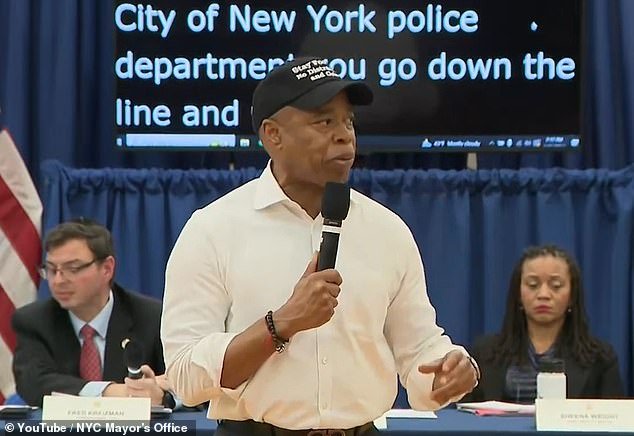

“We need to change the sanctuary city law that if you commit a serious crime or a violent act we should be able to turn you over to ICE and deport you,” he said at a town hall meeting Monday night.

The mayor of New York City repeated his comments at a press conference on Tuesday: “We should not allow people who repeatedly commit crimes to remain here and we cannot collaborate with ICE in the process,” he said.

More than 180,000 immigrants have arrived in New York since spring 2022, costing the city billions of dollars in welfare benefits.

But tensions have risen in the wake of a series of high-profile crimes, including the notorious gang attack on two NYPD officers by Venezuelan immigrants in Times Square last month.

More than 560 cities, states and counties have declared themselves sanctuaries since the early 1980s, with New York adopting the status during the administration of former Democratic Mayor Ed Koch.

But sanctuary cities have been a favorite target of southern border governors, who have bused thousands of migrants north as the migrant crisis has gained steam.

Under the current sanctuary status, police in participating cities cannot arrest anyone because they are an illegal immigrant, and the city will not cooperate with an investigation by immigration authorities unless ordered to do so by a court.

Adams insisted: ‘We must protect our immigrants. Period,” when she ran for office in October 2021, adding, “New York City will remain a sanctuary city under the Adams administration.”

As recently as last month, he was defending the status after Nikki Haley attacked him for encouraging illegal immigration during a Republican primary debate.

“This has nothing to do with sanctuary cities, immigrants and asylum seekers are given parole to enter the country, they are here legally,” he told Fox News.

But the city expects to have spent $10.6 billion by the end of 2025 and announced a budget in December that would reduce the number of NYPD officers by a fifth and cut education by $1 billion over two years.

Migrants collect clothing as mutual aid groups distribute food and clothing in cold weather near the Migrant Assistance Center at St. Brigid’s Elementary School last month in New York.

Adams has desperately turned to a variety of city landmarks, makeshift shelters and temporary housing to find space for the influx of migrants, including the former St. John Villa Academy Catholic school (pictured) on Staten Island.

Adams came under fire for announcing a $53 million debit card plan that could give an immigrant family with two children under 17 up to $15,200 a year.

“Let me tell you something, New Yorkers,” Adams said at a public meeting in September. ‘I have never had a problem in my life that I didn’t see an end to. I don’t see an end to this.

‘This problem will destroy New York City. Destroy New York City.’

This week he faced more pressure over his plans for a $53 million debit card plan that could give an immigrant family with two children under 17 up to $15,200 a year.

Sanctuary city status has come under increasing pressure in other cities facing an influx of immigrants, and Chicago Democratic leaders came under fire for blocking a vote to get rid of its sanctuary city status late last year.

Mayor Brandon Johnson ordered his lieutenants to quash an attempt to put the controversial “Welcome to the City Ordinance” to a referendum in Chicago’s March primary election.

Adams admitted earlier this month that he would use his executive authority to override some sanctuary provisions if allowed, as he was questioned by Republican city councilors.

And his U-turn was welcomed as a “welcome change” by Councilman Joe Borelli.

But the Legal Aid Society said the reform would criminalize the innocent.

“What Mayor Eric Adams seeks would result in local authorities being able to transfer New Yorkers simply suspected of a crime to ICE, disrupting local criminal procedures and perpetuating family separation and dividing communities,” he said in a statement.

Adams blamed Congress for its handling of the crisis Monday night, insisting that his hands were tied by federal laws.

‘People say to me all the time, they see me on the street and they say, ‘Well, Eric, why don’t you stop the buses from coming?’ “It’s against the law, I can’t,” he said at the meeting.

‘Why don’t they allow those who want to work?’ It’s against the law – federal law – I can’t.

The Big Apple has been inundated by an influx of immigrants that the mayor’s office estimates will cost taxpayers $10.6 billion over three fiscal years.

Schools, nursing homes and a number of landmark hotels have been requisitioned to house many of the 180,000 migrants who have arrived in the city since spring 2022.

‘Why do you say you have to shelter everyone who [comes] in?’ Because that’s the law.

‘Why don’t they deport those who commit crimes and harm people who aren’t doing the right thing?’ It’s against the law, I can’t.

‘So I’m inheriting a national crisis that I have to solve and we’re solving that crisis like no other city, folks.

‘Go Google other cities. You don’t see tent cities in New York. You don’t see children and families sleeping on the streets in New York. This team has managed the crisis every time it comes.’