Table of Contents

For an asset that has spent most of its short, eventful life lurking in the shadows of the financial system, it was perhaps fitting that bitcoin broke the $100,000 barrier for the first time in the dead of night.

The flagship cryptocurrency, which has been favored by drug traffickers and money launderers, surpassed the milestone shortly after 2:45 a.m. on December 5, and this week reached a new high of $108,379.

Its enormous advance has made some investors willing to turn a blind eye to the risks, and millions have been accumulating.

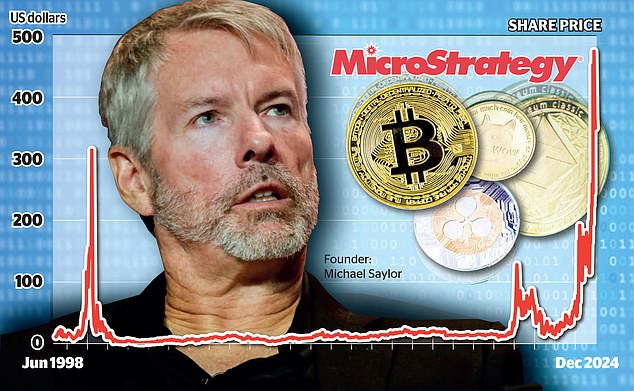

But it’s not just cryptocurrencies that have skyrocketed. Shares of MicroStrategy, an American company that is essentially a turbocharged bet on bitcoin, have risen more than 550 percent in the past year.

That makes them one of the best performers on the US stock market, and British private investors have stampeded in, despite the considerable risks.

MicroStrategy was the most-bought stock in November, according to Interactive Investor, the UK’s second-largest investment platform.

Controversial: MicroStrategy was founded by Michael Saylor (pictured), a tech entrepreneur whose 10% stake in MicroStrategy is worth $9 billion on paper.

The company was founded by Michael Saylor, 59, a controversial tech entrepreneur whose 10 per cent stake in MicroStrategy is worth $9bn (£7.2bn) on paper. So is buying these stocks a route to get rich quick or the road to ruin?

Traded 24 hours a day every day, bitcoin has soared 50 percent since Donald Trump’s victory in the US presidential election.

His return to the White House has fueled hopes among bitcoin believers that he will usher in an era of light regulation, which would be great for cryptocurrencies.

Trump, who once criticized bitcoin as a “scam,” nominated cryptocurrency cheerleader Paul Atkins to head the Securities and Exchange Commission (SEC), which oversees U.S. stock markets and protects investors. .

Think foxes and chicken coops.

Bitcoin and other cryptocurrencies may be about to enter the financial mainstream.

Even so, bitcoin – created in 2008 – has no intrinsic value and for years was rejected by conventional investors who resisted strong price swings. It is known for its volatility and other risks associated with cryptocurrencies, including fraud and scams.

Trump has changed all that. He has declared himself a “crypto president” and promised to consider creating a “strategic reserve” of bitcoins for the US government, which could boost prices further.

This has not gone unnoticed here. About seven million people (12 per cent of the UK adult population)

He now owns some crypto assets, according to recent figures from the city’s watchdog, the Financial Conduct Authority.

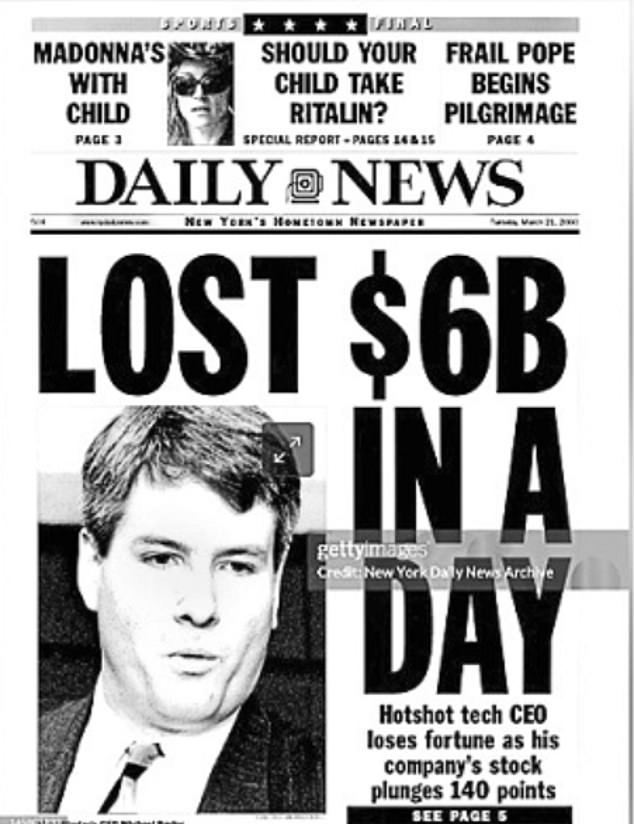

Saylor once lost $6bn (£4.8bn) on paper in one day at the height of the dotcom mania in 2000, after MicroStrategy restated two years of earnings.

The billionaire tech tycoon and two colleagues were fined and agreed an $8.3m (£6.6m) settlement with the SEC without admitting any wrongdoing.

Earlier this year, he and MicroStrategy agreed to pay $40m (£32m) to settle a tax fraud lawsuit.

Saylor, a graduate of the Massachusetts Institute of Technology, has since 2020 transformed what was a struggling data analytics company with a stock price that was going nowhere fast into what one banking expert calls a “giant buying bitcoins.

MicroStrategy is the largest corporate holder of bitcoins in the world. It owns almost 2 percent of the digital currency in circulation, but it wants more. A lot more.

The company is now valued at more than $90bn (£71.9bn).

Surprisingly, that’s more than double the value of all the bitcoins he owns. How is that?

The short answer is leverage, or the art of increasing returns by purchasing assets with borrowed money. The problem is that the risks are also amplified, but bitcoin fans don’t want to hear about it.

Saylor plans to raise $42bn (£33.5bn) over the next three years to buy even more bitcoin. It plans to do this by borrowing money and issuing more shares.

Rough day: Saylor once lost $6 billion on paper in one day at the height of the dot-com mania in 2000, after MicroStrategy restated two years of earnings.

Here’s how it works: MicroStrategy issues new shares at current high values to investors. At the same time, it issues bonds – basically promissory notes – for hedge funds and other market operators.

One feature is that you pay no interest on these bonds, which after a period can be exchanged for MicroStrategy shares, so it costs the company nothing to borrow the cash.

The hedgies and others who buy the bonds and lend money to Saylor for free are, in essence, making a bet that MicroStrategy stock will rise enough to compensate them for not paying interest.

As for the company, it uses the money it has raised by selling its stocks and bonds to buy more bitcoins.

This pushes the price up, which pushes MicroStrategy’s stock price even higher. That means you can sell more stocks and bonds at this higher price to buy even more bitcoin.

And so the rinse and repeat cycle continues. The problem, of course, is that a drop in the value of bitcoin could stop the entire merry-go-round.

Buying bitcoin often involves using offshore exchanges such as Coinbase and Binance, which are not authorized in the UK, so savers have no protection.

People can easily buy MicroStrategy shares through an investment platform, but the risks are even higher because the company’s strategy of buying bitcoin with borrowed money increases its profits but also deepens its losses.

A bet on its stocks could go very wrong if the extraordinary rally in bitcoin and other digital currencies reverses, so don’t invest money you can’t afford to lose.

This is what happened in 2022 when Sam Bankman-Fried’s FTX cryptocurrency exchange collapsed, dragging the price of bitcoin below $16,000 and plunging MicroStrategy into huge losses.

Experts have warned that the latest rise in MicroStrategy’s share price is just another speculative bubble that is destined to burst.

“It’s symptomatic of a market that has become obsessed with believing in get-rich-quick schemes,” said David Trainer, chief executive of research firm New Constructs.

‘If you like bitcoin, go buy it. But don’t invest in a company that is losing money and also buy bitcoin, because then you will have doubled your risk,” he told the Wall Street Journal.

Saylor argues that because there is a limit to the number of bitcoins that can ever be produced, demand will outstrip supply and the price will inevitably rise, albeit with fluctuations. Like gold, the cryptocurrency’s perceived value comes from its limited availability.

Bitcoin’s computer algorithm sets a fixed limit of 21 million coins, most of which have already been “mined” or digitally created.

“It’s the only product invented in the history of the human race that is absolutely capped, meaning you can expect it to keep going up,” Saylor recently told CNBC News.

The value of all bitcoins in circulation is $2 trillion (£1.6 trillion), more than the combined value of all but the largest FTSE 100 companies.

Investment heavyweights BlackRock and Fidelity now offer bitcoin exchange-traded funds in the US, although not yet in the UK.

All of which means that if it crashes again, the global financial system may not be immune either. It would also drag MicroStrategy with it.

“It could be a giant house of cards that would crush many shareholders when it collapsed,” Trainer says. ‘It has become a

Game of musical chairs: you play until the music stops and you just hope you can get out before the accident.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.