<!–

<!–

<!– <!–

<!–

<!–

<!–

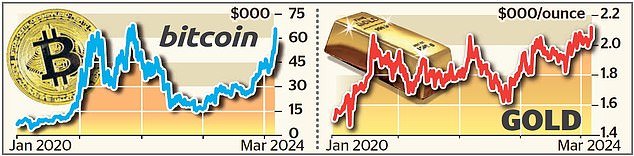

Rise of cryptocurrencies: Bitcoin reached $66,864 yesterday, its highest level in more than two years

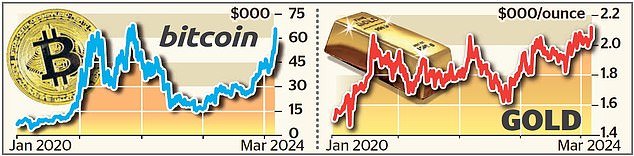

Bitcoin and gold hit all-time highs as investors bet on interest rate cuts this summer.

The digital currency hit $67,584 yesterday, its highest level in more than two years, prompting predictions that an all-time high is “just around the corner.”

Bitcoin is within striking distance of its November 2021 high of $68,999.99, having risen more than 50 percent this year.

At the same time, gold rose to $2,120 an ounce, its highest level since Dec. 4, when prices hit an all-time high of $2,135 before falling later in the day.

Brent Donnelly, trader and president of analytics firm Spectra Markets, said: “We’re back to a 2021-style market where everything’s up and everyone’s having fun.”

Both gold and bitcoin have been boosted by the prospect of lower interest rates in the United States and beyond.

Analysts said any sign that inflation is falling will continue to fuel hopes of rate cuts and, in turn, boost the value of assets like gold.

“If inflation numbers remain subdued, gold will continue to trend higher,” said Jim Wyckoff, senior analyst at Kitco Metals.

Bitcoin plummeted below $16,000 in late 2022 as the cryptocurrency industry was plagued by scandals, including the collapse of trading platform FTX and the subsequent fraud conviction of its founder Sam Bankman-Fried.

But it has recovered strongly, helped this year by the approval by US regulators of 11 exchange-traded funds (ETFs) linked to its price.

And Bitcoin will also get a bigger boost next month due to another event called a “halving,” when the reward for mining Bitcoin will be cut in half.

All of this means an all-time high is “just around the corner,” says Lukman Otunuga, senior market analyst at online broker FXTM.