Gregg Wallace has responded to “unfair” backlash over his Saturday regimen, where he said he “wouldn’t have chosen” to have his child.

The MasterChef judge, 59, revealed his typical weekend routine and opened up about his dramatic 5 stone weight loss and gym regime for The Telegraph’s My Saturday column.

However, Gregg became emotional during an Instagram Live on Wednesday over the backlash, saying the comments had been “cruel”, “disgusting” and “unfair”.

He said: ‘There are only two things I want to address here with Sid (Gregg’s son). People said, “So you spend an hour and a half with your kid, but then you spend two hours on your computer.” No, I’m with my son at home all the time.

“I just didn’t write ‘I was tickled with Sid, playing in the living room’; you’re not logging every minute of the day.” I just registered the blocks. So, that didn’t mean that was all I saw of him that day.

Gregg Wallace responded to “unfair” backlash over his Saturday regimen, where he said he “wouldn’t have chosen” to have his child.

The MasterChef judge, 59, became emotional during an Instagram live on Wednesday over the backlash and said the comments had been “cruel”, “disgusting” and “unfair”.

Gregg added: “If you live in a house with someone, you interact with them all the time.” Not only that: this is a snapshot of a Saturday. I hope that makes sense to everyone.

And the other thing too, and I’m almost going to cry about this, is that people say Sid is unwanted. It took us two years to conceive with Sid. Two years.’

The television personality explained that his wife Anna, who is 22 years his junior, wanted a family, however, he said at the time that he would not have chosen to have children at her age before meeting her.

Gregg was already a single father with two children whom he raised alone, and confessed that he and Anna almost underwent fertility treatment before she became pregnant with Sid.

He concluded that the comments had been “cruel”, “disgusting” and “unfair” and that the interview was “innocent”, while reminding fans that everyone is human and that he was “deeply saddened”.

Gregg left fans baffled after revealing his typical weekend routine for The Telegraph’s My Saturday column.

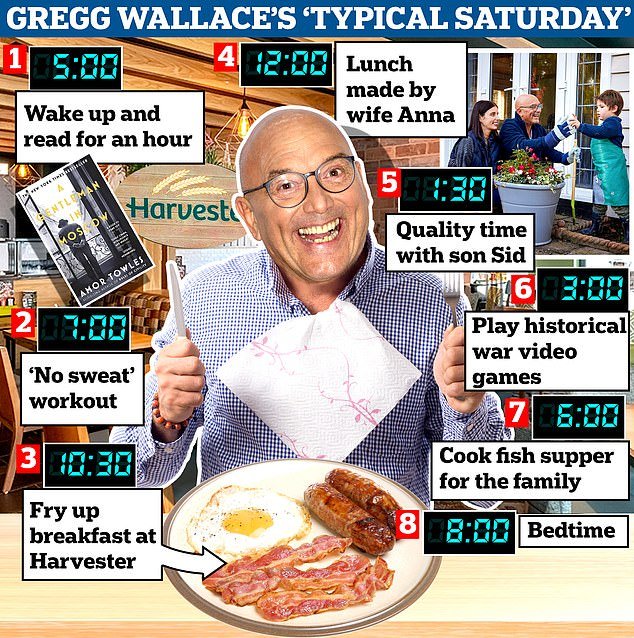

Gregg reveals that he doesn’t allow himself to spend the weekend relaxing and starts his day at 5 a.m., reading for an hour (currently A Gentleman in Moscow by Amor Towles) before making a cup of coffee and checking registration numbers. for your health program.

However, there is no more time to rest as he has to stick to his five-day-a-week training regime, and he revealed that he has persuaded staff to open the gym for him half an hour early every weekend so he can enjoy a private bath and sauna.

Gregg said: “And the other thing too, and I’m almost going to cry about this, is that people say Sid is unwanted.” It took us two years to conceive with Sid. Two years.’

Gregg left fans baffled after revealing his typical weekend routine that includes a “no-sweat” workout, a fry-up in the Harvester and hours playing historical war video games.

Once the crowd starts arriving (at the right time), Gregg heads straight to the treadmills where he works toward his goal of 50,000 steps a week, but insists there’s “no sweat.”

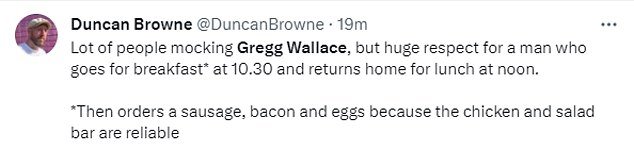

Having worked up an appetite but not broken a sweat, next on the to-do list is breakfast, and Gregg meets his personal assistant at the local Harvester for breakfast, which consists of bacon, sausage, and a fried egg.

While he admitted that people are often surprised to see him at the budget restaurant chain, he has “never been disappointed” by the food and especially likes the grilled chicken and salad bar.

On the contrary, he noted that he has been disappointed by the food on offer at several three-Michelin-star restaurants across Europe.

Over breakfast, conversation turns to business with their personal assistant as they juggle filming MasterChef, the wellness business and the new health and wellness podcast, A Piece of Cake.

Speaking about his new healthy living podcast, Gregg reflected, “I love talking to experts, but I’m also a huge expert, having been journaling, manifesting, goal setting, and reading self-help books for years.”

Apparently blessed with a high metabolism, lunch arrives just an hour and a half after frying, and Gregg’s wife Anna, 38, makes sure there’s food on the table when she gets home at midday.

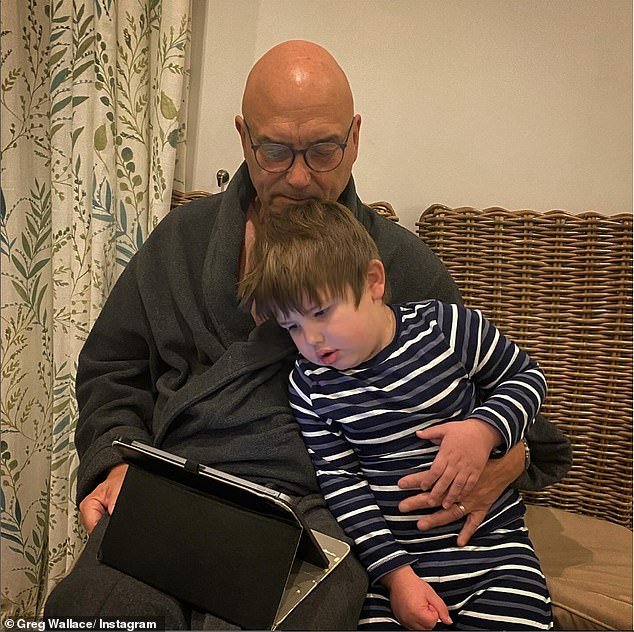

After lunch comes some quality time with her four-year-old son, Sid, who is nonverbal autistic but “has started seeking company and showing eye contact.”

Speaking candidly about his relationship with his youngest son, Gregg, who has two adult children, Tom, 29, and Libby, 26, with his ex-wife Denise, shared: “I’m a much better father now that I’m older, although Another child is not something I would have chosen at my age.

‘I was always very honest with Anna, but it’s what she wanted and I love her. I only asked for two things: that we have help around the house (which is why her mother moved there) and, secondly, that we have at least one week a year to spend the holidays just the two of us.’

Having worked up an appetite but not broken a sweat, next on the to-do list is breakfast, and Gregg will meet his personal assistant at the local Harvester for breakfast: bacon, sausage and a fried egg.

Apparently blessed with a high metabolism, lunch arrives just an hour and a half after frying, and Gregg’s wife Anna, 38, makes sure lunch is on the table when he gets home at midday.

Gregg’s Saturday regime quickly began trending on X, with bemused fans claiming it was like Steve Coogan’s comedy character Alan Partridge.

After an hour and a half of quality time with Sid, Gregg indulges in two hours of free time for me.

As an “amateur historian” and a fan of video games, he likes to lock himself in his home office at 3:00 p.m. playing Total War Saga: Thrones of Britannia, set in the year 878 AD

After leading the Norse, Saxons and Gaels to victory, he sets about preparing dinner for his family.

The restaurateur and former greengrocer revealed that Anna takes on the main kitchen duties while he cooks for his family only once a week, usually a grilled fish dish from the fishmonger.

He is also a fan of making his own “healthy” cheeseburgers, since takeout is banned after his health reform.

Alcohol is also restricted, and Gregg drinks twice a week, usually starting with a pint, then a wine, then a whiskey or brandy, but makes sure not to “binge drink.”

After his long day, it’s time for an early bedtime, at 8 pm, where he and Anna will read or watch a movie on his laptop because Gregg “tried sitting on the couch eating cookies” but didn’t find it “satisfying.”

Sleep usually comes at nine at night.

Gregg’s Saturday regime quickly began trending on X, with bemused fans claiming he was like Steve Coogan’s comedy character Alan Partridge.

They wrote: ‘Catching up on Gregg Wallace’s gorgeously Partridgean My Saturday.’; ‘Gregg Wallace here with an article that would easily place him in the upper division of LinkedIn’s most ridiculously selfish contributors’;

“I met Gregg Wallace once; I don’t have to bump into him not once, but twice in an hour in Manchester city center and, from our fleeting interaction, I’m not entirely surprised by his Partridge-style interview “.

Gregg is keeping busy juggling filming MasterChef, wellness businesses and new health and wellness podcast, A Piece of Cake (pictured with MasterChef co-judge John Torode)

‘This is my favorite part… amateur historian #GreggWallace’; ‘Well, who’s going to open their Fitness First early to let Gregg Wallace in?’; ‘How do we explain to Gregg Wallace that this isn’t actually what historians do?’;

”At 8:00 pm it’s cookies and CHEESE’ Gregg Wallace and Gromit’; ‘Gregg Wallace. This has to be a parody, right?’; ‘I can’t stop reading Gregg Wallace. What a journey, every word is absolutely incredible.’;

“Imagine being that person at the gym who has to arrive half an hour early so Gregg Wallace can swim solo, or his personal assistant who has to go to Harvester every Saturday morning and watch him eat bacon and eggs”;

‘Gregg Wallace: I wake up at the same time every morning. I’ll read for an hour (right now it’s A Gentleman in Moscow by Amor Towles) and then I’ll make myself a coffee and check my emails. Blur: LIFE IN THE PARK’;

‘Gregg Wallace tells the world his son was unplanned and spends more time playing computer games (two hours) than with his autistic son (hour and a half). “If I commented on my feelings about this, Twitter would ban me.”