A billionaire stock market visionary has revealed the shocking financial move he would make if Vice President Kamala Harris won the presidential election.

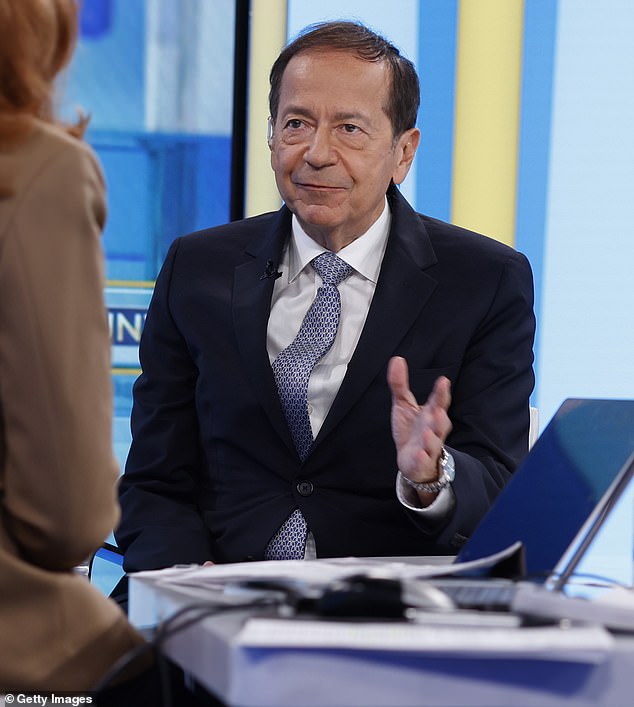

John Paulson, known for his lucrative bet against subprime mortgages in 2007, said Tuesday he would withdraw all his assets from the stock market if the Democratic candidate wins.

“I think if Harris were elected, I would take my money out of the market,” he said. he said on Fox Business’s The Claman Countdown.

‘I would invest in cash and gold because I think the uncertainty about the plans they have outlined would create a lot of uncertainty in the markets and probably lower markets.’

The Paulson & Co. founder, whose estimated net worth is $3.8 billion, went on to describe how he believes Harris’ tax policies would scare away investors, leading to a “pretty rapid recession.”

John Paulson, the billionaire founder of Paulson & Co. known for his lucrative bet against subprime mortgages in 2007, announced Tuesday that he would pull his assets out of the stock market if Vice President Kamala Harris wins the presidency.

Paulson explained to Fox Business host Liz Claman that Trump and Harris’ economic plans are very different, noting that the former president wants to extend his 2017 tax cuts while Harris wants to let them expire.

“Trump’s policies were better for the average American,” argued the investor, a major Trump donor who is tipped to become a potential Treasury secretary.

During the Trump administration, average real wages rose 6 1/2 percent, Paulson said.

He also noted that Harris has proposed raising the corporate tax rate from 21 percent to 28 percent, and wants to raise the capital gains rate from 20 percent to 28 percent.

He has also proposed a 25 percent tax on the unrealized gains of individuals earning $100 million or more, which would create a severe dent in the profits of big investors.

If the 25 percent tax increase were implemented, Paulson said, “it would trigger a sell-off of almost everything: stocks, bonds, homes, artwork.”

“I think that would trigger a market crash and an immediate and fairly rapid recession,” Paulson warned.

Paulson told Fox Business host Liz Claman that she fears Harris’ tax policies could scare away investors.

However, Claman noted that some people who were concerned about former President Barack Obama’s economic policies pulled their money out of the market when he was elected, which backfired when stocks continued to perform well.

Paulson then said that timing of entry into the market and timing of entry into the market by investors would make the difference in the markets if Harris were elected.

But still, he said, he is not willing to take the risk and would sell his shares.

His comments come just days after JPMorgan Chase CEO Jamie Dimon said he would not rule out an outcome for the U.S. economy that is widely seen as worse than a recession.

The chief executive of the country’s largest bank said this week that “the worst income is stagflation,” something he did not want to “take off the table.”

Harris has proposed raising the corporate tax rate from 21 percent to 28 percent, and wants to raise the capital gains rate from 20 percent to 28 percent.

Economists consider stagflation, last seen in the United States in the 1970s, to be worse than a recession. It would send stocks tumbling and hurt 401(k) plans and other retirement savings funds.

Stagflation is the combination of economic factors deer-nation and en-inflationPrices continue to rise as unemployment increases and economic growth slows – a triple threat of trouble.

In a recession, unemployment rises and the economy contracts, but the silver lining is that there is little or no inflation.

Dimon says he is concerned that there are still a number of inflationary forces on the horizon, noting that higher deficits and increased government spending will add pressure to an economy still reeling from the impact of sustained higher interest rates.

JPMorgan Chase Chief Executive Jamie Dimon has said he would not rule out the possibility of stagflation, which economists consider worse than a recession.

JPMorgan Chase’s CEO had previously warned of an economic slowdown, saying he would not rule out a “hard landing” for the US economy either.

A “hard landing” is when a marked economic slowdown occurs after a period of rapid growth.

Other economists have predicted that the United States is on track for a “soft landing,” something that has only happened once before.

This rare slowdown occurs when the inflation rate returns to the Fed’s 2 percent target without triggering a recession.

However, Dimon said in August that he thinks the odds of this happening are about 35 to 40 percent, CNBC reported, implying that a recession is the most likely outcome.

Economists have speculated that the US is on the brink of a recession, and Paulson argued that Harris’s fiscal policies could be the turning point.

Amid speculation about an impending recession, Republicans have seized on economic issues ahead of the November election.

Earlier this month, a pro-Trump super PAC released an ad telling voters they would face an economic cyclone if Harris was elected president, using a roller coaster metaphor to show her circling the track.

The web ad features dizzying roller coaster footage as it rehashes some of Harris’s past statements on the economy and accuses the vice president and Joe Biden to ‘take the piss’.

With ominous music playing as the “Kamala roller coaster” rolls down the track, Harris addresses the worst inflation in 40 years and “the creation of an affordability crisis in food, gas and housing.”

Harris then appears to say that “Bidenomics is working,” an effort to link her to the unpopular Biden at a time when voters are telling pollsters they want change.

“As president, she wants to raise taxes, pass a Green New Deal and double down on Joe Biden’s failed economic policies,” a narrator says.

The ad ends with a call to “get off this roller coaster before it’s too late” with a not-so-subtle image for anyone who doesn’t like getting dizzy: a steep drop with people on the coaster audibly screaming.

Goldman Sachs has argued that Harris would be better for the economy than former President Donald Trump.

However, Goldman Sachs has offered a different view, suggesting Harris would be better for the economy if she triumphs over Trump.

A Democratic victory would create about 30,000 more jobs per month than a Republican victory, according to a new analysis by the bank.

The Wall Street giant also believes Harris’ plans to help middle-class Americans and small businesses would boost consumer spending, benefiting the overall economy.

That boost would offset any negative impact from potential higher taxes on the wealthy and big corporations, the report said.

“A Harris presidency could benefit small and medium-sized businesses, as the focus would appear to be on fiscal policies that provide support through tax incentives and grants for startups,” Javier Molina, senior market analyst at eToro, told DailyMail.com.

“Harris is also expected to generate greater job creation compared to Trump, especially if accompanied by fiscal stimulus and larger tax credits. This could lead to moderate job growth, boosting sectors such as renewable energy and infrastructure,” Molina explained.

The bank argued that if Trump wins the election, inflation would rise again and economic output would suffer in 2025.

Conversely, if Trump wins, inflation would rise and economic output would suffer in 2025, the Goldman Sachs report says.

The blow is believed to be the result of stricter immigration policies that Trump has advocated and the increase in import tariffs that the former president has threatened.

“We estimate that if Trump wins overwhelmingly or with a divided government, the impact on growth of tariffs and stricter immigration policy would outweigh the positive fiscal boost,” the bank’s report said.

An increase in tariffs on goods such as electric cars from China, Mexico and the EU would push core inflation higher, the banks said.

Economists widely view immigration as a driver of growth, as immigrants tend to be younger, boosting the labor market and spending.

Goldman argues that limiting immigration in the ways Trump plans to do would eliminate those engines of growth, damaging the country’s bottom line.