Tax season is in full swing and millions of Americans are eagerly awaiting their refund check.

Many people refer to the day they receive their refund as the “biggest payday of the year.”

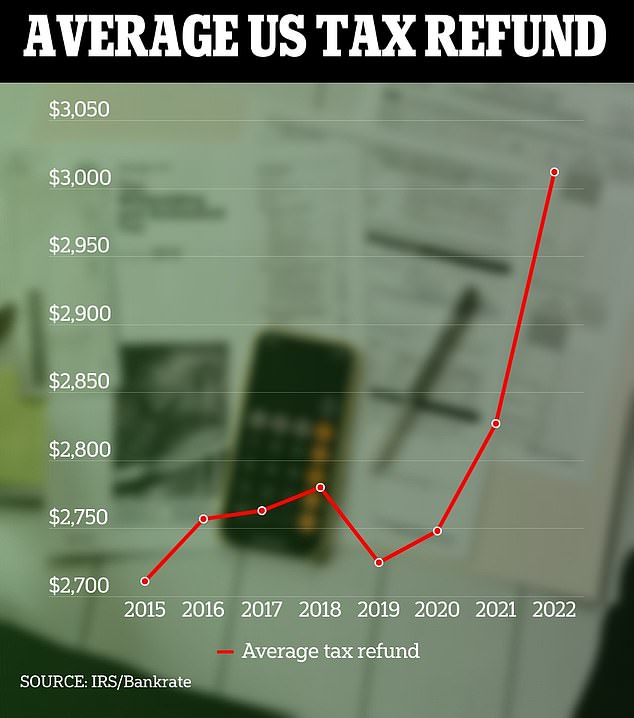

The amount Americans have received in refunds has increased year over year, according to data from the Internal Revenue Service (IRS). For the 2022 season, the typical taxpayer recovered $3,012.

A refund is money you overpaid to the IRS through withholding from your paycheck, which the agency has been holding until you file your tax return.

Experts warn that while a refund may seem like a windfall, overpaying taxes means losing use of the money for the year.

They say it could be spent on family and friends during the holidays, or invested to increase its value. At the same time, too much advance taxation provides the IRS with an “interest-free loan.”

The amount Americans have received in refunds has increased year over year, according to data from the Internal Revenue Service (IRS).

With each paycheck, your employer withholds part of your earnings for taxes like Social Security and Medicare, and the amount depends on how much you earn.

“Experts say we need to change our mindset about tax refunds and remind ourselves that it’s our money to begin with,” said Rebecca Chen, a reporter and CPA. Yahoo! Finance.

“And when you have too many withholdings with the government, it’s essentially like giving them an interest-free loan all year long.”

This is quite important, he added, because we live in an environment of very high interests and high debt.

At its last meeting last month, the Federal Reserve kept interest rates at a 22-year high between 5.25 and 5.5 percent, where they have been since last July.

This has a knock-on effect on mortgages and credit card loans. The average credit card interest rate has soared above 24 percent, according to Loan tree.

If you’re one of the people watching your credit card balances rise and seeing debt eating up a lot, Chen said, it doesn’t necessarily make sense to hold money with the government while paying such high interest.

“Reduce your withholding and use that money to pay off your high-interest rate credit card debt and you’ll be better off financially,” he said.

Less being deducted for taxes means you’ll have more in your paycheck each month that you can invest or deposit into a high-yield savings account.

If an average refund of $3,000 were placed in a high-yield account earning 5 percent interest, this would generate $150 for the entire year.

Rebecca Chen, a reporter and CPA, told Yahoo! Finance experts said they warn that Americans must change their attitude toward tax refunds.

But others argue that people expect to receive a large amount of money in a refund, which they then spend wisely.

According to a National Retail Federation surveyHalf of people expecting a refund last year planned to save it, a third said they would pay off their debts and 28 percent said they would use it for everyday expenses.

If Americans received that money in their paycheck every month, they could spend it immediately, said Mark Steber, director of tax information for tax preparer Jackson Hewitt. USA Today.

“The money these people get on the biggest payday is life-changing,” he said.

He noted that with many major banks’ savings rates hovering around 0.5 percent, this would only generate an extra $15 on an average refund of $3,000.

Some experts warn that while a refund may seem like a windfall, overpaying taxes means losing funds you could have had throughout the year to save or invest.

However, if you withhold too much and pay too little throughout the year, you will be charged an underpayment penalty.

Generally, Americans must pay at least 100 percent of last year’s tax or 90 percent of this year’s tax to avoid a penalty.

To estimate approximately how much you might owe or receive a refund, you can use the IRS Tax Withholding Estimator.

You’ll need your pay stub (and your spouse’s, if applicable), a recent tax return, and information including your filing status, your income, and any deductions you plan to take.

Chen warns that many people don’t realize that they can change their withholdings throughout the year.

You can complete a W-4 form and send it to the human resources department at your work; You should be able to do this as many times as you like during the year to adapt to changes in your living situation.

“It should be reflected in your next paycheck,” he said. “So it’s a quick and easy process for taxpayers to know.”