Table of Contents

Nvidia’s rise to become the world’s most valuable company turned this little-known chip designer and its inspiring founder, Jensen Huang, into the ‘Swifties’ of technology.

Stock markets are unforgiving and often irrational places where herd instincts can get the better of fundamentals.

No sooner had Nvidia replaced Microsoft as the world’s top corporation than it lost ground this week, shedding $500 million in value before recovering in late trading.

One feature of the current bull market is how value creation has concentrated around a small universe of technology stocks, all of which appear to be winners thanks to artificial intelligence (AI).

We are at the beginning of a revolution that will see AI transfer from laboratories to mobile phones and PCs and to all aspects of commerce.

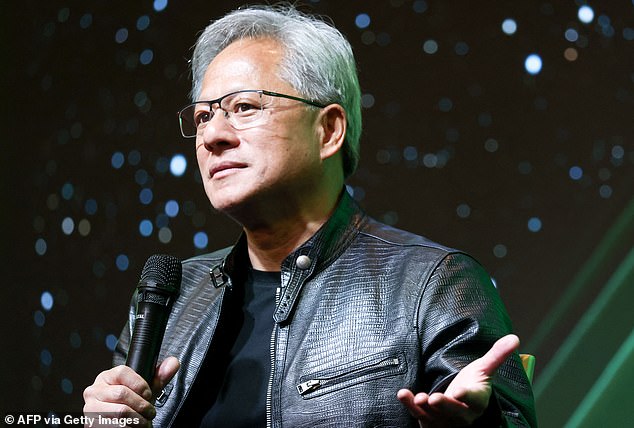

Vision: Nvidia founder Jensen Huang (pictured) has ensured the company is at the forefront of the AI revolution.

The current bull market is better based on solid earnings prospects than the dot-com boom of a quarter-century ago.

But it is a mistake to think that technology giants are immune to changes in values, politics and fashion.

Apple is under attack in the EU for antitrust violations. Tesla shares have risen 11,300 percent since its launch in 2010, but have fallen nearly 30 percent this year amid the competitive threat from cheaper Chinese electric vehicles.

Although Nvidia generates profits, it also faces competitive, antitrust and geopolitical threats, like many companies operating in China’s sphere of influence.

Nobel Prize-winning economist Paul Samuelson was a big skeptic of stock markets as a predictive tool.

Going back five decades to the Yom Kippur War exposes the dangers of placing too much faith in a small group of growth stocks. The S&P 500 index fell more than 50 percent in a matter of months.

In Britain, the FT ordinary share index was hit, falling to its lowest level in 15 years (and half a century after inflation adjustment).

Wall Street’s crash was partly a result of the concentration of value in what were known at the time as “vestal virgin” or “sacred cow” stocks.

Among them were early technology pioneers Eastman Kodak, Polaroid and Xerox, as well as large pharmaceutical companies such as Johnson & Johnson and Merck. The common characteristics were high growth and solid profits.

Valuations, as measured by price-to-earnings ratios, were four times higher than those of most stocks on the New York Stock Exchange.

Market concentration in a small group of stocks was considered serious enough to be investigated by the Senate.

Indeed, they were the precursors of the ‘FANG’ stocks, Facebook (Meta), Amazon, Netflix and Google, or the ‘Magnificent Seven’. Xerox technology, thanks to Bill Gates, was transformed into Microsoft software.

Today, the top 40 stocks in the S&P 500 account for 56 percent of the value, not unlike the market before the 1973 crash.

Much of the value harnessed by the ‘Magnificent Seven’ is based on expectations of enormous future profits. Given its current dominance, such high prices may be justified.

AI could well be a game-changer. However, when it comes to stocks and shares, history tells us that nothing lasts forever.

aircraft manufacturers

One group of old-fashioned stocks that buck the trend since the Russian invasion of Ukraine in February 2022 are aerospace and defense stocks.

Shunned by environmental, social and governance (ESG) experts, stocks like BAE and Rolls-Royce fell out of favor.

That all changed with the shifting of geopolitical tectonic plates and, in the case of Rolls, an inspired change of leadership.

Airbus has issued a warning about its results that shocked the sector. Europe’s aerospace leader has taken a huge £769bn hit on space exploration and revealed it is struggling to source parts and engines to meet aircraft orders.

Among the injured are engine supplier Rolls-Royce and component supplier Melrose.

The decline in stock prices should not be taken too seriously. NATO continues to increase defence spending. Demand for overseas travel is not reciprocated and commercial carriers are expanding and renewing their fleets.

Chocks away.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

eToro

eToro

Stock Investment: Community of over 30 million

Trade 212

Trade 212

Free stock trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you