A major shake-up of Isas this month was supposed to make them more attractive than ever.

Savings accounts already have the benefit of allowing you to earn tax-free interest on up to £20,000 each tax year. And according to the reforms introduced on April 6, they are supposed to be more flexible.

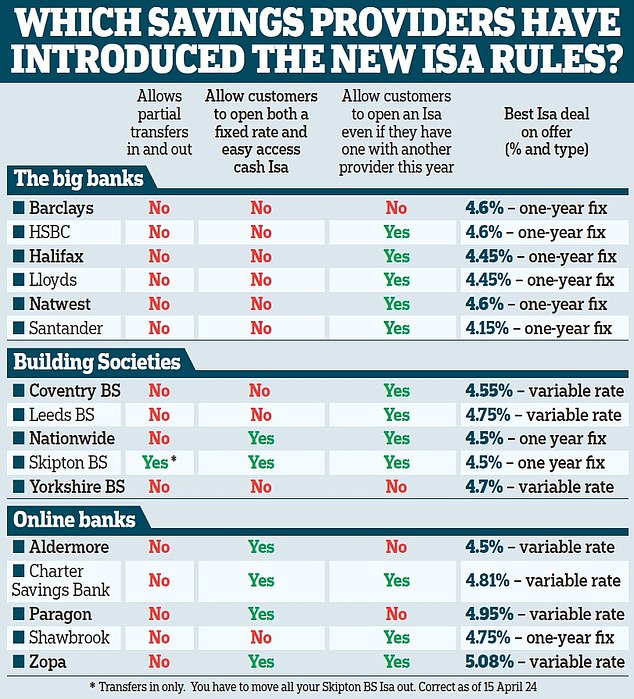

As Money Mail’s savings expert, I’ve spoken to major savings providers to see how they’re getting on with the implementation of the new rules. But the outlook is bleak, as our table reveals.

None of the top 16 savings providers have implemented all of these rules for their Isas. One big bank, Barclays, has not made any of the Government’s three main changes.

Gone are the days when savers needed to choose between an easy-access Isa and a fixed-term Isa.

New rules: Isas now allow you to earn tax-free interest on up to £20,000 each tax year. But with recent reforms they are supposed to be more flexible now.

The latest rules from HM Revenue & Customs mean you should be able to open as many as you like, as long as you don’t exceed your £20,000 annual limit.

The new rules allow Isa savers to have more than one with the same provider, or several. That’s the theory.

But, more than a week since the new rules came in, no major bank allows you to open more than one Isa with them in a single tax year.

So if you open an easy access Isa with them and then they launch a great fixed rate offer, you can’t take advantage of it.

Only Skipton Building Society, Nationwide, Paragon, Aldermore and Zopa offer this flexibility.

Several major providers don’t allow you to open an Isa if you’ve already opened one with a rival this tax year.

Partial transfers are also allowed, so in theory you can move some of your cash if you find a good deal and leave the rest where it is.

Of the 16 providers I spoke to, only Skipton Building Society allows partial transfers to their Isas.

And that doesn’t help anyone much, since no provider allows partial transfers. So if you’ve put money into a cash Isa this tax year and want to move it to get a better deal, you need to move the whole lot or none of it.

The new rules only apply to Isas in the current tax year – money from previous years can be transferred to as many accounts with as many providers as you like.

Insiders tell me that even if savings providers wanted to offer Isa customers the new flexibility allowed by HM Revenue & Customs, they couldn’t, because they simply don’t have the back-end technology to support it.

This suggests it could take months for savers to fully benefit, and some providers may not make any changes.

However, most assure me that they are working behind the scenes to achieve this.

Some providers already allow a mix of fixed-fee and easy-access Isas. This is because when they originally launched their Isas, they structured them so that all Isa accounts count as one.

These providers are now in a strong position to allow savers to mix and match.

They include Charter Savings Bank with its Mix and Match Isa, Zopa (Smart Isa), Paragon (Isa Wallet), Nationwide (Portfolio Cash Isa), Newcastle Building Society (CustomIsa) and Aldermore (MaximISA).

The Hargreaves Lansdown savings platform offers the same flexibility, except the accounts offered are from third-party savings providers.

Unfortunately, all this means savers need to do more homework to choose the best Isas. You’ll need to delve into the fine print first.

This is a great shame. Isa savers were promised a big shake-up and new changes that were announced last year to great fanfare.

But few will benefit and savers will have to work harder to get the best deals.

The rules should mean that Isas are no longer the poorer cousin of ordinary savings accounts. Savers should have no reason not to opt for the tax-free version now.

However, with Isas in their current state, I fear savers looking for flexibility will opt for ordinary savings accounts and then be hit with a tax bill.

Zopa Bank allows you to mix and match easy-access, fixed-rate Isas into your Smart Isa. A good option if you are willing to open an account through the app.

Shawbrook Bank pays the highest rate on one-year bonds, 4.76 per cent, but it is only available online. The bank allows you to open just one of its Isa accounts this tax year.

Charter Savings Bank offers good rates and allows you to open as many Isas, both fixed rate and easy access, as you like online. You pay 4.7 percent fixed for one year and 4.81 percent in your easy-access account. But you need £5,000 to open one.

Skipton Building Society is a good option if you want to manage your account through a branch. It allows you to open an easy-access, fixed-rate Isa. Their fixed rate offer is 4.5 percent for one year, but look elsewhere to get your easy-access account.

Yorkshire Building Society’s one-year fixed rate Isa of 4.65 per cent is a good rate. But if you open one, you won’t be able to open another one with it this year.

Virgin Money: If you have your current account here you can earn 5.05 per cent on your one-year fixed rate Isa. You can only open a cash Isa with the bank this tax year.

Sy.morris@dailymail.co.uk

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.