The 2024 solar eclipse is peaking in New York City, where observers see nearly 90 percent of the moon’s shadow covering the sun.

Peak coverage occurred at 3:25 p.m., about 80 minutes after the eclipse began at approximately 2:00 p.m. The event begins anywhere when the edge of the moon touches the edge of the sun.

The eclipse, which will reach totality in upstate New York, closer to the Syracuse area, will only cover 90 percent of the sun in New York. Instead of total darkness, the city appears to be experiencing a very cloudy day.

Upstate, where darkness will truly descend, thousands of people have gathered with family and friends in Niagara Falls, Buffalo and the areas surrounding the finger lakes to watch the celestial event.

In the Big Apple, hordes gather at prime viewing spots, including ‘The Edge’, which is the Hudson Yards observation deck.

People gather at ‘The Edge’ viewing platform ahead of a total solar eclipse in North America, in New York City on April 8, 2024.

Celestial observers take photographs at ‘The Edge’ observation deck in New York ahead of Monday afternoon’s solar eclipse.

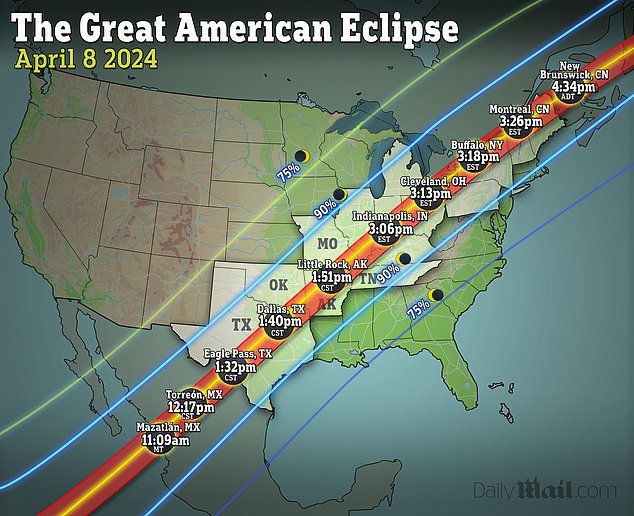

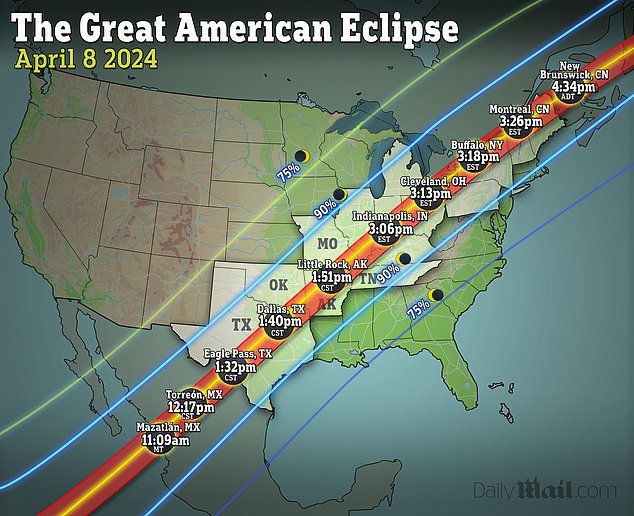

The eclipse is on track to travel more than 4,000 miles across North America as its path of totality began in Texas and will travel through parts of the south, into New York state and ending in Maine.

It made landfall in Mazatlán, Mexico, on Monday morning and is moving through 15 states.

In New York, the skies will begin to darken around 2:50 p.m. and brighten again at 4 p.m.

Although the Big Apple is not in the path of totality, parts of upstate New York will experience total darkness for up to four minutes and 28 seconds.

Monday’s eclipse will last almost twice as long as the great eclipse of 2017. There will also be more than twice as many people in the path of totality.

New York Governor Kathy Hochul appeared at Niagara Falls State Park ahead of Monday’s eclipse. She previously said the state was prepared to receive a greater influx of visitors ahead of the event.

More than a million people visit New York to see the eclipse.

‘This is truly a once-in-a-generation event, and my administration has been working for 18 months to ensure a safe and enjoyable viewing experience for everyone. With our world-class parks and charming urban centers, I encourage visitors to come to see the eclipse, but stay to enjoy all that New York has to offer,” she said before Monday.

A woman looks up at the sky as the eclipse begins in New York

New York City will be plunged into 90 percent darkness at 3:25 p.m.

This year’s path of totality is 185 kilometers (115 miles) wide and is home to nearly 32 million Americans, with an additional 150 million living within 200 miles of the stripe.

Big day for ‘The Edge’ profit model at Hudson Yards, where tickets start at $41

People camp at Prospect Point hours before the total solar eclipse at Niagara Falls.

Children flock to watch the eclipse in NASA costumes as the space event generates huge interest across the country.

Adrian Plaza, 9, of Queens, tries out his eclipse glasses before a partial solar eclipse, where the moon will partially block the sun, at the New York Hall of Science in the borough of Queens, New York City.

A total solar eclipse will sweep across North America and be visible for up to four minutes

The Empire State Building is seen as a man takes a photo from the ‘Edge at Hudson Yards’ observation deck

New York Governor Kathy Hochul speaks to the media at Niagara Falls State Park ahead of a total solar eclipse in North America.

At Niagara Falls, photographers lined up early in the morning to find the best spot to take photos of the eclipse.

Astrophotographer Stan Honda said cnn Photographers of any level can capture photographs of the eclipse as long as they have a sturdy, stable tripod and a remote shutter release for their camera.

“With virtually any type of camera or lens you can get a good image of the eclipse,” he said. “I would just recommend a fairly sturdy tripod, so the setup is fairly stable, and a remote shutter release, because that allows you to take pictures without shaking or moving the camera too much.”