- President Joe Biden’s budget plan has little chance of becoming law

- It serves as an important message to voters about his plans for the economy

<!–

<!–

<!– <!–

<!–

<!–

<!–

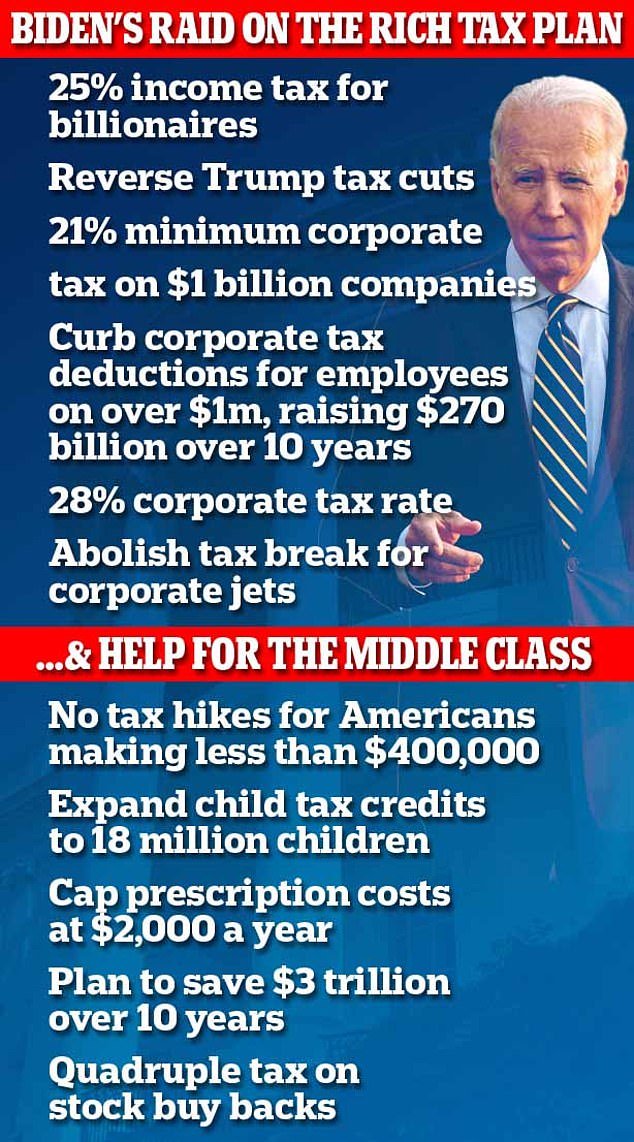

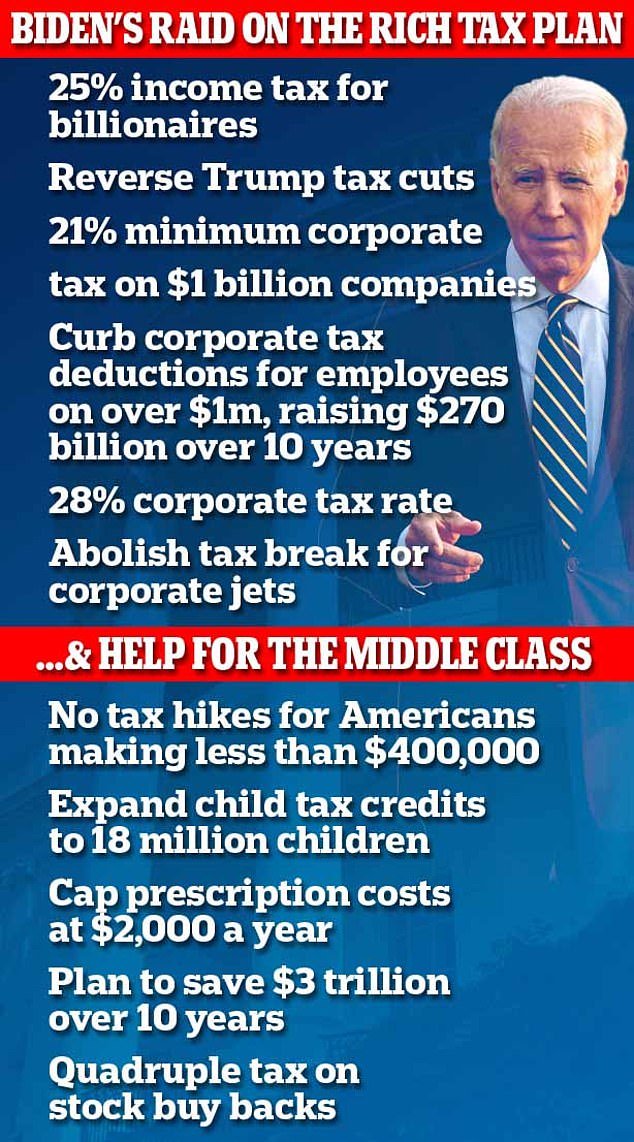

President Joe Biden’s budget proposal includes a 25% tax increase on billionaires, tax cuts for families, new social programs and lower health care costs — all designed to appeal to voters as he seeks a second term.

His plan, released on Monday, will serve as an important message to voters as he seeks to reassure them about his stewardship of the economy and his plans to lower the deficit.

It will also serve as a contrast between his vision for the country and that of his rival Donald Trump.

President Joe Biden’s budget plan has little chance of becoming law, but will serve as an important message to voters about his plans for the economy

Among Biden’s budget proposals: the deficit would be reduced by $3 trillion over a decade, home buyers would get a $9,600 tax credit, and parents would get a child tax credit.

His plan also asks Congress to apply his $2,000 cap on drug costs and $35 insulin to everyone, not just people with Medicare. And he wants Medicare to have the ability to negotiate prices on 500 prescription drugs, which could save $200 billion over 10 years.

He also targets the wealthy.

His plan would raise the corporate tax rate to 28 percent from 21 percent.

Biden is also proposing a new minimum tax on large corporations and a quadrupling of a tax on stock buybacks with the goal of raising more revenue from large corporations and the wealthy to pay down the nation’s debt.

Over the past three years, the national debt has risen from $27.8 trillion to $34.4 trillion.

The budget builds on what Biden outlined in his State of the Union address last week. And this week, he’s off, traveling to three battleground states — New Hampshire, Wisconsin and Michigan — to sell his plan.

Biden’s budget includes a 25% tax on billionaires like Jeff Bezos – seen above with Lauren Sanchez at the 2024 Vanity Fair Oscar Party

Voters have repeatedly given Biden the thumbs down on his handling of the economy. An NBC News poll last month found voters trust Trump more on economic issues by 20 points.

And a CBS/YouGov poll in February found that 55 percent said Biden’s policies would make prices more expensive, while only 34 percent said that about Trump’s policies.

His budget seeks to reassure a jittery electorate. Its proposals are designed to appeal to the middle class, parents, students and those opposed to climate change.

Biden will paint Trump as the opposite – in favor of tax cuts for the wealthy.

“No billionaire should pay a lower tax rate than a teacher, a sanitation worker, a nurse,” he said in his State of the Union address last week.

‘Do you really think the rich and big corporations need another $2 trillion in tax cuts? I certainly don’t. I will keep fighting like hell to make it right!’ he remarked.

House Republicans have passed their own budget proposal that would massively cut government spending, undo the Inflation Reduction Act and kill the Affordable Healthcare Plan.

And just as Biden won’t sign the Republican budget into law, they won’t pass his on Capitol Hill.

Meanwhile, Congress is still trying to fund the government for this year.

On Saturday, Biden signed a $460 billion package to avoid a shutdown of several federal agencies, but lawmakers are only about halfway through dealing with spending for this fiscal year.