- Draft proposal outlines who would qualify due to financial hardship

- Proposal could provide relief to ‘tens of millions of student loan borrowers’

- Biden Administration Undergoes Rulemaking to Cancel Student Loan Debt After Supreme Court Strikes Down Original Plan

Even more Americans could see their student loans forgiven after the Biden administration announced how the debts of those struggling with their payments could be erased.

The proposal released Thursday outlines multiple factors the Secretary of Education can consider to determine whether borrowers face the type of hardship that would provide them with relief.

The Biden administration has already canceled $136.6 billion in student loan debt for 3.7 million borrowers, but the Supreme Court struck down President Biden’s original $400 billion plan to cancel it last June.

Critics have accused Biden of abusing his authority and punishing taxpayers who did not obtain a college education.

Some hardship factors include the borrower’s total student loan balance and required payments relative to household income and whether the borrower faces high financial burdens for essential expenses such as healthcare or childcare.

Other considerations include whether the borrower received a Pell Grant, age, disability, and other indicators identified by the secretary.

The proposal would provide automatic relief to borrowers who are highly likely to default on payments within two years. Those borrowers would be identified through a method developed by the Department of Education using information in the secretary’s possession.

It would also allow the Secretary of Education to provide additional relief to struggling borrowers through an application process.

Secretary of Education, Miguel Cardona, with President Biden at the White House. The new draft proposal includes multiple factors that the secretary can consider to determine whether borrowers face financial hardships that would qualify them for student loan relief.

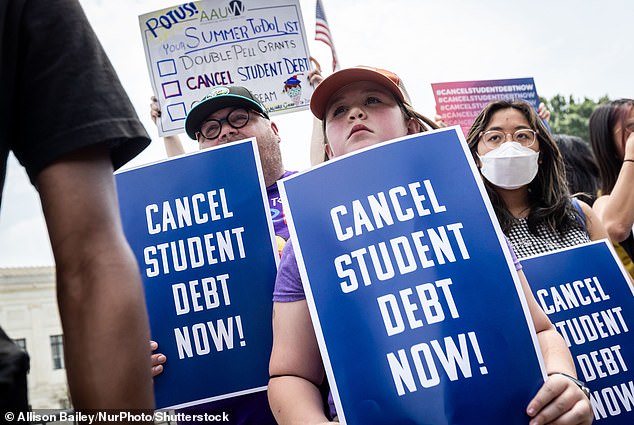

Protesters gathered outside the Supreme Court as the court blocked President Biden’s earlier student loan relief plan.

“The ideas we’re outlining today will allow us to help struggling borrowers who are experiencing difficulties in their lives, and are part of President Biden’s overall plan to give relief to as many student loan borrowers as possible,” said the Undersecretary of Education. James Kvaal in a statement.

“It is an important part of the Biden-Harris Administration’s permanent solutions to the problem of unaffordable loans,” he added.

The draft proposal was released by the Department of Education on Thursday ahead of further rulemaking discussions on February 22-23.

“The broad definition of hardship in the new rule proposed today will boost debt relief for anyone who had to borrow for college and are still struggling to stay afloat,” said Persis Yu, deputy executive director of the Protection Center. of Student Borrowers in response to the draft proposal. ‘

“The new hardship rule is a strong step in the right direction, creating an important safety valve for paying off debt when things don’t go as planned, and giving millions of people a second chance to take advantage of the economic opportunity they’ve been given. promised.” Yu said.

This is the latest in an ongoing effort by the Biden administration that has been slowly reducing the more than $1.74 trillion in student loan debt in the United States.

Protesters calling for student loan debt forgiveness outside the Supreme Court on June 30, 2023 as the conservative court struck down Biden’s student loan relief plan.

Last summer, the administration launched the SAVE program, an income-driven repayment plan that calculates payments based on a borrower’s income and family size, not the loan balance. Forgives remaining balances after a certain number of years.

According to the administration, the SAVE plan will reduce many borrowers’ monthly payments to zero and save other borrowers about $1,000 a year.

The administration has also taken numerous other steps to cancel student loan debt since the president took office in 2021.

To date, the administration has canceled $136.6 billion in total student loan debt for more than 3.7 million borrowers.

It included $45.7 billion for more than $930,500 borrowers through changes to income-driven repayment (IDR) plans that moved thousands of borrowers closer to loan forgiveness, as well as $56.7 billion for more than 793,000 borrowers who have benefited from changes to public service lending. forgiveness program (PSLF).

The administration also canceled billions in debt for totally and permanently disabled borrowers and those who were defrauded from their schools.