Table of Contents

The European Commission has been at the forefront of trying to curb the excesses of Big Tech.

Ireland is awash in cash as a result of the EU’s anti-competitive tax ruling against Apple which resulted in £11 billion in fines.

The United States is soft on Big Tech, fears damaging Silicon Valley’s enormous contribution to growth, and is highly susceptible to the power of lobbyists.

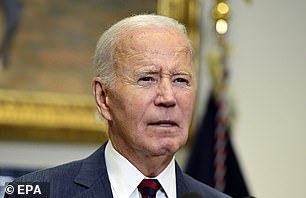

It’s fascinating that just as the Biden Administration is coming to an end, the US Department of Justice, after long delays, is rediscovering antitrust fervor and has Google in its sights.

The US Department of Justice has Google in its sights

Some 40 years have passed since Washington successfully attacked monopoly power when it dissolved the telecommunications company AT&T, creating seven new companies that became known as ‘Baby Bells’.

A ruling calling for breaking up Microsoft in 2001 was overturned in the federal appeals court on the grounds that lower courts seeking to enforce the breakup had gone too far.

The Biden Administration is considering ‘a full range of tools’ against Google. The least intrusive measures would prevent Google from using its Chrome browser or Android operating system to take advantage of its services.

The Biden Administration is considering ‘a full range of tools’ against Google

The company has doubled down on its lead by paying billions to other web browser operators and mobile device makers to make Google its default search engine. A separate action is aimed at your online advertising activities.

As expected, Google is angry. It maintains that measures to hinder its activities would be detrimental to innovation and consumers.

The most worrying part of the ruling for Google and the entire tech sector is the suggestion of “structural” rather than behavioral solutions.

Britain’s Competition and Markets Authority ordered behavioral changes following Microsoft’s acquisition of gaming site Activision Blizzard in October 2023, requiring open access to other game creators on its platform.

Structural remedies go much further. The United States could demand that Google remove its Chrome browser, its Android phone systems, or its Play app store, or all three! Other Silicon Valley players will watch anxiously.

The Federal Trade Commission, another antitrust body, wants Facebook to spin off Instagram and WhatsApp, claiming it bought rivals to avoid disrupting its social media monopoly.

Silicon Valley’s global power is unlikely to be a major feature in the final days of a US election campaign dominated by geopolitics, migration and pocketbook issues.

However, presidents from Teddy Roosevelt in the early 20th century onward have discovered that taking on big corporations wins them votes.

future proof

Calls from advisers telling me how wonderful it is when offers come in for UK companies at a 30, 40 or 50 per cent premium are standard.

The prices paid are often illusory given the lower valuations of London-listed stocks than those on Wall Street and the strength of the dollar.

Against this backdrop, Rio Tinto’s £5.1bn bid for lithium producer Arcadium at a 90% premium puts into perspective the turnaround that has seen so many big British companies fall into foreign hands.

Rio coach Jakob Stausholm struck at a good time. The lithium market has been in the doldrums, with prices falling 80% from the 2022 peak.

But as electric vehicles and battery storage from wind, sun and other energy sources become more prevalent, lithium sales will likely increase. Forecasts suggest demand could increase eight-fold by 2040.

Rio’s scale and exposure in Canada and Argentina, where most of Arcadium’s resources are located, should offer room for savings on transportation, processing and logistics.

In his first major acquisition, Stausholm is looking to the future, something highly unusual among the defensive-minded leaders of London-listed companies.

Millions lost

The American saying “a billion here, a billion there and soon you’ll be talking real money” came to mind when I took a call from the Serious Fraud Office.

This column inadvertently suggested he had set aside £237.7bn to meet legal costs arising from a dispute with ENRC.

Enough to have paid for the NHS and more. The actual figure was £237.7 million. Either way, taxpayers’ money goes down the drain.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.