A German electrician who left his job to pursue a career as a Jeff Bezos lookalike now enjoys a lavish lifestyle reminiscent of the Amazon tycoon himself.

Cagdas Halicilar, 46, known for his striking resemblance to billionaire Bezos, is now often found traveling on extravagant cruises as strangers constantly approach for selfies.

Three years ago he made the decision to found his own transport company, CB Transporte, after growing tired of the exhausting hours of work on construction sites.

After a friend showed him a photo of Bezos and highlighted their similarities, Halicilar began emulating the Amazon founder’s bald look.

A German electrician who left his job to pursue a career as a Jeff Bezos lookalike now enjoys a lavish lifestyle reminiscent of the Amazon mogul himself.

Cagdas Halicilar, 46, known for his striking resemblance to billionaire Bezos, is now often found traveling on extravagant cruises as strangers constantly approach for selfies.

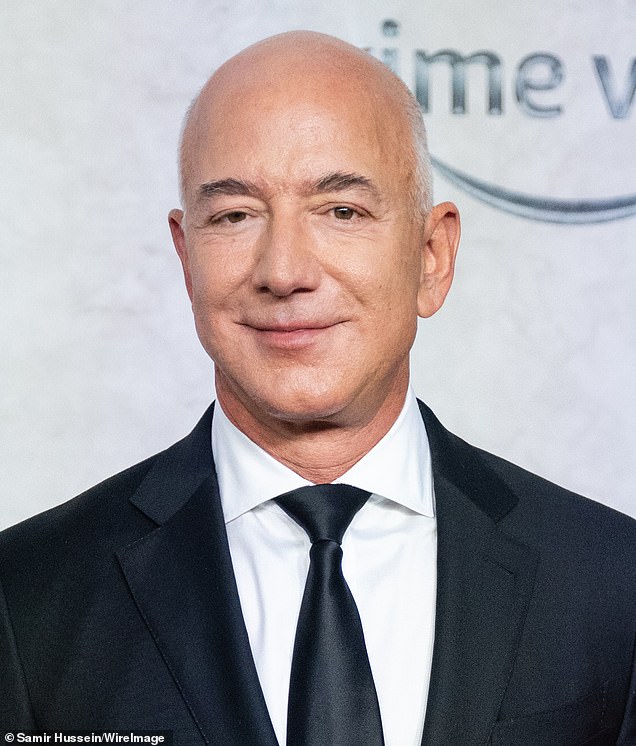

After a friend showed him a photo of Bezos and highlighted their similarities, Halicilar began emulating the Amazon founder’s bald look. Pictured: Jeff Bezos with Lauren Sanchez at the Vanity Fair 2024 Oscar Party in March

“When I became a businessman, my friends and acquaintances told me I looked like a multimillionaire,” he said. What is the jam?

“I didn’t know what they meant by that until they showed me the photo of Jeff Bezos; some of my friends joked that he had cloned me,” he added.

Halicilar said he always dreamed of becoming an entrepreneur. Like Bezos, who left his job at a hedge fund to set up Amazon in the 1990s, Halicilar made the bold decision to quit and go freelance.

At the suggestion of a friend, Halicilar began shaving his head and signed up with a dual agency.

“Since Jeff Bezos also dresses casually, it doesn’t matter if I’m wearing a suit or jeans and a polo,” he said.

‘All I do is shave my head and apply Nivea cream regularly. But I’ve been doing this for over ten years now.’

Halicilar said he always dreamed of becoming an entrepreneur. Like Bezos, who left his job at a hedge fund to set up Amazon in the 1990s, Halicilar made the bold decision to quit and go freelance.

The stuntman also appeared on several local TV shows and even landed a guest spot on the German Netflix miniseries, ‘King of Stonks.’

Within three years, he appeared on Netflix shows and local events, enjoying a luxurious lifestyle as a part-time stuntman.

“I look like his twin brother,” he said. “When I see the photos of his brother Marc Bezos there is no resemblance between them.”

‘My right eye gets smaller in the sunlight as does yours. But I have to admit that no one has flirted with me yet because I look like Jeff Bezos,” he said jokingly.

“My partner sometimes gets upset when people come up to me and want selfies, but many don’t dare talk to me.”

During his recent trip to Seattle, Halicilar recounted how Amazon employees flocked to him asking for selfies.

‘When I was in Seattle with my friends, we walked around the Amazon campus. “All the Amazon employees came to see me, wanted to take selfies, and thanked me for being proud to work at Amazon,” he said.

Halicilar shared that he now lives a lifestyle similar to that of Bezos, the second richest person in the world with a net worth of more than $200 billion.

Social media posts featuring the Bezos lookalike capture him posing in picturesque locations around the world and enjoying sumptuous meals aboard cruise ships.

The stuntman also appeared on several local TV shows and even landed a guest spot on the German Netflix miniseries, ‘King of Stonks.’

Halicilar shared that he now lives a lifestyle similar to that of Bezos, the second richest person in the world with a net worth of more than $200 billion.

“I also have a lifestyle almost like him: I often travel on boats and even have a butler and drink good whiskey like Jeff,” he said.

Social media posts featuring the Bezos lookalike capture him posing in picturesque locations around the world and enjoying sumptuous meals aboard cruise ships.

He said: “My wish is to drink a whiskey with Jeff Bezos on his yacht – he’s as much of a yacht fan as I am.”