Table of Contents

Pension trap: Investors can accumulate large losses early on and never recover them if they are not careful.

The devastation of pound costs is a nasty trap that can cause serious damage to pension investments, especially in the early years of retirement.

It means that when markets fall, you suffer the triple whammy of a drop in the fund’s capital value, further depletion from the income you’re withdrawing, and a drop in future income.

In financial jargon, this is also known as negative pound cost averaging or sequencing risk.

It poses a problem whenever markets fall, but it’s especially dangerous early in retirement because investors can rack up big losses and never recover them if they’re not careful.

On top of that, people who persist in earning income in the early years will crystallize their losses and accumulate problems for the future.

Earning income from shrinking investments early on can cause disproportionate and irreparable damage to your portfolio, because it is much more difficult to rebuild it to a position of strength.

But defenses against market shocks can be established before you retire, and there are also ways to overcome investment setbacks in the early years. Find out what strategies are available to you below.

How does the cost of the pound work?

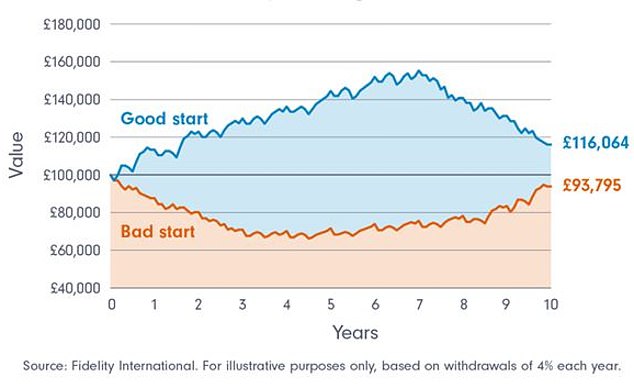

A sell-off in the financial market is worrying for anyone who relies on pension investments to fund their retirement income, but, as described above, it can cause particularly big problems at first. The following graph illustrates what could happen.

“Let’s say that over 10 years, your portfolio will earn an average annual return of 5 percent,” explains Ed Monk, associate director at Fidelity International.

‘Some years you will get higher returns. Some years it will be lower (maybe even a loss). If you start earning income when your investments are doing well, you won’t have to sell as many investments to get the income you need.

‘This will give you a “good start” to earning and you can see this on the graph in blue (below). Although his earnings have declined in recent years, he still has around £116,064 left in his pension fund.’

But Monk says that if you start withdrawing income at a time when your investments aren’t performing very well, you’ll have to sell more investments.

‘This is the “bad start” shown by the orange line. When ten years have passed, your pot will be significantly smaller than if you had enjoyed the “good start.”

“That’s why it’s important to evaluate how your investments are doing when you start receiving income from your pension fund.”

Monk says the two examples use exactly the same illustrative investment returns, but in reverse order as to the timing of good and bad years.

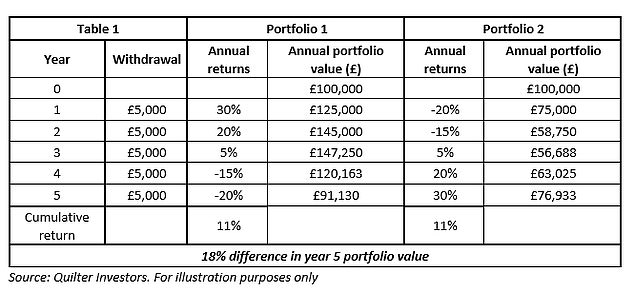

The table below from Quilter also highlights the impact of early losses versus early wins.

‘When you sell units for income, you lock in these losses, making it difficult for the value of the portfolio to fully recover. This is despite the cumulative performance without withdrawals being identical in both cases,” says CJ Cowan, income portfolio manager at Quilter Investors.

‘In a market that is trending upwards, selling shares in a fund to generate income works very well. But in a sideways, downtrend or particularly volatile market a different investment strategy is required.’

How do you protect yourself before retirement?

It’s wise to prepare ahead of time in case problems arise in the market early in your retirement.

You can avoid making withdrawals and crystallizing losses on your pension investments if you have cash on hand or other assets and income sources to fall back on while you wait until the market calms down.

Monk says: ‘By creating a cash savings fund and earning income from it in the first instance, you can give the money invested a chance to recover.

‘For example, keep two years’ worth of income in cash and pay yourself with that. After one year, if the value of the money invested has lost value, you can earn second year income from the cash fund instead of selling assets.

“Hopefully, by year three your investments will have regained some ground and you’ll be able to replenish your cash.”

What if the market crashes right after you retire?

There are a variety of options to consider, depending on your personal circumstances, financial means and attitude to risk.

1. Use your cash savings before selling investments

As mentioned above, you can prioritize spending your cash savings as protection against investment losses.

2. Earn only “natural” income from your investments

This means withdrawing only money generated from dividends on shares or share funds, or ‘coupons’ (interest) from bonds.

“By choosing a natural return strategy, investors will likely see their portfolio tilt toward different asset classes, regions and sectors compared to a portfolio that invests solely for long-term capital growth,” Cowan says.

“This will include sectors more associated with cheaper or “value” segments of the market.

3. Review your pension investments

You may want to reconsider your strategy, but that doesn’t necessarily mean moving into lower-risk investments if you plan to stay invested through a retirement that could last decades.

If you have questions about building an investment retirement portfolio, you should consider paying for financial advice.

4. Stop or vary the size of withdrawals if you can

Many people who invest their pensions often don’t realize they can adjust or stop withdrawals, past research has revealed.

Some retirees need to continue earning regular income from investments to cover immediate living expenses in old age, but if not, a more ad hoc approach may be considered.

5. Delay your retirement plans

You can postpone retirement if your personal circumstances allow, or consider returning to work or accepting a different type of job.

Anyone who chooses to wait will typically benefit from greater investment growth. They can afford larger withdrawals and their savings are likely to last longer.

6. Consider alternatives to downsizing

Buying an annuity to fund retirement is an irrevocable decision, but you can change your mind about the reduction in income, especially if you are getting older and feel less able to manage investments.

You can still choose to put all or part of your money into an annuity. You may consider combining withdrawals and annuities to maximize retirement income. Interest rate increases have led to better annuity deals.

7. Be opportunistic and buy

This is risky, so only for the bravest, most experienced or wealthiest investors, those who can afford losses without harming their standard of living.

But market declines can be the cheapest time to buy if you’re looking to invest for the long term.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.