One of the best things about modern life is convenience.

If you don’t want to trudge through the supermarket, just open your laptop.

However, shopping online is not always as easy as it seems, as demonstrated by this gallery of photographs from around the world, collected in a strange album like bored panda sample.

Maybe you find your white toilet seat boring and prefer one decorated with images of food.

Some people find the classic white toilet seat very boring; Well, luckily for them, they can buy this option, decorated somewhat strangely, with different foods.

This portable baby bathtub should put the fear of God in any parent. Surely that’s not how it’s supposed to be used?

If so, there’s one for sale on Amazon that will add a whole different meaning to getting five a day.

If you’ve ever wanted to drink a cold beer on the couch with a lobster glove to cover your hand, then that wish is satisfied too.

And sometimes there is nothing wrong with the product in question, but the advertising leaves a lot to be desired, specifically a cat carrier, for a pet with false eyelashes and who also wears red lipstick.

Here, FEMAIL shows off some of the weirdest things you can buy on Amazon that will leave you scratching your head…

As this article demonstrates, there is literally no reason to hold a beer when you can use a novelty lobster claw holder.

This snap, shared by a buyer believed to be in North America, is perfect for those times when your cat goes somewhere with a face full of makeup.

It may be a relief to find out that this ad is for the headband and not the weird sunglasses photoshopped onto the model’s face.

Do you want to save a few cents? Surely no one will notice that these are counterfeit versions of Garfield?

The description of this item is a bit strange, unless, of course, you are the type of person who likes to have a large collection of stuffed animals in the kitchen.

Who says a salt and pepper shaker set has to be bland? There are many options, like this shark and severed limb combination.

This doesn’t seem like the best deal available. The special price seems surprisingly similar to the standard price.

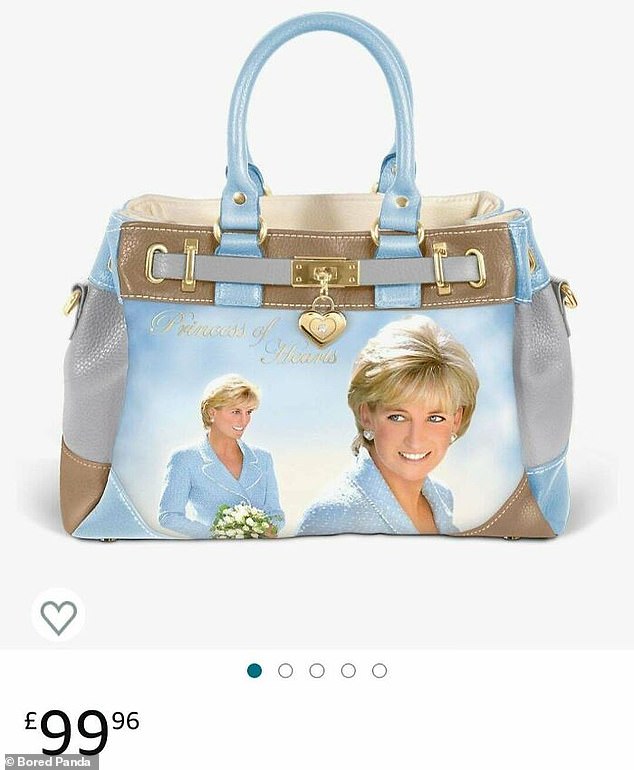

You’d have to be a huge fan to spend almost £100 on this special Diana, Princess of Wales bag.

The strange thing here is not so much the article, but the advertisement. Surely not many people keep their containers next to their young children’s beds?

There is something a little scary about an advertisement for an electrical item that appears to malfunction and generate sparks.